It was clear from Federal Reserve Chair Janet Yellen's first testimony to the House Financial Committee on February 11 that she will use the Fed to continue to bail out the big banks of Wall Street rather than unemployed workers, homeowners, students and the medically uninsured. We at FedUp aren’t expecting to hear anything new from her about changes to monetary policy that benefit the 99% when she speaks today before the Senate Banking Committee.

We were, however, inspired by Yellen's positive response to invitations by members of Congress to participate in town hall meetings across the country. We encourage Yellen to follow through on that promise where her predecessors did not, and speak to the people about how the Fed can bail out Main Street and demand a more just system that serves the 99% as opposed to the 1%.

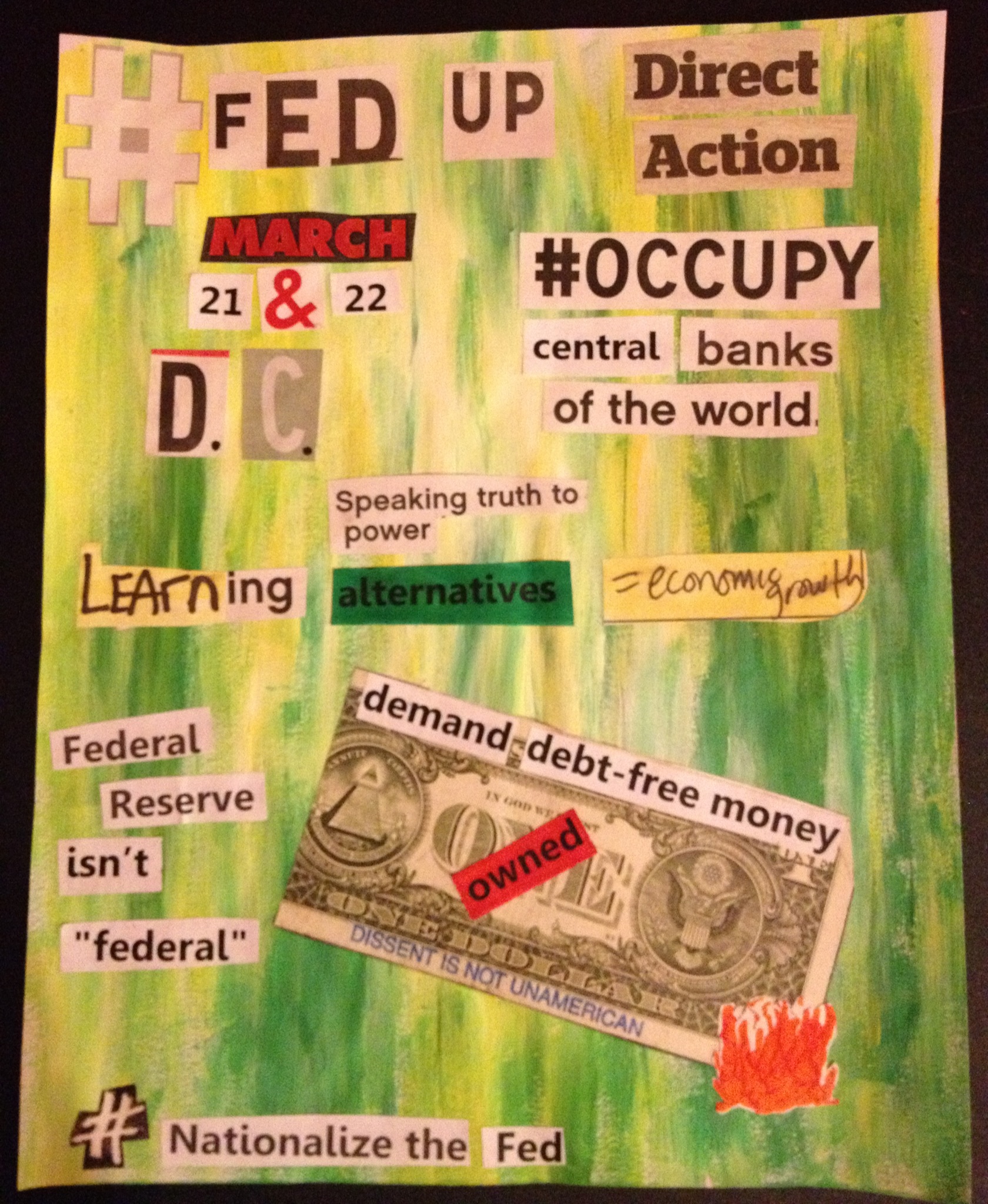

FedUp intends to meet Yellen halfway on her pledge this coming March 21 and 22 in Washington, DC, at a two-day conference on International Monetary Policy, co-sponsored by the Federal Reserve Board and the European Central Bank (ECB).

The Fed and ECB will be discussing how International Monetary Policy can be used to continue to make the 1% richer rather than how to end the great recession. FedUp will use education as direct action and hold our own parallel international conference at the Fed to discuss how the global central banking system should bail out we the people.

FedUp is a national grassroots coalition of occupy activists from Strike Debt, which buys debt for the purpose of eradicating it; the Public Banking Institute and the Occupy Money Cooperative, who came together on the 100th anniversary of the Federal Reserve in order to illuminate the relationships between the Federal Reserve with the too-big-to-fail Wall Street banks, the unemployment, educational and housing crises of the great recession as well as our simple demand that the Fed be nationalized in order to solve these crises.

FedUp is in the process of organizing grassroots teach-ins, work-shops and presentations to showcase viable, radically alternative economic models and solutions to the global centralized banking system that keeps banks from failing. We're still in the early planning stages and collaboration is welcome.

We will demand that Fed Chair Janet Yellen and the rest of the conference attendees join our alternative conference on International Monetary Policy for the people in order to discuss the merits and economic benefits of federalizing the Federal Reserve and also in order to tell the central bankers ourselves how the central banks and international monetary policy should be used to bail out the citizens of Main Streets across the globe instead of the Banksters of Wall Street.

We are calling for radically progressive communities across the globe to express their solidarity for our action by organizing creative grassroots actions to educate the people of the world on the problems caused by the central banking system in their own local communities and online if they are unable to join us in person in Washington D.C. in March.

Meanwhile, as Andre Lopes Massa reported in "Let's Nationalize the Fed," published on The Nolan Chart:

—

Have you ever wondered where the money in your wallet really comes from? Have you ever wondered what really gives money its value? Since 1913, the Federal Reserve System has been in charge of managing the money supply. Despite the intense criticism it has come under in recent years, our friends at the Fed have actually done well recently. Racking in profits of up to $77.4 billionin profit in 2011, our neighborhood friendly central bank has done what it’s supposed to do; maintain price stability and set us on the path to achieving maximum employment.

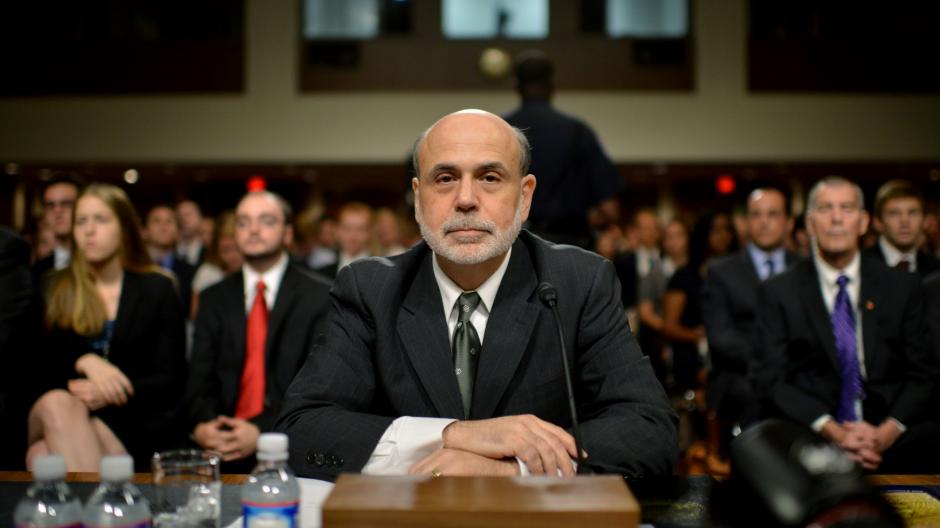

Recent statistics show that core prices have only risen by 1.4 percent this past year, below the Fed’s target of 2 percent, while Ben Bernanke, despite former House Speaker Newt Gingrich calling him the "most inflationary chairman ever," has actually kept inflation at a mere 2.3 percent per year, the second lowest out of the last six chairmen of the Federal Reserve Board. Quantitative easing by the Fed in the wake of the 2008 financial crisis has saved or created over 2 million jobs and it’s easy to see why - when the Federal Reserve engages in quantitative easing by buying Treasury securities, the spike in demand forces bond prices to rise, forcing interest rates down, which encourages borrowing and increased consumer spending, thus encouraging job creation and increased production to keep up with the increased consumer demand.

So, it seems like our friends at the Fed have been doing a good job recently, so what’s the problem? Why do we need to nationalize the Fed? Well, the problem is that the Fed isn’t actually "federal" at all.

One of the most common misconceptions that most Americans have is that the Federal Reserve is actually an agency of the government, but that could not be farther from the truth. This excerpt from the Fed’s own website* tells you all you need to know regarding who’s really in charge and whose interests the Fed is really concerned about:

"The twelve regional Federal Reserve Banks, which were established by Congress as the operating arms of the nation’s central banking system, are organized much like private corporations – possibly leading to some confusion about "ownership." For example, the Reserve Banks issue shares of stock to member banks. However, owning Reserve Bank stock is quite different from owning stock in a private company. The Reserve Banks are not operated for profit, and ownership of a certain amount of stock is, by law, a condition of membership in the System. The stock may not be sold, traded, or pledged as security for a loan; dividends are, by law, 6 percent per year."

So, what we learn is that the Fed, by their own admission, is currently structured as a privately owned banking cartel that has an obligation to its shareholders first and foremost. So, now the question that we must ask is this; how does the Fed turn a profit? Once again, the answer can be found on the Fed’s own website:

"The income of the Federal Reserve System is derived primarily from the interest on U.S. government securities that it has acquired through open market operations."

The "open market" operations by which the Fed acquires Treasury Securities is the way which the Fed expands the monetary base; by issuing electronic "money" to the U.S Treasury Department, who then print the currency and circulate it while exchanging Treasury securities for the "right" to use these Federal Reserve notes. It’s no coincidence that the interest the U.S government is charged for the right to circulate each dollar is at 6%, the same rate of interest the Fed is obligated to pay its shareholders in dividends. Now, the Fed tries to cover up this gruesome reality in many mischievous ways:

"After it pays its expenses, the Federal Reserve turns the rest of its earnings over to the U.S. Treasury."

Don’t be fooled by this; this is only the profit the Fed makes off the M0 money supply (total amount of physical currency in circulation), which totals about $2.6 trillion. The rest of the money in circulation is created by a process known as fractional reserve banking, by which the Federal Reserve and their member banks create new money by issuing electronic loans that are about 10 times greater than the actual physical supply of currency in reserve. In other words, if you go to the bank and deposit a $100, the Fed and their member banks can create new money by issuing a loan of about $190 to the next customer, so long as they remain within the Fed’s 10:1 ratio. The Federal Reserve does not have to turn the profits made on this money over to the Treasury Department, which is why $1.4 trillion dollars of our national debt is owed to - you guessed it - the Federal Reserve. This number will only continue to get higher if we continue with this financial system. The Federal Reserve is a perpetual debt machine and as long as it remains in the hands of private bankers, we will never pay off the national debt.

Despite the gruesome reality of the very structure of our current Federal Reserve system, the recent statistics above show that central banking can indeed play a positive role in stimulating economic recovery. So, why don’t we nationalize the Federal Reserve? After all, if we manage to nationalize the Federal Reserve, we can instantly reduce the national debt by $1.4 trillion dollars and, more importantly, begin issuing debt-free money. The U.S would once again gain the ability to coin its own money like the Constitution intended and we could finally begin paying off the national debt while maintaining our promises regarding Social Security, Medicare, and other entitlement programs. Let’s take back our country, let’s end the cycle of debt. Let’s nationalize the Federal Reserve.

*This excerpt originally appeared on the Federal Reserve's website, but was later removed.

Please RSVP if you plan on attending The People's 1st International Conference on Monetary Policy in person, via social media or in the general spirit of solidarity, or even if you happen to be Janet Yellen herself. Check this facebook event invitation for new updates. You can also join the FedUp 100 group on the Commons.Occupy.com community.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments