This is the third article in a three-part series looking at China's transformed role on the world financial stage. Read the first and secondarticles here.

In pursuing the strategy toward China of “integrate, but hedge,” the United States and its G-7 allies attempted to manage China’s global financial role, giving the world’s second largest economy a greater stake in the existing system while attempting to prevent alternative or antagonistic emerging market economies from gaining power.

However, due to the slow pace of reforms and their often disappointing results – case in point: the five-year delay of International Monetary Fund (IMF) reforms that would give China and other emerging economies greater influence in the Fund and World Bank – China has turned to creating its own development bank, the Asian Infrastructure Investment Bank (AIIB). And while China was developing the AIIB over the course of 2015, China was not only hedging its own bets – it was also advancing a strategy of "integration" on the monetary front. In the world of currencies, central banks and the global monetary order, China had an important year.

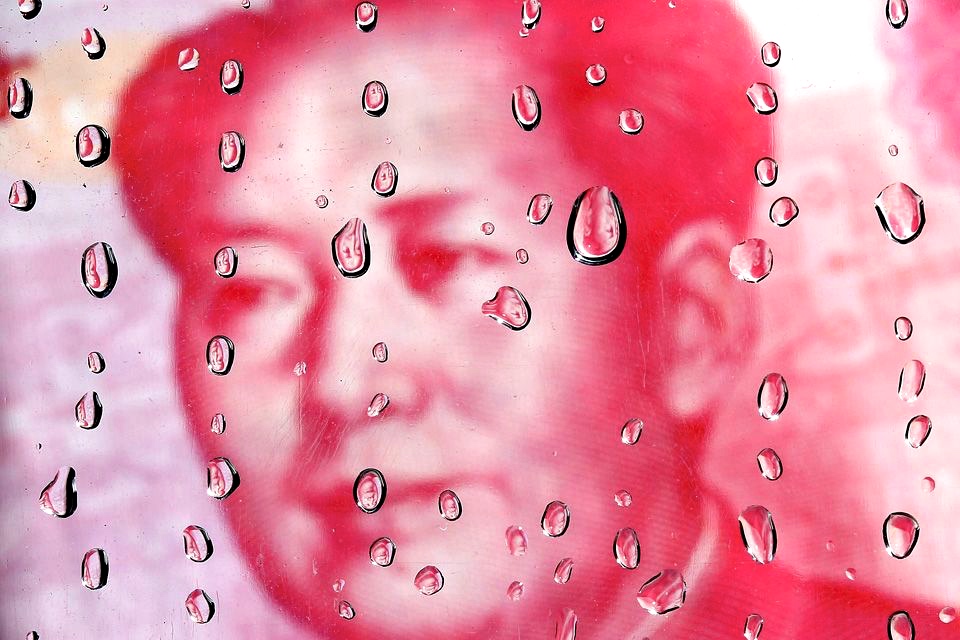

The main issue has been the inclusion of the Chinese currency – the yuan, or renminbi – in the elite basket of currencies managed by the IMF known as Special Drawing Rights (SDRs). Consisting of four of the world’s most traded currencies (the U.S. dollar, the euro, Japanese yen and British pound), the SDR is a currency unit whose value is weighted among those four currencies and used in IMF transactions between nations and central banks. But the real importance of the SDR basket is that it is a symbolic grouping of the few select currencies (and countries) that dominate the global monetary system. They are the most traded, saved and important currencies in the world, giving the countries and institutions that control them inordinate power in the global monetary and economic system.

China has lobbied for years to be included in the SDR basket, as both a sign of its global economic status and as a recognition of its new geopolitical power. But for China to be included, it needed to meet a number of criteria related to how easily tradable the currency is, how many central banks use the currency as a reserve asset, and whether or not interest rates are determined by market forces. Eswar Prasad, an economics professor at Cornell University who was previously the China country director at the IMF, commented that “this is ultimately going to be decided on political rather than economic merits.”

In laying the groundwork for inclusion, the IMF announced late last May that the renminbi was no longer considered to be “undervalued” – a long-held complaint of the IMF, United States and other G-7 nations that felt for such a large economy to maintain such a cheap currency gave it an overwhelming trade advantage, keeping its products cheaper and thus more competitive in international markets. Thus, the IMF’s declaration paved the way for consideration of the Chinese currency to be included in the SDR.

When the G-7 finance ministers and central bank governors met in Berlin in late May, they discussed the potential inclusion of the renminbi in the SDR basket. German Finance Minister Wolfgang Schauble said that “it is desirable in principle” but “the technical conditions must be examined.” The G-7 countries continued to push China to reform its capital markets in order to increase its potential for inclusion. This pressured China to implement further market reforms to “liberalize” its financial markets, allowing for private financial institutions to play a larger role in managing the country’s economy (as opposed to being more state-directed and managed).

Earlier that same month, the People’s Bank of China (PBoC), China's central bank, approved roughly 30 foreign financial institutions to invest its domestic bond market, giving banks like HSBC, BNP Paribas, Société Générale, ING and Morgan Stanley greater access to the world’s third largest bond market (following the U.S. and Japan). China made moves over subsequent months to increase the access of foreign central banks and sovereign wealth funds to its bond market, as the country continued reforms that liberalized its economy. However, China still remained hesitant to adapt market forces too quickly or too fully that might have the effect of destabilizing the economy.

In August, the IMF recommended that while the renminbi should be added to the SDR basket, with a final decision to be made in November, the currency's actual addition to the basket should not take place until September of 2016. This was in order to allow the country to implement further financial reforms and give banks, central banks and asset managers enough time to adjust their currency holdings to a slightly reformed monetary order. Some G-7 countries, such as Germany, France, Britain and Italy, favored a quick inclusion of the renminbi to the SDR, but Japan and the U.S. favored a more cautious approach.

Then, partway into August, China shocked global financial markets with a rapid currency devaluation – done partly to provide a boost to its own slowing economy – raising criticism from several countries that China was engaging in a currency war to lower the value of the renminbi in order to boost exports at the expense of other nations. However, because China’s currency is so closely tied to the U.S. dollar, as the dollar has risen in value over the past year or so, China’s currency has risen with it. This has put further strain on China's economy and decreased its competitiveness relative to other global currencies whose value has declined relative to the rise of the dollar. That's why, when China devalued in August, it explained the move as an attempt to move more towards a market oriented value for its exchange rate.

China was accused of currency manipulation due to its sudden devaluation, though it was in fact more accurately a response to the pressures from the manipulated changes in the value of the big currencies (U.S. dollar, Japanese yen and euro), which fluctuated in response to the winding down or ramping up of their respective Quantitative Easing (QE) programs. China managed to mute some harsher criticisms of its move by quickly announcing further market-oriented reforms to its financial and interest rate markets.

At a meeting of G-20 finance ministers and central bank governors in early September, U.S. Treasury Secretary Jacob Lew pressured his Chinese counterparts to continue the process of implementing market reforms, and specifically allowing markets a larger say in determining the value of the Chinese currency.

In mid-November, the IMF officially recommended that China be included in the SDR basket, which would “turn its currency into one of the pillars of international finance,” noted the New York Times. However, the final decision was to be made by the IMF’s Executive Board at the end of the month, where the G-7 countries have the power to pass or block any final moves. Following the IMF staff recommendation, China’s central bank announced that it would be implementing further reforms to allow markets more of a say in setting interest rates. And in late November, the IMF Executive Board voted in agreement to let the renminbi be included in the SDR basket, effective October 1, 2016.

Then, partway into December, China announced that it would begin to measure the value of its currency against a basket of 13 currencies instead of just the U.S. dollar. This would give the currency more room to fall in value relative to the U.S. dollar’s rise, and would give the country more “monetary independence” from the decisions and actions of the U.S. Federal Reserve. The announcement came just as the Fed was set to raise interest rates for the first time in nearly a decade, a move that would drive the U.S. currency even higher and put even more pressure on China as its economy continues to slow. In response, the Chinese currency hit a new four-year low against the U.S. dollar, increasing the country’s trade competitiveness.

The rise of China is one of the most important economic stories of the late 20th and early 21st centuries, and will continue to remain so. While the United States and the G-7 seek to “integrate, but hedge” their bets in bringing China into the structures of global economic governance, such as through inclusion into the SDR basket, China continues to pressure for greater political power commensurate with its economic weight, “hiding its brightness, biding its time.” But the time is increasingly present, visible with China’s founding of the Asian Infrastructure Investment Bank (AIIB), as a potential rival to the World Bank.

The integration of China into the structures and systems of global economic governance will have lasting ramifications. Not simply because it represents a shift from the dominance that the G-7 nations held over the global economy for the past four decades, but because the Chinese model of state-run totalitarian capitalism itself presents an alternative approach to constructing a market economy. As China increasingly becomes a part of the governing structure of the world economy, its model will gain increased influence. Indeed, if war and hostilities between the other great powers are to be avoided, the future of global capitalism may well rely on a combination of Western markets and institutions backed up by totalitarian institutions like the regime in Beijing.

Given that the capitalist system is experiencing a crisis in its legitimacy – with warnings from the head of the Bank of England, the IMF, and influential financial dynasties that the system is increasingly under threat due to its excesses – democracy may no longer be compatiblewith capitalism. And totalitarian state structures may be the only way to save capitalism from itself.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments