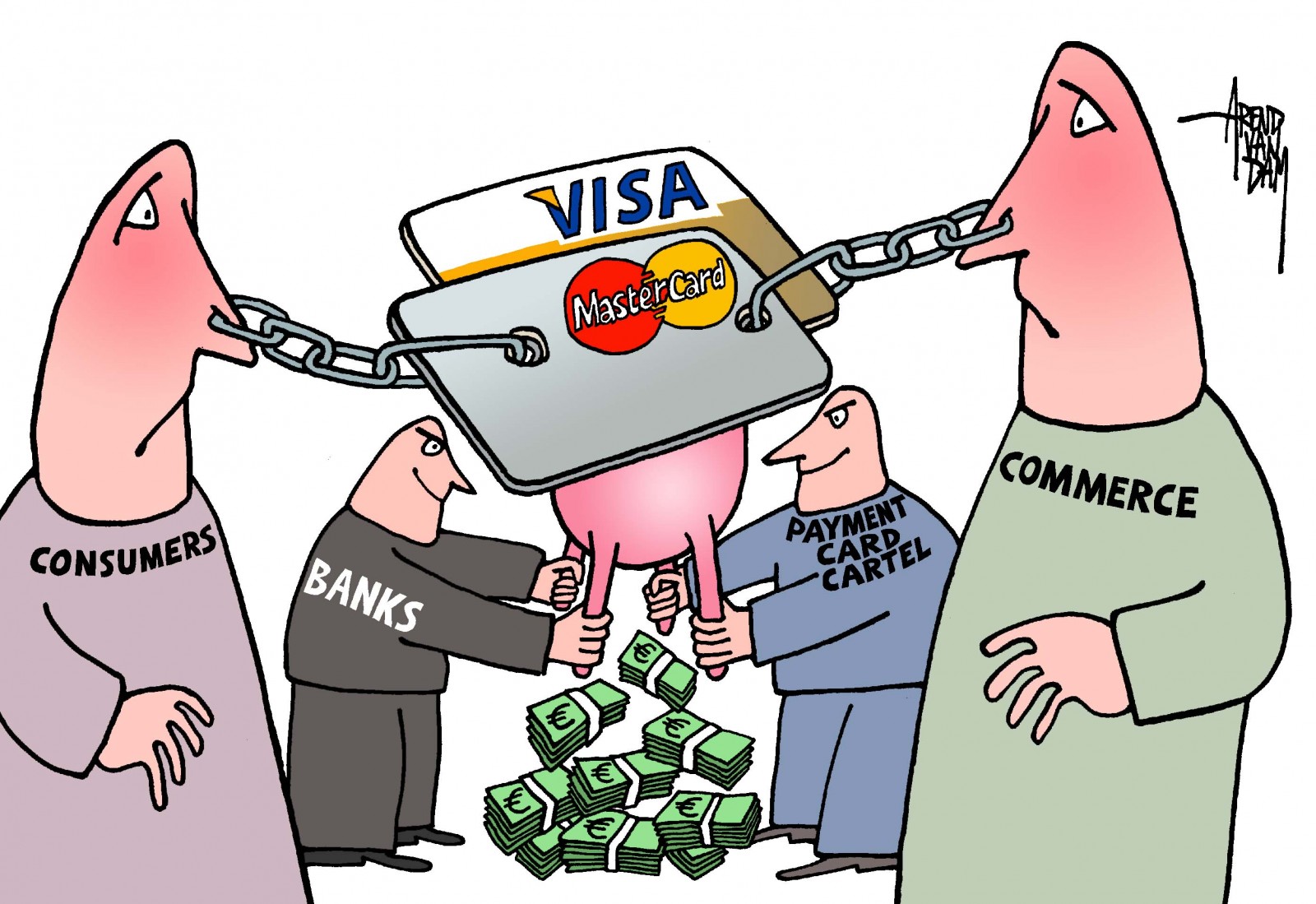

The credit card business is now the banking industry’s biggest cash cow, and it’s largely due to lucrative hidden fees.

You pay off your credit card balance every month, thinking you are taking advantage of the “interest-free grace period” and getting free credit. You may even use your credit card when you could have used cash, just to get the free frequent flier or cash-back rewards.

But those popular features are misleading. Even when the balance is paid on time every month, credit card use imposes a huge hidden cost on users — hidden because the cost is deducted from what the merchant receives, then passed on to you in the form of higher prices.

Visa and MasterCard charge merchants about 2% of the value of every credit card transaction, and American Express charges even more. That may not sound like much. But consider that for balances that are paid off monthly (meaning most of them), the banks make 2% or more on a loan averaging only about 25 days (depending on when in the month the charge was made and when in the grace period it was paid).

Two percent interest for 25 days works out to a 33.5% return annually, and that figure may be conservative.

Merchant fees were originally designed as a way to avoid usury and Truth-in-Lending laws. Visa and MasterCard are independent entities, but they were set up by big Wall Street banks, and the card-issuing banks get about 80% of the fees. The annual returns not only fall in the usurious category, but they are returns on other people’s money – usually the borrower’s own money! Here is how it works.

The Ultimate Shell Game

Economist Hyman Minsky observed that anyone can create money; the trick is to get it accepted. The function of the credit card company is to turn your IOU, or promise to pay, into a “negotiable instrument” acceptable in the payment of debt. A negotiable instrument is anything that is signed and convertible into money or that can be used as money.

Under Article 9 of the Uniform Commercial Code, when you sign the merchant’s credit card charge receipt, you are creating a “negotiable instrument or other writing which evidences a right to the payment of money.” This negotiable instrument is deposited electronically into the merchant’s checking account, a special account required of all businesses that accept credit.

The account goes up by the amount on the receipt, indicating that the merchant has been paid. The charge receipt is forwarded to an “acquiring settlement bank,” which bundles your charges and sends them to your own bank. Your bank then sends you a statement and you pay the balance with a check, causing your transaction account to be debited at your bank.

The net effect is that your charge receipt (a negotiable instrument) has become an “asset” against which credit has been advanced. The bank has simply monetized your IOU, turning it into money. The credit cycle is so short that this process can occur without the bank’s own money even being involved. Debits and credits are just shuffled back and forth between accounts.

Timothy Madden is a Canadian financial analyst who built software models of credit card accounts in the early 1990s. In personal correspondence, he estimates that payouts from the bank’s own reserves are necessary only about 2% of the time; and the 2% merchant’s fee is sufficient to cover these occasions. The “reserves” necessary to back the short-term advances are thus built into the payments themselves, without drawing from anywhere else.

As for the interest, Madden maintains:

“The interest is all gravy because the transactions are funded in fact by the signed payment voucher issued by the card-user at the point of purchase. Assume that the monthly gross sales that are run through credit/charge-cards globally double, from the normal $300 billion to $600 billion for the year-end holiday period. The card companies do not have to worry about where the extra $300 billion will come from because it is provided by the additional $300 billion of signed vouchers themselves... “That is also why virtually all banks everywhere have to write-off 100% of credit/charge-card accounts in arrears for 180 days. The basic design of the system recognizes that, once set in motion, the system is entirely self-financing requiring zero equity investment by the operator... The losses cannot be charged off against the operator’s equity because they don’t have any. In the early 1990′s when I was building computer/software models of the credit/charge-card system, my spreadsheets kept “blowing up” because of “divide by zero” errors in my return-on-equity display.”

A Private Sales Tax

All this sheds light on why the credit card business has become the most lucrative pursuit of the banking industry. At one time, banking was all about taking deposits and making commercial and residential loans. But in recent years, according to the Federal Reserve, “credit card earnings have been almost always higher than returns on all commercial bank activities.”

Partly, this is because the interest charged on credit card debt is higher than on other commercial loans. But it is on the fees that the banks really make their money. There are late payment fees, fees for exceeding the credit limit, balance transfer fees, cash withdrawal fees, and annual fees, in addition to the very lucrative merchant fees that accrue at the point of sale whether the customer pays his bill or not. The merchant absorbs the fees, and the customers cover the cost with higher prices.

A 2% merchants’ fee is the financial equivalent of a 2% sales tax – one that now adds up to over $30 billion annually in the U.S. The effect on trade is worse than either a public sales tax or a financial transaction tax (or Tobin tax), since these taxes are designed to be spent back into the economy on services and infrastructure. A private merchant’s tax simply removes purchasing power from the economy.

As financial blogger Yves Smith observes:

“[W]hen anyone brings up Tobin taxes (small charges on every [financial] trade) as a way to pay for the bailout and discourage speculation, the financial services industry becomes utterly apoplectic.... Yet here in our very midst, we have a Tobin tax equivalent on a very high proportion of retail trade.... [Y]ou can think of the rapacious Visa and Mastercharge charges for debit transactions... as having two components: the fee they’d be able to charge if they faced some competition, and the premium they extract by controlling the market and refusing to compete on price. In terms of its effect on commerce, this premium is worse than a Tobin tax.”

A Tobin tax is intended to have the positive effect of dampening speculation. A private tax on retail sales has the negative effect of dampening consumer trade. It is a self-destruct mechanism that consumes capital and credit at every turn of the credit cycle.

The lucrative credit card business is a major factor in the increasing “financialization” of the economy. Companies like General Electric are largely abandoning product innovation and becoming credit card companies, because that’s where the money is. Financialization is killing the economy, productivity, innovation, and consumer demand.

Busting the Monopoly

Exorbitant merchant fees are made possible because the market is monopolized by a tiny number of credit card companies, and entry into the market is difficult. To participate, you need to be part of a network, and the network requires that all participating banks charge a pre-set fee.

The rules vary, however, by country. An option available in some countries is to provide cheaper credit card services through publicly-owned banks. In Costa Rica, 80% of deposits are held in four publicly-owned banks; and all offer Visa/MC debit cards and will take Visa/MC credit cards.

Businesses that choose to affiliate with the two largest public banks pay no transaction fees for that bank’s cards, and for the cards of other banks they pay only a tiny fee, sufficient to cover the bank’s costs.

That works in Costa Rica; but in the US, Visa/MC fees are pre-set, and public banks would have to charge that fee to participate in the system. There is another way, however, that they could recapture the merchant fees and use them for the benefit of the people: by returning them in the form of lower taxes or increased public services.

Local governments pay hefty fees for credit card use themselves. According to the treasurer’s office, the City and County of San Francisco pay $4 million annually just for bank fees, and more than half this sum goes to merchant fees. If the government could recapture these charges through its own bank, it could use the proceeds to expand public services without raising taxes.

If we allowed government to actually make some money, it could be self-funding without taxing the citizens. When an alternative public system is in place, the private mega-bank dinosaurs will no longer be “too big to fail.” They can be allowed to fade into extinction, in a natural process of evolution toward a more efficient and sustainable system of exchange.

Ellen Brown is an attorney, chairman of the Public Banking Institute, and author of twelve books including the bestselling "Web of Debt." In her latest book, "The Public Bank Solution," she explores successful public banking models historically and globally. She is currently running for California State Treasurer on a state bank platform.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments