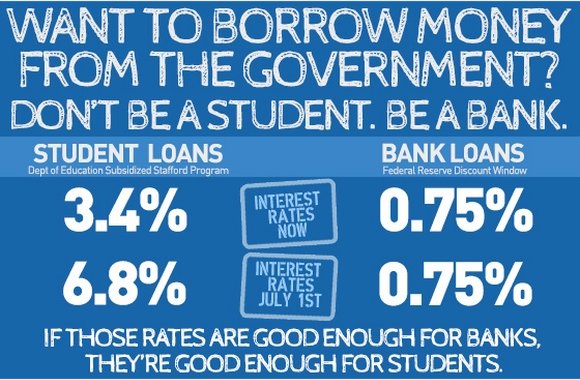

On July 1, interest rates will double for millions of students – from 3.4% to 6.8% – unless Congress acts; and the legislative fixes on the table are largely just compromises. Only one proposal promises real relief – Sen. Elizabeth Warren’s “Bank on Students Loan Fairness Act.” This bill has been dismissed out of hand as “shameless populist demagoguery” and “a cheap political gimmick,” but is it? Or could Warren’s outside-the-box bill represent the sort of game-changing thinking sorely needed to turn the economy around?

Warren and her co-sponsor John Tierney propose that students be allowed to borrow directly from the government at the same rate that banks get from the Federal Reserve — 0.75 percent. They argue:

"Some people say that we can’t afford low interest rates for students. But the federal government offers far lower rates on loans every single day — they just don’t do it for everyone. Right now, a bank can get a loan through the Federal Reserve discount window at a rate of less than one percent. The same big banks that destroyed millions of jobs and broke our economy can borrow at about 0.75 percent, while our students will be paying nine times as much as of July 1.

"This is not fair. And it’s not necessary, either. The federal government makes 36 cents on every dollar it lends to students. Just last week, the Congressional Budget Office announced that the government will make $51 billion on the student loans it issued this year — more than the annual profit of any Fortune 500 company, and about five times Google’s yearly earnings. We should not be profiting from students who are drowning in debt while we are giving great deals to big banks."

The archly critical Brookings Institute says the bill “confuses market interest rates on long-term loans (such as the 10-year Treasury rate) with the Federal Reserve’s Discount Window (used to make short-term loans to banks), and does not reflect the administrative costs and default risk that increase the costs of the federal student loan program.

Those criticisms would be valid if the provider of funds were either a private bank or the American taxpayer; but in this case, it is the U.S. Federal Reserve. Warren and Tierney assert, “For one year, the Federal Reserve would make funds available to the Department of Education to make these loans to our students.” For the Fed, completely different banking rules apply. As “lender of last resort,” it can expand its balance sheet by buying all the assets it likes. The Fed bought over $1 trillion in “toxic” mortgage-backed securities in QE 1, and reportedly turned a profit on them. It could just as easily buy $1 trillion in student debt and refinance it at 0.75%.

Which is a Better Investment: Banks or Students?

Students are considered risky investments because they don’t own valuable assets against which the debt can be collected. But this argument overlooks the fact that these young trainees are assets themselves. They represent an investment in “human capital” that can pay for itself many times over, if properly supported and developed. This was demonstrated in the 1940s with the G.I. Bill, which provided free technical training and educational support for nearly 16 million returning servicemen, along with government-subsidized loans and unemployment benefits.

The outlay not only paid for itself but returned a substantial profit to the government and significant stimulus to the economy. It made higher education accessible to all and created a nation of homeowners, new technology, new products, and new companies, with the Veterans Administration guaranteeing an estimated 53,000 business loans. Economists have determined that for every 1944 dollar invested, the country received approximately $7 in return, through increased economic productivity, consumer spending, and tax revenues.

Similarly in the 1930s and 1940s, the Reconstruction Finance Corporation funded the New Deal and World War II and wound up turning a profit, without drawing on taxpayer funds. It’s an initial capitalization was only $500 million; yet the RFC eventually lent out $50 billion – the equivalent of about $500 billion today. It raised money by issuing debentures, a form of bond. It got all of this money back, made a profit for the government, and left a legacy of roads, bridges, dams, post offices, universities, electrical power, mortgages, farms, and much more that the country did not have before.

In 1944, President Franklin Roosevelt proposed an Economic Bill of Rights, in which higher education would be provided by the government for free; and in the progressive 1960s, tuition actually was free or nearly free at state universities. Some countries provide nearly-free higher education today. In Norway, Denmark, France and Sweden, the cost of college is less than 3% of median income, as compared to 51% in the U.S.

Other countries make loans available to their students interest-free. For more than twenty years, the Australian government has successfully funded students by giving out what are in effect interest-free loans. They are “contingent loans,” which are repaid only if and when the borrower’s income reaches a certain level. New Zealand also offers 0 percent interest loans to New Zealand students, with repayment to be made from their incomes after they graduate.

Banks Are Good Credit Risks Only Because They Are Backed by the Government

In a National Review article titled “Warren’s Student-loan Demagoguery,” Ian Tuttle argues that the discount window should not be available to students because the Fed defines that resource as “an instrument of monetary policy that allows eligible institutions to borrow money, usually on a short-term basis, to meet temporary shortages of liquidity caused by internal or external disruptions,” and because the discount window is “an emergency measure used to prevent runs on banks.”

It may be true that the Fed’s discount window is open only to banks, but the Federal Reserve Pact was passed by Congress and can be modified by Congress. The reasoning behind the policy needs to be re-examined.

The question is, why do banks routinely have “shortages of liquidity”? What does that mean? It means they have lent out depositor funds that don’t properly belong to them, gambling that they will be able to replace the money before the depositors demand it back. The banks have a binding commitment to return customer money “on demand.” They can make good on that commitment because, and only because, the Fed and the FDIC back them up in a massive shell game, in which they borrow from each other or the Fed overnight – just long enough to make their books appear to balance – and then give the money back the next day. Banks are good credit risks only because they have the backstop of the Fed and the government behind them. Without those guarantees, we would be back to the cycle of endless bank runs of the 19th and early 20th centuries.

“Our students are just as important to our recovery,” says Warren, “as our banks.” What if students, too, were backed by the government’s guarantee? What if, as in Australia and New Zealand, students were not required to repay the investment in human capital represented by their educations until the economy provided them with jobs? What if the government made it a policy to provide them with jobs? This too has been done before, quite successfully. It was part of Roosevelt’s New Deal. As detailed by Prof. Randall Wray, citing N. Taylor’s The Enduring Legacy of the WPA:

"The New Deal jobs programs employed 13 million people; the WPA was the biggest program, employing 8.5 million, lasting 8 years and spending about $10.5 billion. It took a broken country and in many important respects helped to not only revive it, but to bring it into the 20th century. The WPA built 650,000 miles of roads, 78,000 bridges, 125,000 civilian and military buildings, 700 miles of airport runways; it fed 900 million hot lunches to kids, operated 1500 nursery schools, gave concerts before audiences of 150 million, and created 475,000 works of art. It transformed and modernized America."

In the 1930s, the government was in a worse financial position to achieve all this than it is now; but the commitment and the will were there, and the means were found. In World War II, the means were found again. The government always seems to be able to find the means to fund a war. We can just as easily find the means to fund our economic recovery. And if the funding comes from the Federal Reserve, the government need not be propelled into a mounting debt owed at mounting interest. The funds can be provided interest-free; and because they represent an investment in productive capital, the debt itself can be repaid with the fruits of the investment – the jobs that create the salaries that generate taxes and consumer demand.

The default rate on student loans is close to 10% today because there are no jobs available to repay the loans, and because the interest rate is so high that the debt is doubled or tripled over the life of the loan. Give students loans and jobs, and the default problem will cure itself.

Investing in our young people has worked before and can work again; and if Congress orders the Fed to fund this investment in our collective futures by “quantitative easing,” it need cost the taxpayers nothing at all. The Japanese have finally seen the light and are using their QE tool as economic stimulus rather than just to keep their banks afloat, and we need to do the same.

Ellen Brown is an attorney, chairman of the Public Banking Institute and author of twelve books, including Web of Debt and the just-released sequel, The Public Bank Solution. Her websites are The Web of Debt and publicbanksolution.com.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments