Many of you have likely heard about public banking and how it is central to many developed economies in the world, and the dominant model in others. Germany has public banks funding much of their manufacturing sector as well as their rapid installation of renewable and distributed energy production systems.

New Zealand has a postal bank, which they use to provide convenient and low cost banking services to their people. China has the largest development bank in the world. Japan has the largest public bank by deposits in the world. India has the largest public bank, in terms of its number of branches, in the world. And Scotland has the largest public bank by assets.

And the United States? Our country is bereft of public banking and true public finance. Sure, we talk about public finance as if it serves the public, but the reality is that virtually all of our public finance has been co-opted by private banks. With the exception of North Dakota, all state treasurers deposit their state tax revenues and fees into private banks — usually the ones on Wall Street, setting the stage for endless dependency on the private banking cartel.

We've been led to believe there is no alternative. Take, for example, the California Infrastructure Bank, or I Bank. An I Bank is a public entity that uses private money to fund public projects. On the face it it, this seems like a good approach — not using taxes to fund public projects. But the reality is that the I Bank is another form of hidden taxation, in the form of interest payments, making wealthy people wealthier by teeing up safe, long-term investments in public projects like bridges and other infrastructure.

The San Francisco/Oakland Bay Bridge was initially funded with the I Bank. Ignoring the twists and turns of the planning process during the 90's and the last decade, the new bridge is a safe investment; the money will undoubtedly be paid back by tolls. The cost for this new bridge is $6.4 billion, a sum widely quoted in local papers. What is not said is that the interest and fees for this will be another $6 billion. $6 billion to be paid until the year 2049.

This is a good time to ask why we hold labor costs under the microscope and rarely do the same for debt servicing costs? Ask your local elected officials; do they know the debt servicing costs in their budget? I suspect that many of them know, to the penny, what the labor costs are.

This is now playing out in Detroit where pension plans are readily placed on the altar to be sacrificed, but what is due to the banks is sacrosanct. Yet North Dakota, the only state in our country with a public bank, does not have debt servicing costs because they "don't spend more than they take in," or so the locals like to say.

The reality is that North Dakota doesn't issue general obligation bonds because the state has its own bank to finance public infrastructure. Last year their public bank, the Bank of North Dakota, issued a $50 million loan to fund a new water pipeline. The paid interest on this loan is reported as profits to the bank and — guess what — it gets returned to the state general budget, benefiting the very same people who paid for the water.

Meanwhile, in California, public finance is being starved for funds. Earlier this year, California Watch published a study that showed that over the last six years over $9 billion in loans have been taken out as "capital appreciation bonds" by our school districts to fund school construction and improvements. The estimated cost in interest: over $26 billion. In other words, we are obligating future taxpayers, our sons and daughters, to pay $35 billion for our use of $9 billion today! What kind of legacy is that?

Elected officials cannot raise taxes; they've cut as much as they can cut, many districts are bonded out, they've reached their debt ceiling and are privatizing whatever they can for short-term gain. So, what options do they have other than to take out these toxic debt products peddled by Wall Street?

It does not have to be this way. Your treasurers at city, county and state levels can easily take public monies that are on deposit in Wall Street banks, deposit them in a public bank and use the bank credit for the public good.

If we had a state Bank of California, the state could have funded the entire $6.4 billion bridge construction cost simply with bank credit generated by state deposits. Think of that the next time you pay the $6 toll on the Bay Bridge — knowing that over 55% of that money is going toward decades of interest payments to the big Wall Street banks.

A state public bank means the state gives itself a license to issue credit through use of deposits. The "bank" is simply a few cubicles staffed by people who understand credit and interest rate risk. But the heart of it is the license, issued by the California State Department of Financial Institutions. This can be done at the county or city level and can effectively eliminate debt servicing costs, a major line item in the budget.

Public banking is all about economic sovereignty and self sufficiency. It is about sharing the exclusive privilege that we, as a people, have given banks to use bank credit, issuing loans simply by writing them into their books.

We recognize that in a free market there are essential public utilities that exist side by side with well-regulated products. Tap water at low cost exists side by side with more expensive bottled water. Electricity provided over the wires exists side by side with power generators. Mass transit exists as an alternative to using expensive cars, and are complimentary. 44-cent first class postage through the US Postal Service exists side by side, for now at least, with $17 overnight delivery through FedEx.

We are so used to banks being the exclusive provider of bank credit that many of us don't even recognize that we can create an alternative. Fortunately, most other countries,have not been snookered the way we have. They are not paying FedEx prices for public finance.

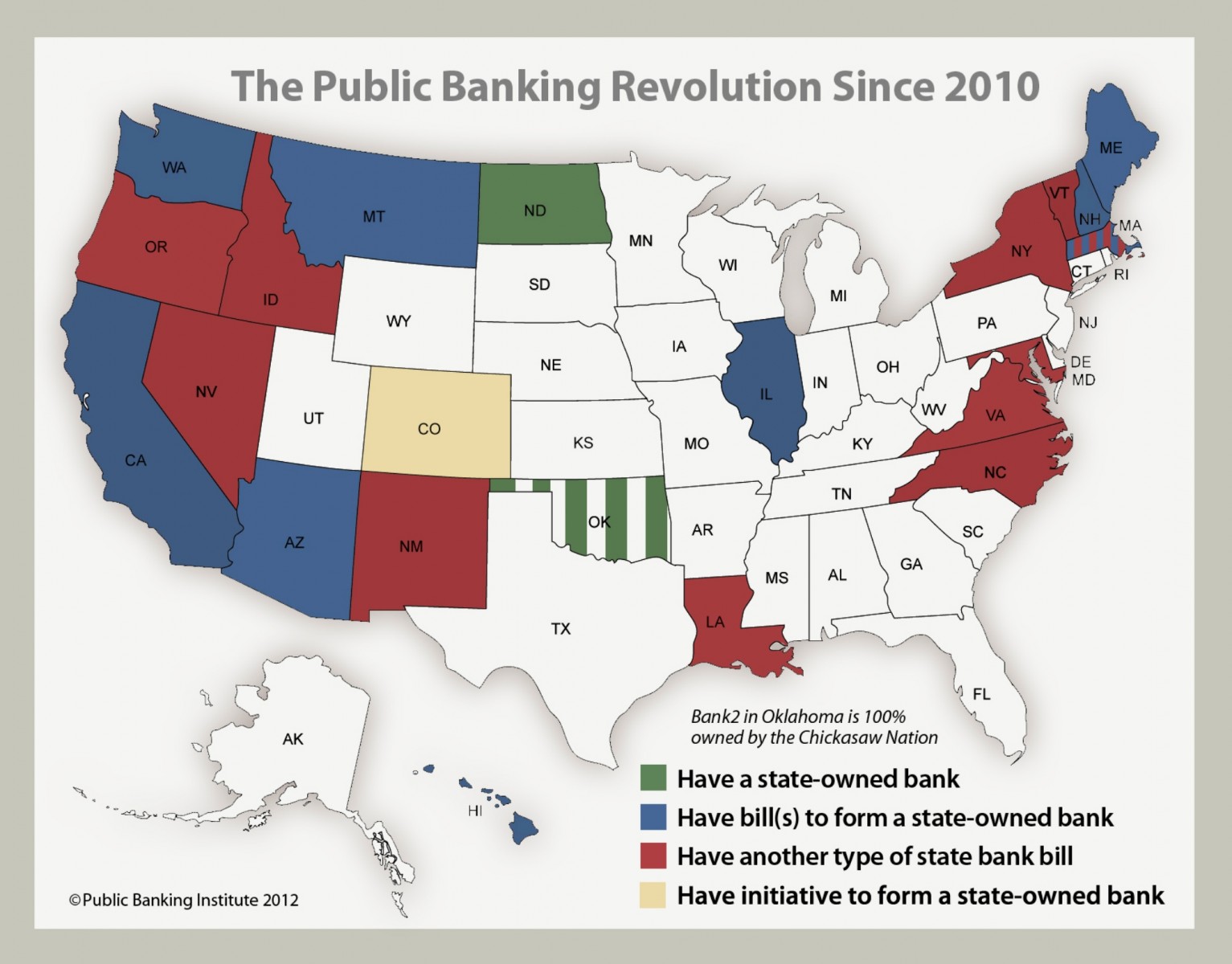

The Public Banking Institute's vision is to see a network of public banks — 50 state owned banks and scores of county and city owned banks, with the US Postal Service additionally providing core, low cost banking services to 10 million currently unbanked people and over 20 million who are underbanked — established throughout the United States.

Not only can this network provide low cost banking services and affordable credit for infrastructure financing and to create jobs, but it can also provide LIBOR-like interest rate benchmarks that can be used instead of relying upon the private banking cartel for this important index.

Even more important, our vision is for the self sufficiency of our communities. Do you want your county to reduce its carbon footprint? Start a loan program to improve the energy efficiency of homes. Sonoma County in northern California did this a few years ago, but did it with tax assessments on property bills. The costs for the Sonoma County Energy Independence Program (SCEIP) could have been much lower with a county owned bank. The Bank of North Dakota has 26 of these loan programs.

Do you want to see your county build or extend mass transit, clean water, clean energy, etc? Fund these projects with a county bank, and every one of these loans will be self liquidating — paid back with the fees generated from the service provided.

So, if you're looking for one cause to take on that truly changes the way our society works, pick up public banking in your city or county. Austerity, the fiscal cliff, the dominating headlines that scream “We're Broke!!” — these are all myths, and they are being steadily, increasingly revealed as such. Challenge the Wall Street cartel of private banks and you will be contesting with the most well financed lobby the world has ever known.

But you will be acting as a citizen in the interest of your community and your country. And the great thing about it is: We, the People, can win.

Marc Armstrong is executive director of the Public Banking Institute. This article was adapted from a speech Armstrong gave at the Progressive Festival in Petaluma, California, on Sept 15, 2013.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments