Oxfam has urged European leaders to make taxation more transparent following revelations about HSBC helping its wealthy customers dodge taxes.

Since news emerged last month that a Swiss subsidiary of HSBC systematically aided hundreds of millions of pounds in tax avoidance for many of its super-rich clients, existing legal tax loopholes have come under heavy scrutiny – with Oxfam declaring Europe has become home to a "toxic tax system."

The aid and development agency says that using legal loopholes to help affluent people avoid paying tax is driving greater wealth inequality and depriving governments of using that money to help combat poverty and push economic growth for all.

Jim Clarken, Oxfam Ireland’s chief executive, told the Irish Times, “Today’s story highlights the key role the HSBC played in advising their clients to doge taxes and hide assets, and the international nature of the scandal."

"We’re talking about over 130,000 people hiding their money offshore,” he said.

In order to combat the burgeoning wealth inequality that tax loopholes help create, Oxfam says it's essential that European legislators create greater transparency on tax matters.

Clarken says governments in the E.U. should implement “automatic information exchange between tax authorities” as a means of eradicating loopholes. For while the HSBC scandal may have set off intense debates about banking and taxpaying standards, it's hardly an isolated case.

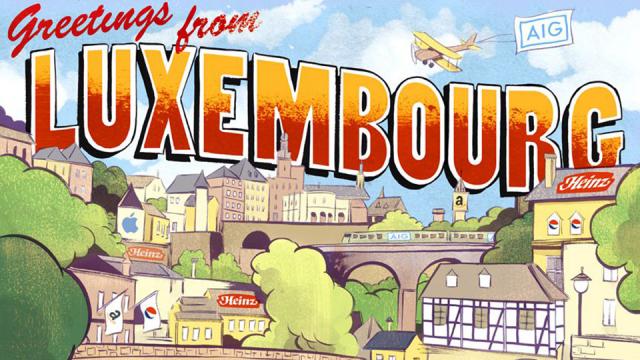

Luxembourg’s Tax Havens

Last November, [leaked documents reported by the International Consortium of Investigative Journalists]http://www.icij.org/project/luxembourg-leaks/leaked-documents-expose-glo...) showed that many international corporations including IKEA, Pepsi, FedEx and some 340 others had secured secret deals from Luxembourg, which enabled them to slash their tax bills while maintaining their presence in Europe.

The review, compiled by more than 80 journalists in 26 different countries, revealed that through the use of complicated accounting and legal structures, the companies appeared to make hundreds of billions of dollars in tax savings through Luxembourg.

Oxfam was quick to condemn Luxembourg’s actions, and welcomed the leaked documents. “[The] leaks underline the scale of the problem of tax dodging. It’s not just one isolated scandal; we’re talking about a whole industry making profits disappear, which hurts Europeans and developing countries alike," said Oxfam tax expert Catherine Olier.

"Tax dodging is depriving governments from much needed money to pay for basic public services like health and education,” she said.

U.K. Tax Avoidance

Those disclosures sparked a political row in the U.K. over whether or not tax authorities here have done enough to pursue accused wrongdoers and combat tax avoidance.

At the center of the controversy is Herve Falciani, the HSBC whistleblower who claims he sent an email to HMRC, or Her Majesty’s Revenue and Customs, the U.K. government department responsible for collecting tax.

The email Falciani sent in 2008 to HMRC was obtained by the French newspaper Le Monde, revealing information about bank account holders in Switzerland. The HMRC has been accused of failing to act on the email, claiming it holds no record of it.

Deteriorating Banking Standards and "Dodgy Practices"

Lord Lawson, former U.K. Chancellor of the Exchequer, who was a member of the parliamentary commission on banking standards, says the standards and values by which banks operate have deteriorated over the years.

“Things which would never have been done in the past are being done now," Lawson said. "The big banks are not only too big to fail but too big and too complex to manage.”

The Labour Party’s finance spokesman Ed Balls also publicly questioned banking practices in the UK, asking why in the last five years there has only been one prosecution out of the 1,100 individual identified as being involved with tax avoidance in Switzerland.

Meanwhile Inequality Grows

Yet, while some of the world’s wealthiest are being assisted in dodging taxes by Europe’s biggest bank, the poorest U.K. households pay almost half their income in tax.

Last December, research conducted by the Taxpayers' Alliance – a U.K. grassroots campaign to lower taxes and reduce extravagant government spending – found that direct or indirect taxes accounted for an average of 47% of the gross income of the poorest households.

The research was based on figures provided by the Office for National Statistics, which showed that during 2012-2013, 13.9% of gross income for the the poorest 10% of the population went to VAT, 7.2% to a council tax, and 5.6% to alcohol or tobacco duties.

“Our tax system is neither progressive nor fair, and we need radical reform as well as necessary savings if the way we tax and spend is to become fit for purpose,” said Jonathan Isaby, chief executive of the Taxpayers’ Alliance.

As Oxfam pushes for a fairer and more transparent tax system across the continent, anger in the UK is growing over the billions of pounds that could have been spent improving healthcare, education and other public sector services instead of lining the pockets of those who need it the least.

As John, a public sector worker in the Midlands, told Occupy.com: “Once again, it’s one rule for them and one rule for the rest of us. How can they justify rigged tax rules at a time of austerity? It’s simple. Make tax fair for everyone and iron out economic inequality.”

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments