Jacqueline Taylor immigrated from Hungary, became an American citizen and is graduating from college this year. Like many of her fellow graduates, Taylor took out student loans to pay for her education. Student loan debt has reached almost $1.5 trillion; despite the low unemployment rate, loans 90-day delinquent or in default have increased over the last year. This year’s graduates, like Taylor, face crippling debt that exacerbates wealth inequality and is a drag on the U.S. economy as a whole.

So, is college still worth it? This is the very question the Federal Reserve Bank of St. Louis is asking. Median income for those with only a high school degree is about $36,500 a year. With living costs varying by location, this figure can be woefully inadequate in high-priced cities like New York or San Francisco. For those with a bachelor’s degree, median income increases by almost two-thirds. Still, high student loan debt can negate much of the increase.

Taylor will be graduating in May from Southern University of New Orleans with an MA in museum studies. This degree coupled with her Bachelor of Arts in psychology will leave her with about $40,000 in federal student loan debt. She has two children under the age of 18.

“If you break down my payment plan, it’s almost impossible to make it with the payments and the living expenses,” said Taylor, who pursued museum studies because she hopes to use art therapy to treat patients with mental illness. “It’s very hard because I have a bachelor’s in psychology and you can’t make much money with only a bachelor’s.”

The rising cost of higher education in the last decade has coincided with massive cuts to state public universities. State funding since the 2008 recession varies, but collectively there has been more than a 10 percent decrease, with costs passed on to individual students. Minorities disproportionately bear higher student loan debt obligations, with graduates from historically black colleges and universities (HBCU) holding a median $29,000 in student loan debt.

The Catch-22 for today’s students is that not going to college almost guarantees not progressing into the middle class and being relegated to long-term financial insecurity. But high student loan debt is also restricting social and economic advancement, leading the Fed to conclude that college is still worth it but with the caveat: “Considering all of the evidence, we conclude that the conventional wisdom about college is not as true as it used to be.”

Cost to the U.S. economy and to individuals

The rise in federal student loan debt payment delinquencies hits the U.S. government’s pocketbook. If the trend continues, the shortfall will increase the federal deficit, already in place from the 2017 tax cuts. Federal deficits and debt may not have repercussions in the short-term but long-term will result in less funding for social welfare programs like food stamps and Medicaid, as well as infrastructure and defense spending.

There is evidence that student loan debt is also an obstacle to innovation. Despite the perception, millennial-owned startups exist far less than their peers did in the 1980s. With high debt loads, recent college grads cannot afford the growing pains and the early period of getting a business off the ground. Renowned for its technological and economic innovation, America remains the number one economy in the world – even ahead of China with its much larger workforce and rapidly growing middle class. But because of student debt, that dominance could be in jeopardy.

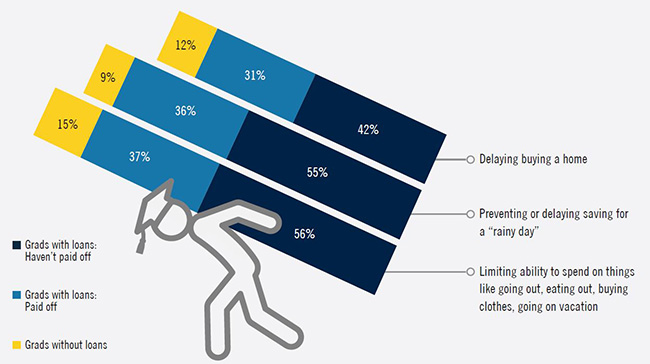

For individuals, high student loan debts impact major life decisions, including ones that are economically beneficial to society as a whole. Millennials are putting off marriage and having children; saving for retirement; and home ownership, to name a few. Home ownership has been the prime source of middle class wealth. Those with higher debt-income ratios are riskier to lenders, and if high-risk individuals obtain a loan, it comes with a higher interest rate.

“I rent an apartment. It’s like a Catch-22. On the application, it shows up on your credit score,” Taylor said. And while the economic numbers remain strong, there is concern that this year’s class of graduates could face a recession in the near future.

“We are statistically at the end of the current economic cycle, so the job market will be harder going forward. Graduates may land a job immediately, but could see challenges soon,” Robert Farrington, creator of “The College Investor”, a site targeted to millennials, told Occupy.com.

It has been over a decade since the last recession in the U.S., and recessions occur on average once a decade. There is no crystal ball to determine when the next one will occur. But high debt burdens are a prime source of slow economic growth.

How to minimize or reduce your student loan debt

While student loan debt is quite burdensome, with the right information, consumers can reduce their student loan debt obligations or reduce the amount they need to borrow. The federal government allows for income-based repayment plans and loan forgiveness after a certain number of years (anywhere between 10 to 25 years). Student loan debt obligations can be forgiven if a person is employed for a specified time with government or non-profit entities.

Student loan debt forgiveness has become a core policy issue in the field of Democrats running for office in 2020. Sen. Elizabeth Warren has proposed forgiving up to $50,000 of student loan debt for those making less than $100,000, and covering the entire cost of higher education for those who attend moving forward. Her plan would be funded by a 2 percent income tax increase on those with a net worth of $50 million or more.

Some Democratic candidates, such as Sen. Bernie Sanders, support her plan. Others, such as Mayor Pete Buttigieg of South Bend, Ind., contend that it will primarily benefit wealthier individuals at the expense of those not attending college. In perhaps a sign of the severity of the problem, the issue crosses party lines. Donald Trump’s 2020 budget proposal actually includes loan forgiveness, but would change some aspects of the program including federal subsidies of student loans.

For recent high school graduates attending college, or recent college grads looking at attending school further, financial experts suggest viewing a college education with a clear and concrete return in mind. “We need to get kids in high school to understand college is like any other investment. College needs a clear ROI,” or return on investment, Farrington said.

Experts suggest students apply for as many scholarships and grants as possible, try not to take on much debt for a career with a low salary range, and work part-time while going to school.

Jacqueline Taylor became an American citizen in 2001 and exercises her rights to pursue public higher education and voting. She expects lawmakers to address student loan debt burdens. “It’s a shame our country has a system like this where people end up in so much debt,” she said.