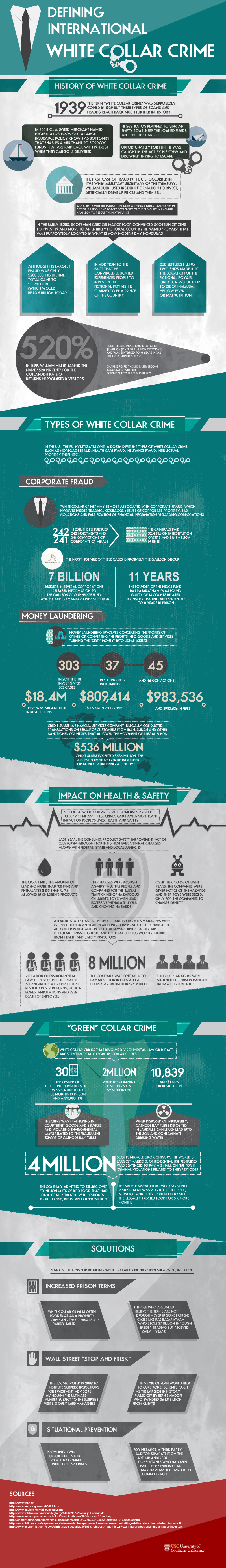

White collar crime is as old as business itself, with the pioneers of the art form resorting to crude measures to bilk others out of their hard-earned currency. One of the earliest recorded white collar crimes on record included an importer who, after taking out a loan to acquire goods for sale, planned to fake a shipwreck and make off with the goods and money.

Now, plans to steal money have only grown more sophisticated, with scammers coming up with new and innovative ways to part people from their money. With insider trading, kickbacks and money laundering marring the reputation of corporations both small and large, some are coming to associate Wall Street with organized fraud and unchecked corporate greed.

The solution?

Tougher penalties for white collar crime will deter criminals. Currently, white collar crime is treated as a property crime, and jail sentences are often light or nonexistent. The law, however, is catching up to these master manipulators. Disgraced financier Bernie Madoff ran one of the longest-running Ponzi schemes in history and bilked individuals, corporations, educational institutions and charities out of billions of dollars. His triple-digit prison sentence was unprecedented and an eye-opener for anyone who was considering following in his tracks.

While there will always be white collar criminals, prevention and punishment will go a long way in stopping thieves in their tracks. Removing the opportunities for fraudsters to practice their craft is one of the best ways to deter crime. In the meantime, vigilance and justice will keep innocent people from becoming victims.

Originally published by USC Gould School of Law

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments