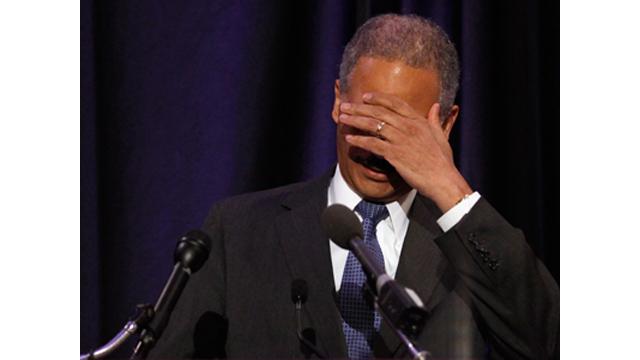

Photo: Eric Holder covers his eyes in what we imagine is shame.

It was clear that the foreclosure fraud settlement which the Administration and most states reached with major U.S. banks was a great deal for the big banks – and a lousy deal for the public. But some of us found reason to hope against hope that the settlement would be accompanied by real investigation of crooked bankers, after years of flim-flammery and disgraceful inaction by the Justice Department.

Not that we were entirely naïve. The administration's track record was poor, and even had a slight resonance of bad faith, when it came to prosecuting Wall Street criminality. So, speaking only for myself, that cautious support came with renewed pressure on the Administration to back its words with action.

Now it looks like we were – fooled again. From a report published this weekend in The Huffington Post: "A last-ditch effort by federal and state law enforcement authorities to hold Wall Street accountable for nearly bringing down the U.S. economy is unlikely to lead to any criminal charges against big bank executives, according to a source close to the investigation."

The Huffington Post's anonymous source said that instead of criminal indictments, the task force "will instead most likely bring civil lawsuits against some of the banks involved." That would most likely mean more of what we've seen so far: Bankers earn hefty salaries and bonuses by committing crimes. Punishment is restricted to fines, which are paid by the bank and not the bankers – giving them absolutely no reason not to do the same thing again.

In the months since the President boasted of the beefed-up task force in his State of the Union message, reports (including our own) have suggested that the Justice Department consistently refused to provide it with even the minimal resources it had requested. (It had asked for roughly 100 to 200 staffers, depending on the sources cited, as opposed to more than 1,000 which were assigned to the much smaller savings and loan scandal of the 1980s.)

In case the chain of command is unclear, let's spell it out: Everyone at the Justice Department reports to Attorney General Eric Holder. Holder reports to the President of the United States.

The Record

Barack Obama took office as the economy was suffering a massive collapse brought on by widespread Wall Street fraud. It wasn't a good sign when he appointed Eric Holder, a highly-paid attorney for the prominent Wall Street law firm Covington & Burling, to act as the nation's chief law enforcement officer. While it's certainly possible for talented attorneys to move from defense to prosecution or vice versa, when it comes to Wall Street Holder has managed the Justice Department like ... well, like a highly-paid attorney for a prominent Wall Street law firm.

First Holder tried to buffalo the public into believe he was fighting mortgage fraud with a deceptive publicity scam called "Blind Trust" – which the Columbia Journalism Review reviewed with the headline, "Obama Administration's Financial Fraud Stunt Backfires."

Then Holder declined to prosecute anyone for the misdeeds of the AIG Financial Products group (note: I was a midlevel AIG executive in another part of the organization), despite the massive evidence of potentially criminal wrongdoing compiled the Levin Subcommittee and others.

(See "Law and Order: AIG" for, among other things, a chronology of events which includes an investor call in which executives made statements which their independent accounting firm considered false. There's a name for what happens when executives make false public statements about the material condition of their firm. That name is "investor fraud.")

The Holder Justice Department also declined to prosecute anyone at GE Capital, much to the astonishment of SEC investigators who had not only identified multiple instances of investor fraud but had identified specific individuals in the accounting department who had compiled and released the fraudulent information.

A Class Act

Journalist Michael Hudson compiled evidence of additional misdeeds regarding subprime mortgages at GE Capital. Its CEO, Jeffrey Immelt, lavished praise on an executive whose company he bought with a fortune in shareholder money.

What was that company? As Hudson notes, it "was a place where erstwhile shoe salesmen, ex-strippers and even a former porn actress could sign on as sales reps and make big money pushing home loans. WMC's top salespeople earned a million dollars a year or more and lived fast, swigging $1,000 bottles of Cristal and wheeling around in $100,000 Ferraris and Bentleys."

And when an investigator tried to put the brakes on fraudulent activity in that operation, Immelt's GE Capital sidelined him so that the party could continue. Not only was the firm spared any indictments, but the Treasury Department and Federal Reserve bent the rules so that it could be bailed out!

Not that its executives escaped punishment altogether. Immelt was sentenced to attend multiple public meetings – as the head of the President's Economic Advisory Panel. (They even renamed the group when Immelt took over, calling it a "Jobs and Competitiveness Panel." That might have been a bit of mordant humor on someone's part, given Immelt's record of outsourcing American jobs overseas.)

Fraud=Settlement

What about that $25 billion foreclosure fraud settlement, which paid out less than $2,000 to people who had lost their homes through illegal foreclosure? We gave that deal a failing grade on all five criteria we'd defined for scoring the agreement: openness, justice, restitution, deterrence, and reconciliation. But we thought there was a possibility that some its provisions could be used to restore some measure of justice – especially if it led to criminal indictments.

Apparently not.

And as we suspected and feared, the penalties and restitution won't even amount to $25 billion. Banks are being "credited" for actions they were already taking before the settlement came along (shades of "Blind Trust").

Among the crimes involved in that settlement: Forgery and perjury, in the mass filing of notarized documents which falsely state that the person signing the document has seen and reviewed all the documents which prove that the bank is entitled to foreclose on a property. (That's what they call "robo-signing" – since a false notarized document is a form of perjury, a better name would be "robo-crime.")

Robo-signing is one of many forms of bank lawbreaking which turned into a crime wave in recent years. And while the banks have promised to stop, Wells Fargo – one of the banks who signed the deal – illegally foreclosed on the same house last week for the second time. And they hired a firm to do it that was so sleazy its employees apparently vandalized and robbed the property when they raided it a second time.

How did they get permission to foreclose on this home, which the owners owned outright and which had no mortgage, unless they filed false documents twice stating that they had the proper documentation in hand to seize it?

The Big Sting

Then there's the enormous area of investor fraud, in which these banks bundled and sold mortgages to investors – including many pension plans and public institutions – which they knew were likely to fail. In fact, the entire "liar's loan" industry was built around writing bad mortgages and then defrauding investors into buying them.

It's like The Sting, multiplied a millionfold and unleashed on the entire country. (And considerably less photogenic leading actors. Blankfein and Immelt may be shrewd operators, but Redford and Newman they ain't.)

The racketeers even built a phony shell company and an electronic database to expedite their fraud.

As it turns out, Housing and Urban Development audits of banks involved in the settlement showed that all of them had hindered investigation into their misdeeds. That makes the deal even more of a travesty than it initially seemed to be, since it means the banks made it impossible to know how much criminality they were guilty of – or how high in the organization the culpability went – before the deal was done.

Investigators were polite in their language – always saying "failed to maintain controls" while describe ongoing patterns of deliberate misrepresentation, and taking banks at their word sometimes when bankers claimed they couldn't locate vital records – but the picture they paint is clear. It consistently includes phrases like "Probable violations of the False Claims Act" in addition to providing descriptions of better known crimes.

And while the False Claims Act is a civil statute, the politically connected lobbying and law firm Arent Fox correctly notes that "there are many criminal statutes ... that are close analogs ... it is essential to consider if there is any basis present for possible criminal liability as well."

The audits even include remarkable sentences like this one: "Wells Fargo told us that we could not interview the other (employees) because they had reported questionable affidavit signing or notarizing practices when it interviewed them. "

Oh, well in that case never mind.

Wells Fargo bankers weren't even indicted for laundering money from the Mexican drug cartels that have murdered 65,000 people. Why would they worry about indictments for obstructing justice, or for something as trivial as defrauding the US taxpayer? (That's what the False Claims Act addresses.)

It was a dead giveaway when the so-called "Justice" Department declined to prosecute Goldman Sachs for its apparent defrauding of customers, or for what appeared to be perjury when senior executives appeared before Senate investigating committees.

Why has the Justice Department let all these wrongdoers go free? There's been a shifting panoply of excuses. There was the "no laws were broken" excuse, dutifully echoed by both Barack Obama and Tim Geithner, but there's overwhelming evidence of lawbreaking to refute that claim.

There's also many billions of dollars paid out in fraud settlements. But then, the crooks themselves don't pay those settlements and fines. Their shareholders do – sometimes for acts of fraud against the shareholders themselves. That aside, did these multi-billion-dollar frauds commit themselves?

That suggests a new concept: "drone fraud," a form of crime which takes place without any individuals present to commit it.

What Real Prosecutors Can Do

The Justice Department is also fond of complaining that getting convictions in financial fraud cases is too hard because the details are complicated. Leaving aside the absurdity of the excuse-making – what would townsfolk do if their police chief said "I'd arrest those crooks, but it's pretty hard work chasing those boys" – there are thousands of convictions to disprove this argument. There are, for example:

More than 1,000 convictions obtained (mostly be Republican Justice Departments) in the far smaller Savings and Loan scandal. Nineteen executives who were convicted or offered guilty pleas in the Enron scandal. Two senior executives convicted in the Tyco scandal. (Those convictions were obtained under Republican President George W. Bush, whose record of pursuing corporate crime is actually superior to Obama's at this point.) Two brokers convicted in a municipal bond big-rigging scandal. There's more, but you get the idea.

Higher Authority

Of course, the Huffington Post piece could be wrong. Justice – real justice – could be right around the corner. The Post's anonymous informant even said a criminal indictment might come as the result of a "Hail Mary pass."

The term "Hail Mary pass" has come to describe any action performed against near-impossible odds in the hope that a miracle will happen. Older football fans know that it was coined after Catholic quarterback Roger Staubach explained a seemingly impossible winning touchdown pass by saying "I closed my eyes and said a Hail Mary."

From the looks of things it's going to take some sort of divine intercession for justice to be done on Wall Street. The current management doesn't seem all that interested.

By Any Other Name

We thought the Administration and the Justice Department might at least try to take action. Whatever the outcome, indictments alone can discourage wrongdoing. There's a deterrent effect when wrongdoers know that they may face a jury. They may get off in the end, but even the wealthiest Wall Street executive would prefer to avoid the experience.

So why is the Attorney General, along with others in the Administration, arguing against indicting Wall Street bankers When there's a preponderance of evidence suggesting a crime was committed, it's the defense attorney's job to argue there wasn't – or that it will be too hard to obtain a conviction. It's the defense attorney who usually meets with reporters to explain why the case won't hold up.

What do you call a Justice Department that would rather do the defense's job than its own? "Covington & Burling" is already taken. If these reports are true, the Department will definitely need that new name. But whatever you call it, don't call it 'justice.'

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments