Many people are responsible for the financial disaster of 2008, and the economic hardship that has continued to unravel since. We still have not seen one criminal prosecution among the CEOs who were – and many still are – at the frontlines where everything started to crumble. Those people are hiding behind corporate protection, always blaming the next in line behind them, never accepting responsibility, and very often putting the blame on the very people they have ruined with their fraudulent dealings.

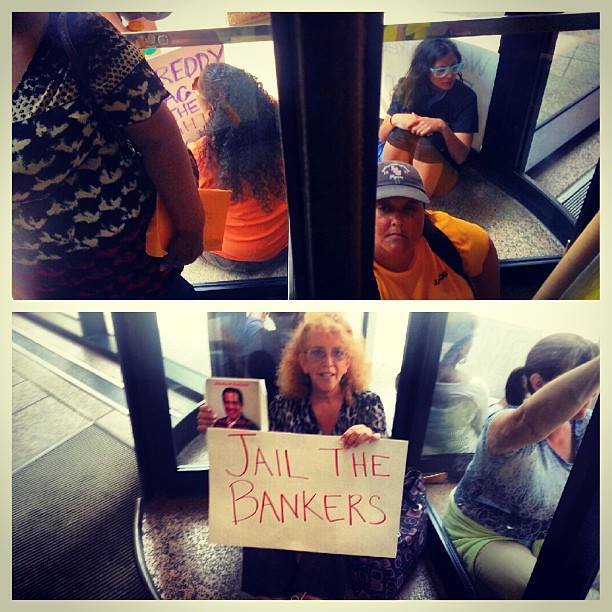

One of those people is a remarkable woman named Sherry Hernandez. She is the type of fighter you always encounter when society faces a crisis: the type who refuses to back down in the face of hardship. Hernandez decided to scratch beneath the surface of the mortgage-lending fraud that threatened to destroy her life savings, steal her home and ruin her family. She stood up, faced it, and denied the self-proclaimed "experts" on Wall Street from foreclosing on her California home. I first profiled Hernandez back in 2014. Here is a follow-up to her inspiring story, where the lesson is: never give up when you're fighting for justice.

Senka Huskic: Your case is a perfect example of how so many people ended up in a foreclosure maze. Could you please tell us when and how your battle to save your home started?

Sherry Hernandez: Our battle with these lenders started almost immediately after we signed our first loan in 2006. It was an option ARM loan we had been talked into by the Countrywide sales manager. We were aware of the pitfalls, but we planned on paying the fully amortized payment. What we didn’t know was that they could arbitrarily raise the interest rate. In four months time our fully amortized payment had increased by $800 per month. We also did not know that all loans at that time bordered on being predatory. Our lawsuit with Countrywide went on for over five years, from 2007 to 2013. In 2013 we settled in part and won in part.

We refinanced to be free of the predatory Countrywide loan in 2008 because we were suing them. Then, our servicer at that time, CitiMortgage, gave us a "trial modification" which they did not honor; rather they transferred our loan to a company we have never heard of, PennyMac. That company put us into forced-place default by not honoring the trial modification [that] CitiMortgage initiated, and attaching exorbitant fees and arrearages. From the very onset they made it known they had no intention of dealing with us fairly. After an extended period of time, we found out that PennyMac was indeed the illegitimate offspring of Countrywide.

We filed our case against PennyMac in March 2013. Our jury trial with Countrywide/Bank of America was scheduled for Jan. 16, 2013. However, on Jan. 13, 2016, PennyMac moved to get a release from stay in the Bankruptcy court. We felt forced to settle with Countrywide in order to save our home from PennyMac. It was over five years with Countrywide and now over three years with PennyMac. If we had known from the beginning how corrupt the system was, we probably never would have started, but we always had a deep-seated belief that justice would prevail.

SH: Tell us about the recent California Superior Court decision on your case. How long did it take you to get here?

Hernandez: On June 27, 2016, our case was "remanded" back to the trial court, but the court let Trustee Corps off the hook. We now have another opportunity to prove we have enough cause to go to trial, with an Appeals Court ruling and Supreme Court review, which means the judge has to review our allegations in terms of what the Appeals Court has outlined. Once our charges are correctly pled, we will go to trial. We have demanded a jury trial. The new ruling in the Yvanova v. New Century Mortgage Corporation case allows a homeowner to challenge who owns the loan. The new ruling states that the challenge should have been legally allowed all along.

The thinking with regard to letting Trustee Corps off the hook is that since they are a third party, they have no monetary gain or loss from being the Trustee. I disagree, but it is not up to me, and I have not yet had the opportunity to present the evidence of their complicity.

Often at this point, the opposing side offers a settlement to keep from going to trial. That is the reason why there are so few wins for homeowners. Homeowners like Yvanova have to endure a great deal of pressure to make it this far, but their persistence makes changes for others. A settlement entails a confidentiality clause. Homeowners often operate from a place of fear. Most of us were not prepared for this hubris onslaught of apathetic servicers and their employees. We settle because we fear what going forward will entail.

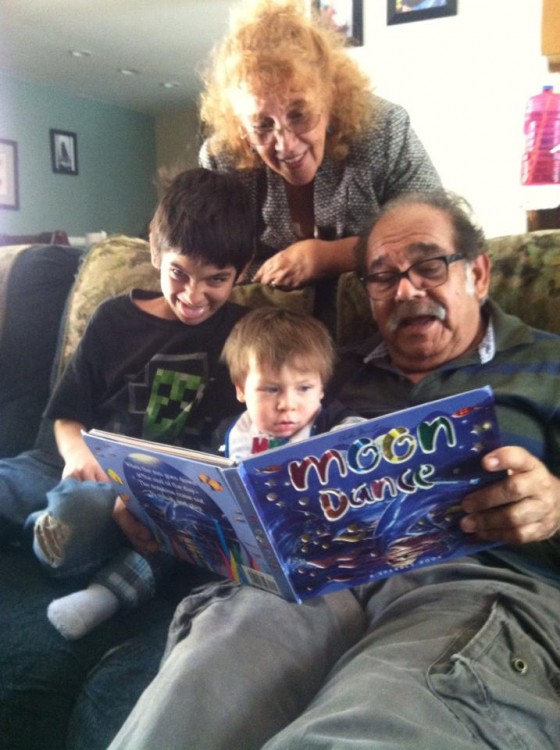

SH: Here is a paragraph from your 2014 interview: “Last Christmas our family had a tiny Christmas tree set up in an obscure corner of our home. We minimized the gift giving and didn’t have any extended family over. We didn’t want anyone embarrassed if the police came to serve us the five-day notice to leave. That was 2013. There has been nothing in our lives thus far to prepare us for this moment. Nothing prepares you for the fear, the tension, constantly studying the law, looking over our shoulder. Nothing prepares you for the fear that these circumstances will rob your grandchildren of their childhood and their innocence. I often wonder if anyone understands how deep that pain goes into a parent’s heart. Words cannot describe the horror I felt when my granddaughter was the one to find the five-day notice on our front door.” How do you feel now reading these words?

Hernandez: Those words instill in me the white hot fury of a thousand suns! I am not alone. These companies continue to steal with impunity. Recently in the San Francisco Appeals Court there was another win, Walker v. PennyMAC Loan Services, LLC [which stated]: "The nub of his allegations is that the bank foreclosed even though he made all of his loan payments on time and prevented him from reinstating the loan before the sale by refusing to provide him an accurate reinstatement figure. The complaint sufficiently alleges causes of action for breach of contract and wrongful foreclosure, so we reverse as to those causes of action.”

How does that happen? How does a borrower make all of his loan payments and still get foreclosed on? How is it that a borrower that made his loan payments has to fight his way through the lower courts and not be heard? Why wouldn’t it be better for customer relations to save a homeowner and his home? What kind of sociopath does that to a fellow human being? There was a time that having customers was something you cultivated, worked for, and struggled to give good service to. When did we become nothing more than a mark?

SH: How many times did you change lawyers since you first started to fight this battle for your house?

Hernandez: My first lawyer was with us from 2007 to 2010, then he ran out on us and left us believing our case was waiting for a trial date, when in actuality he had settled it out behind our back, without a signature. It remained under the jurisdiction of the court until we found out. John Wright of piggybankblog.com helped us to find the second lawyer. That lawyer was good and thorough, but after our settlement and problems with the firm he worked for, he got out of the business of helping homeowners.

Our third lawyer was skilled, likable and still learning the field himself. I admired him, he answered all calls, but like many attorneys in this battle his objective was to help us get a modification, and PennyMac was unrelenting in order to hide their own fraud. Following him, we were forced to go to appeal. The appeal lawyer – number four – for the Unlawful Detainer (UD) trial, deserted us two weeks before the appeal was due. I still suspect she was bribed. I was forced to get a consultant to help me file pro per, and we lost for lack of form and procedure – procedures that I did not know because I am a fashion designer, not a lawyer.

The court dismissed our civil case with no leave to amend and once again we were forced to go into the appeal court pro per. My current lawyer, number five, rescued us from my pro per status and brought it in to the ruling we have now.

SH: We know from your previous interview the impact that this foreclosure had on your family and your life. Can you tell us your reaction when they got the news from the superior court?

Hernandez: Did you ever see a 62-year-old woman do a victory dance? I remember finding the "slingshot" in my backyard, and what it meant to me… I had lost that vision for a moment, but I’ve got it back now along with the scripture that summarizes the current state of affairs in our country:

Ezekiel 22:12-1412. In you they take bribes to shed blood; you take usury and increase; you have made profit from your neighbors by extortion, and have forgotten Me,” says the Lord God. 13 “Behold, therefore, I beat My fists at the dishonest profit which you have made, and at the bloodshed which has been in your midst. 14 Can your heart endure, or can your hands remain strong, in the days when I shall deal with you? I, the Lord, have spoken, and will do it."

Some call it Karma, some call it reaping what you sow. At the end of the day, I often wonder if those who are responsible for this theft from their fellow citizens find it worth what they sold their souls for?

SH: Do you feel that there is a turning point in California, and all around the country, in regards to foreclosure fraud litigation in recent years? What has to be done to get more lawyers available to people whose houses were stolen or who are about to be foreclosed on?

Hernandez: I sincerely hope we have reached a turning point. I sincerely hope that we are still civilized enough to recognize we do not want a mafia nation. I have definite ideas how to get more help for the homeowners, but most of the ideas have to do with taking them seriously when they say there is a problem. The sad thing is that with the amount of money spent on litigation by the servicers and lenders, they could have modified the loans, reducing the principles, and kept people in their homes and our economy moving, but they chose not to. The Special Inspector General for the Troubled Asset Relief Program, or SIGTARP, recently wrote a report outlining the modification illusion and how it has been used as a prerequisite to foreclosure. How is it that we have so many government agencies and financial experts that seem to know this, and homeowners are still losing in court? Below is a quote from that report:

"In the last year, Treasury found in its on-site compliance testing that 6 of the 7 largest HAMP servicers wrongfully terminated homeowners out of HAMP. At each large servicer, each quarter Treasury selected samples of 100 homeowners who had been in HAMP but redefaulted, and reviewed the servicers’ loan files.vi According to Treasury, within those sampled files, Treasury identified homeowners who had not defaulted in HAMP but who were nevertheless improperly terminated by their servicer."

SH: What are the next steps now for your case? How ready you are to present the facts to a judge or possible jury? You have been waiting for that for a long time, but didn't get a chance to do it.

Hernandez: I have not been waiting silently. I have spent my time following the money, getting certified and authenticated evidence of the fraud in our case. Not one document filed at the recorder’s office in our case is clean. Not one. I want a jury trial. I want to know if the American people will look the other way when they get a full view of the kind of injustice and fraud homeowners have been subjected to.

SH: Nobody can comprehend what those who have decided to stand up and fight fraudulent foreclose are subjected too, what kind of nightmares you have to face each day while you did nothing wrong.

Hernandez: We have not just lost our home: we have lost our credit-worthiness and our good reputations, our retirement savings and our dignity while the purveyors of this fraud have gone on to make million dollar salaries. During the pendency of our case, PennyMac sold our home.

We had a Lis Pendens on our home while our lawsuit was alive and active. I did not know it had been sold when I went to collect our mail. The house was empty and neglected, although it looked like some gardening had been taking place. I picked up my mail when some erratic man began yelling at me, “Hey, what do you think you’re doing!” He accused me of stealing his mail, told me it was his house. I told him I did not know, we were actively involved in a lawsuit, was he aware? He didn’t answer. He took the mail from me to check it and began to call someone. ”She’s here, what do I do? Yeah, she’s taking some mail….” He had been "warned" about me. Me, who had done nothing wrong, and had wronged no one. He called the police and insisted I stay. The same police I tried to file a theft report with, as outlined by the Department of Real Estate when we suspected fraudulent documents have been filed, the same police came and found no wrongdoing, of course. But I left wondering, what have we become when we become so heartless and unfeeling toward our fellow man? Who ever thought this would happen in my country?

SH: Your family is a poster case for millions of others who lost their homes, and who are losing their homes every day due to mortgage fraud. While our country is trying to decide the next president, only one candidate wasn’t shy of speaking the truth as it is: that in order to move forward, in order to get the trust back to people about their government, we must prosecute those who were responsible for these crimes which left many family homeless and destroyed. You are still fighting, now more than ever.

Hernandez: We are going to fight to get our home back. It was stolen. I can prove it, and for PennyMac to disprove it they will have to produce more fraud upon the court. Funny, we still have hope.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments

Comments

Daniel Lopez replied on

Help! Pennymac's killing my American Dream!

I live in alameda California in 2002 with the help of BoA's first time home buyer program I bought this craftsman fixer upper that was filled with cat feces and dead cats. After a lot of work I moved my young family in and all was well with the world. Then in 2005 we refinanced to get caught up with bills and to work on the house more in 2007 we wanted to get a equity line of credit with Countrywide. So we filled out all the paperwork and when the loan person came to our house for signing we were told that there was a problem with my credit so they put the loan solely in My wife's name and changed her income to qualify for a new loan for mire than we wanted. When I asked how we would pay for this he said that the equity would go up and we could just take the money out later to cover it. Red flags went up but I guess my greed trumped common sense and we sign a reverse armontization loan with a minimum payment that put us in the whole more and more each month.we fell behind for the first time and when I tried to take money from my 401K I couldn't because my name was not on the loan so I made my last mortgage in August 2008, eight years from next week August 2016. I managed to fend off the foreclosure three times without a lawyer by sending a QWR (qualified written request) But now Pennymac and their new henchmen NewRecon called my bluff when I asked to see the original deed of trust. They said I could make an appointment and drive down to southern California and see it. Sence I could not make it down there we agreed in early May 2016 to sign a deed in lew of foreclosure. I lost my wife, kids, job and my home to these heartless people. I'm still living in the house because I have no where to go and not much reason to go on. I've asked Pennymac to give me $5000.00 above to @1000.00 they promised my wife for us to vacate the property. So far no answer just harassment from the realtor who is working as middle man for pennymac.

Does anyone have any suggestions as to what I can do at this late point? I feel as long as I have physical possession of the house I have some leverage but I fear not enough.

I really don't understand why they let me stay here for 8yrs without a payment.

Thank you for listening to my troubles. God bless you all.