BARCELONETA, PUERTO RICO — The sprawling pharmaceutical plants nestled in the hills of this town west of San Juan are testament to the unusual nature of this island’s struggling economy.

The factories once employed a small army of highly trained workers that would be the envy of many other places in the United States. But those jobs — for engineers, chemists and others skilled in precision manufacturing — have been rapidly disappearing for largely the same reason they came here in the first place: policy decisions made in Washington.

A generous series of tax breaks enacted by Congress shielded the profits of U.S. corporations operating here and helped transform Puerto Rico from a largely agrarian society to a manufacturing powerhouse. But what Washington gave, it also took away.

When Congress decided to phase out a crucial tax credit that ended in 2005, it helped plunge Puerto Rico into a recession that began a decade ago and has yet to end. Last week, Gov. Alejandro García Padilla said the island could not repay more than $70 billion in debt, setting it down a path that could rock the municipal bond market and lead to higher borrowing costs for state and local governments across the United States.

Officially a U.S. commonwealth, Puerto Rico is treated in some ways like a foreign country, in other ways like a state, and in still other ways unlike anywhere else. But it has never had full control over its destiny.

Now, it’s again at the mercy of Washington, as García Padilla asks Congress and the president to allow the island and its public corporations — which provide basic services including electricity and water — to file for bankruptcy, a process that would give Puerto Rico and its creditors an orderly way to restructure the territory’s staggering debt. Without that power, Puerto Rico is at risk of spending years in a situation akin to the Greek debt crisis playing out in Europe.

“In some ways, what you have in Puerto Rico is an economic crisis manufactured by the U.S.,” said Victor Rodriguez, a professor in the Department of Chicano and Latino Studies at California State University Long Beach who closely tracks events on the island. “Now trying to fix it is like fighting a championship battle with your hands tied.”

The tax change by Congress is just one chapter in the history of the island being whipsawed and hampered by decisions made 1,500 miles away. Lawmakers closed several large military bases in the early 2000s, triggering the departure of tens of thousands of troops and civilian personnel and costing the economy hundreds of millions of dollars a year.

Meanwhile, a federal law dating from 1920 requires every product shipped to Puerto Rico from the mainland to be transported on U.S.-flagged vessels, raising the prices of a wide variety of products.

New Relationship Urged

Some analysts and business people say that forging a lasting solution to the island’s economic problems will require a reworking of its convoluted relationship with the federal government.

“This is the worst crisis ever that we have had in our history, and we have no tools to fix it,” said Gustavo Vélez, an economist and former legislative and gubernatorial adviser here. “We have to start a conversation with the U.S. government to change the current restrictions on Puerto Rico. We have to revise the current economic relationship with the mainland.”

The implications of Puerto Rico’s debt are also serious for investors on the mainland, because more than 180 municipal bond mutual funds have at least 5 percent of their portfolios in Puerto Rican bonds, according to Morningstar, an investment research firm.

Overall, Puerto Rico is the third-largest issuer of state and local debt in the United States, behind only California and New York. This, too, is partly a result of federal tax policy, which made Puerto Rican debt exempt from federal, state and local taxes and thus encouraged the island to borrow money and enabled it to do so at relatively low rates.

“The federal government has a great deal of responsibility for the problem,” said Jeffrey L. Farrow, chairman of the Oliver Group and former co-chair of President Bill Clinton’s Interagency Working Group on Puerto Rico. “Not exclusively. Puerto Rico created a lot of the problem itself. It doesn’t have to be in the situation it’s in. But there is a big element of federal responsibility."

As much as some Puerto Ricans chafe under rules made in Washington, it is also true that, as U.S. citizens, Puerto Ricans are protected by the federal safety net. About 40 percent of the island’s residents receive federal support, including Social Security, retirement benefits, food stamps and disability insurance. Meanwhile, they do not pay any federal tax on local income.

In addition, analysts say, Puerto Rican policymakers carry their share of the blame for the island’s economic problems. Government workers account for an outsize share of the overall workforce. Business people complain that local regulations discourage job creation and the development of clean energy, which would help the island lower its exorbitant electricity prices. And servicing the staggering debt consumes nearly half the island’s budget.

High oil prices, which began to set in around the time the key tax break was phased out a decade ago, have also pushed the commonwealth into recession because the electric utility relies on oil for about 70 percent of its generating capacity.

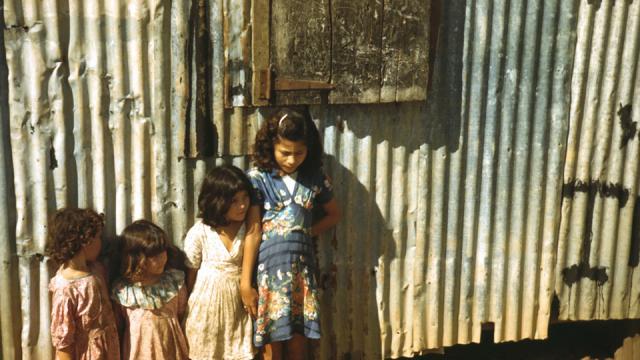

Many Puerto Ricans have looked at all these problems and decided to flee to the mainland, a prime reason the island’s population is declining by roughly 1 percent a year. But for the 3.5 million Puerto Ricans left trying to carve out lives amid rising taxes and dwindling job opportunities, the stakes in finding a solution to the island’s problems are high.

Factories Came and Went

“There is so much uncertainty,” said Victor Guilbe, 41, an engineer with drugmaker Abbott Laboratories. “The taxes here are always changing, and the price of energy is very high. “When taxes change, many corporations have decided it is better to go elsewhere, or to lay people off.”

He knows that firsthand. Guilbe worked for years at pharmaceutical giant Merck, only to be laid off before picking up his current job seven years ago. His wife, Vanessa, spent eight years at Bristol-Myers Squibb, and another seven at Merck working as a chemist, before finding herself out of work when its plant here closed.

In 1996, when Congress began phasing out the tax break that made subsidiaries of U.S. corporations operating on the island exempt from federal taxes, the impact was severe. Factories downsized or closed, causing manufacturing employment to plunge by more than half. The balance sheets of Puerto Rican banks, once flush with corporate deposits earned in those plants, began to shrivel.

“Puerto Rico is more dependent on manufacturing than any state in the U.S.,” said Waleska Rivera, president of Danosa Caribbean, a firm that makes roofing material, and a former head of the island’s manufacturing association. “Even with all the job losses, manufacturing is still 48 percent of our economy. We have to find a way to protect it.”

As manufacturing slowed, tax revenue withered, leaving the government to borrow heavily to cover its spending. Though the government has recently raised taxes, the island’s public debt has more than doubled in the past decade.

With the island’s central government coming to an economic reckoning, local officials here in Barceloneta are looking for ways to make up for the loss of factory jobs. Some of the plants have gotten new operators. Meanwhile, the town’s mayor, Wanda Soler Rosario, is proud of its large outlet mall and the Olive Garden and Chili’s restaurants that have opened in recent years.

The town is looking to expand coffee production and to promote itself as a tourist and sports destination. A new skate park is nearing completion, and the town has an aquatic park and a park for BMX biking.

“There is a lot of anxiety among the people,” said Wanda Hernandez, the town’s events coordinator. “But the mayor is doing all she can to create jobs.”

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments