Complaining that the United States has one of the world’s highest corporate tax levels, President Trump and congressional Republicans have repeatedly vowed to shrink it.

Yet if the level is so high, why have so many companies’ income tax bills added up to zero?

That’s what a new analysis of 258 profitable Fortune 500 companies that earned more than $3.8 trillion in profits showed.

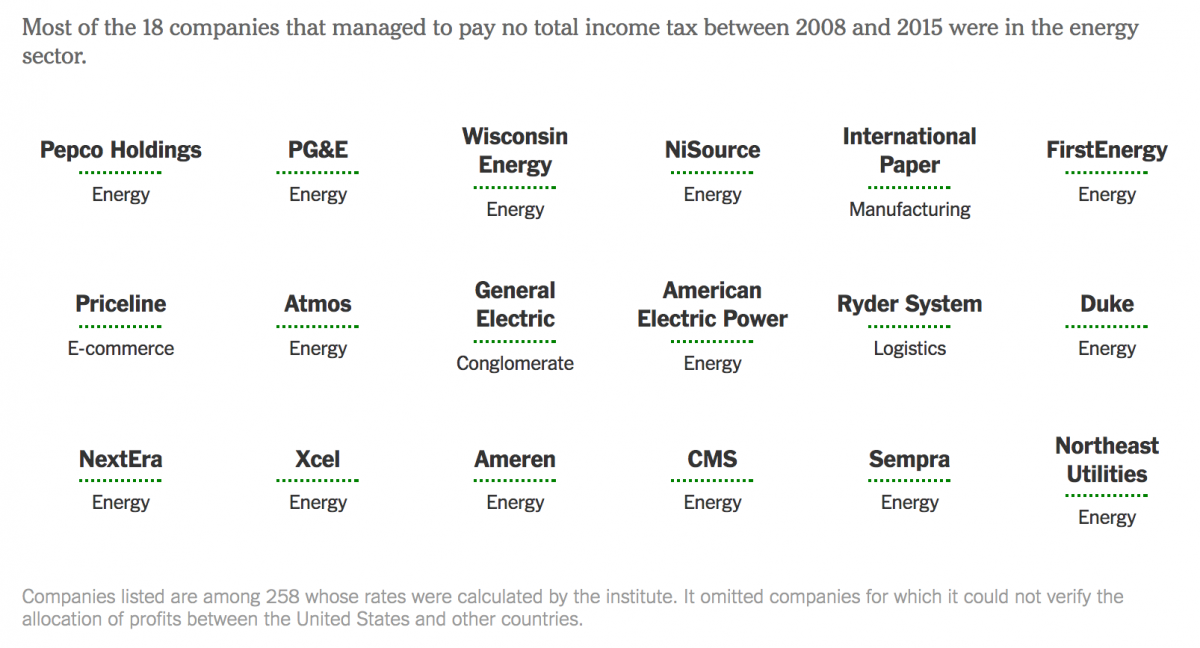

Although the top corporate rate is 35 percent, hardly any company actually pays that. The report, by the Institute on Taxation and Economic Policy, a left-leaning research group in Washington, found that 100 of them — nearly 40 percent — paid no taxes in at least one year between 2008 and 2015. Eighteen, including General Electric, International Paper, Priceline.com and PG&E, incurred a total federal income tax bill of less than zero over the entire eight-year period — meaning they received rebates. The institute used the companies’ own regulatory filings to compute their tax rates.

How Does a Billion-dollar Company Pay No Taxes?

Companies take advantage of an array of tax loopholes and aggressive strategies that enable them to legally avoid paying what they owe. The institute’s report cites these examples:

Multinational corporations like Apple, Microsoft, Abbott Laboratories and Coca-Cola have ways of booking profits overseas, out of the reach of the Internal Revenue Service. (Those companies were not among the 258 whose rates were calculated by the institute, which said it could not verify the breakdown of their profits between the United States and other countries.)

Citing evidence in the report, Senator Bernie Sanders, the Vermont independent, and Senator Brian Schatz, Democrat of Hawaii, introduced a bill on Thursday to eliminate tax loopholes that encourage companies to shift activities offshore. “The truth is that we have a rigged tax code that has essentially legalized tax dodging for large corporations,” Senator Sanders said. “Offshore tax haven abuse has become so absurd that one five-story office building in the Cayman Islands is now the ‘home’ to more than 18,000 corporations.”

Others, like American Electric Power, Con Ed and Comcast, qualified for accelerated depreciation, enabling them to write off most of the cost of equipment and machinery before it wore out.

Facebook, Aetna and Exxon Mobil, among others, saved billions in taxes by giving options to top executives to buy stock in the future at a discount. The companies then get to deduct their huge payouts as a loss. Facebook used excess tax benefits from stock options to reduce its federal and state taxes by $5.78 billion from 2010 to 2015, the institute found.

Individual industries have successfully lobbied for specific tax breaks that function as subsidies: for instance, drilling for gas and oil, building Nascar racetracks or railroad tracks, roasting coffee, undertaking certain kinds of research, producing ethanol or making movies (which saved the Walt Disney Company $1.48 billion over eight years, the report says).

Why Do Some Industries Make out Better than Others?

These industry-specific subsidies mean that the goodies were not evenly distributed. Utilities logged an effective tax rate of just 3.1 percent over the eight-year period. Industrial machinery, telecommunications and oil, gas and pipeline companies paid roughly 11.5 percent. Internet services paid 15.6 percent. In just two sectors — health care and retail — companies paid more than 30 percent of their profits in federal income tax.

“One of the things that jumps out pretty starkly is there’s a real gap between the tax rates paid by different industries,” said Matthew Gardner, a senior fellow at the institute and a co-author of the study. “When the biggest companies aren’t paying their fair share, that means the rest of us are left to pick up the slack. It means small business and middle-income families are paying more.”

But Tara DiJulio, a spokeswoman for General Electric, called the report “deeply flawed and misleading.”

“G.E. is one of the largest payers of corporate income taxes,” she said. “Over the last decade, G.E. paid $32.9 billion in cash income taxes worldwide, including in the U.S., and pays more than $1 billion annually in other U.S. state, local and federal taxes.”

She added: “The tax code is complex and outdated, which is exactly why tax reform must happen this year. G.E. has long been advocating to simplify and modernize the tax system — even if it means we pay more in taxes.”

Tax reformers have long argued that the nominal 35 percent federal rate on corporate profits more often than not functions like a strike-through price — an artificially inflated number that sounds high but rarely applies. Thanks to a variety of loopholes and tax-dodging methods, those 258 corporations paid an average rate of 21.2 percent. (Other studies, including a new one by the Congressional Budget Office that compares corporate income tax rates in various countries, have found that average and effective rates in the United States are lower than the nominal rate.)

Who are the biggest beneficiaries?

Companies with the biggest tax subsidies over the eight years, the institute’s report said, included:

■ AT&T ($38.1 billion)

■ Wells Fargo ($31.4 billion)

■ JPMorgan Chase ($22.2 billion)

■ Verizon ($21.1 billion)

■ IBM ($17.8 billion)

■ General Electric ($15.4 billion)

■ Exxon Mobil ($12.9 billion)

■ Boeing ($11.9 billion)

■ Procter & Gamble ($8.5 billion)

■ Twenty-First Century Fox ($7.6 billion)

■ Time Warner ($6.7 billion)

■ Goldman Sachs ($5.5 billion)

Some of the tax incentives, including those enacted during the recession, were meant to increase economic growth and hiring, but the institute’s report said they often didn’t work that way.

Republicans say their tax overhaul will eliminate some of the biggest loopholes, although critics counter that the substitute will end up further reducing companies’ tax bills.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments