The American Dream: those words meant so much to so many, repeated by generations as an inspiration to get out and work hard and make it in this beautiful country. Then, something changed and people’s dreams started to turn into the American Nightmare. What do you do when you realize your life is eroding before your eyes while you simply try to piece together the complicated puzzle known as MBS – mortgage backed securities?

Here is what Sherry Hernandez, a homeowner from California, did: She stepped into the maze, not realizing that step would lead her into the biggest fight of her life. When I asked Sherry how her family is adjusting to the uncertainty of possible foreclosure eviction – her next eviction hearing date is Sept. 25 – here is what she told me:

“Last Christmas our family had a tiny Christmas tree set up in an obscure corner of our home. We minimized the gift giving and didn’t have any extended family over. We didn’t want anyone embarrassed if the police came to serve us the five-day notice to leave. That was 2013.

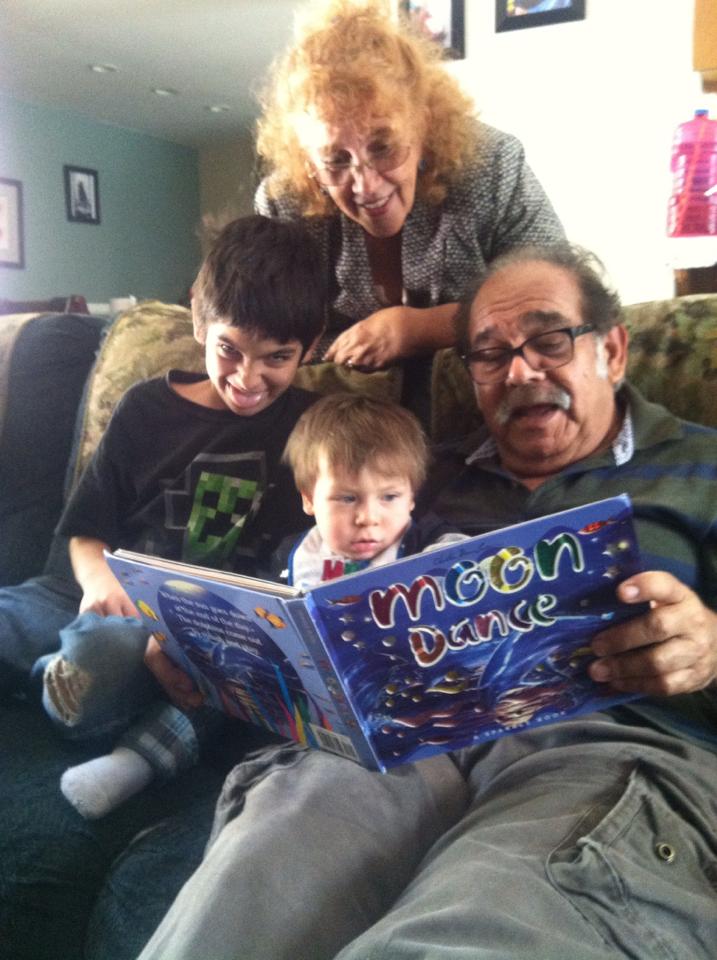

"There has been nothing in our lives thus far to prepare us for this moment. Nothing prepares you for the fear, the tension, constantly studying the law, looking over our shoulder. Nothing prepares you for the fear that these circumstances will rob your grandchildren of their childhood and their innocence. I often wonder if anyone understands how deep that pain goes into a parent’s heart. Words cannot describe the horror I felt when my granddaughter was the one to find the five-day notice on our front door.”

Sherry is one of those people who possess an impeccable calmness while talking about a life-changing experience. She is resilient in her fight for justice. She is also one of the regulars who attend Occupy Fights Foreclosures meetings in the Los Angeles area, helping other homeowners who are facing foreclosures and bringing awareness to the general public.

“When we first realized we had become victimized by a predatory loan, in 2006, we thought it would be a simple fix,” Sherry said. ”Little did we know then [that] we had to battle with the people who claimed we should have read what we signed – that we are the greedy ones and purchased more house than we could afford. These people didn’t know us, they didn’t know our lives and they didn’t know how much we paid for the house or the size of the home we lived in, or the prices of the homes in the neighborhood where we lived and work. They had simply been pitted against us by the propaganda machine, no doubt initiated by the predatory lenders.”

Sherry and her husband used to lead conservative lives, trying to save up and build their safety net before they retired. Her favorite slogan is “We’re Not Deadbeats,” which she keeps repeating to whomever is willing to listen. Her point: Homeowners like her are not predators and are not seeking a "free house," but, rather, are fighting on the frontlines not only for themselves but for many others still unaware of mortgage fraud and its octopus effect on the country and the economy. When I asked how she felt when she realized U.S. elected leaders were silently watching the demise of the people and communities they were elected to represent, Sherry said:

“Over the past few years the things we have seen, the things we have learned about our government and our financial industry are eye-opening. Sadly, we are not the optimistic people we once were. We have seen the evil and it is dark, it is relentless and it is without mercy.

"It is not just our homes that we lose," she continued. "It is our credit worthiness, our way of life, our dignity and our years of 'doing the right thing' because we thought that doing right would be rewarded. Instead we now see the evil being rewarded – and even given bonuses."

The Hernandez family’s experience with mortgage and foreclosure fraud is a perfect example of the assembly line of mortgage backed securities production – where servicers treated our homes and our lives as the fastest way toward profit, making their own rules as they went and erasing our existing laws on their way to top earnings. For Sherry, the path to foreclosure started in a way that was similar to many others, but at the same time unique:

“We were finally able to refinance out of the predatory loan from Countrywide and we sued them for fraud and two counts of bad faith to recoup the money they had stolen from us in the process," Sherry said. "Our home loan was $68,000 more, due to their purported fraudulent behavior and it was costing us $1,400 more per month, but at least it was a lower interest, and we were sure we could recoup our losses. After all, they violated our contract.

"At this point in our journey, I have read far too many stories and spoken to far too many homeowners to believe that the courts are just. If the stories only consisted of people who had not paid their mortgages because they could not afford them, I would have a different perspective. But many of these stories are about families who have been promised help only to have the help used as an excuse to foreclose. Some families have never missed a payment; others have had their identity stolen and their equity stripped from their home, and they were not the ones to take out the loan against their property.

"But in 2009 I still believed. So when I received a phone call from our new servicer, CitiMortgage – who bought our loan from Countrywide – asking if we would benefit from a modification, I was elated. I didn't know that they were merely using it as the ‘foam on the runway’ to foreclosure.

"Of course, they did not honor their own temporary modification. Later they explained to us it was only a ‘trial’ modification; there was no signed agreement and therefore they did not HAVE TO honor it. Once again they used the old ‘You have to read carefully’ anything they send you. They have ‘legally’ been allowed to dangle the ‘hope’ in front of our noses only to strip it away at whim. [Finally] our servicer CitiMortgage told us that our loan had been sold to PennyMac," Sherry continued.

"We were still in litigation with Countrywide and we had tried to keep up with our payments and stay current because we knew Countrywide was stalling to cause us to go into default before we got into court. It had been almost five years waiting for our day in court. We were infuriated as it looked like they were going to get their way. PennyMac introduced themselves to us by offering us a shortsale, or Deed in Lieu, meaning they were not willing to honor the ‘trial’ modification. They acquired our loan in 2011, and in 2011 we ceased paying our mortgage – not because we lost our job or suffered some debilitating illness, but because for five years the previous lenders were allowed to increase their profit, cheat us, lie to us and trick us by promising help that never came until our trust and our finances were exhausted."

And that's when Sherry and her family had a choice to make:

"Do we take the balance of our retirement fund to pay this new lender and ‘catch-up’ on fees and penalties and arrears we do not owe? Or do we use what money we have left to fight back? Can you trust the lenders to do the right thing when they are allowed to lie and trick you into a trust that will be later twisted to use against you, like modifications?"

I have personally talked to hundreds of homeowners throughout the country in the past few years, and their stories about servicers’ deceits are identical. In many cases homeowners were offered a modification while the other department of the same servicer was starting a foreclosure procedure on the same loan – known as a dual tracking. However, every time a servicer offers something else instead of foreclosure, a homeowner hopes this time will be different, and that they will be able to keep their home. Sherry Hernandez and her family experienced the same web of deceit.

“The lies, the manipulations that the lenders have been allowed to get away with en masse have no comparative,” she continued. “Worse yet is the fact that our leaders have deliberately turned a blind eye to the massive theft; our leaders who we elected to represent us, the people, are going after settlements to fill their own coffers and ignoring the people who were the victims of the fraud.

"For a brief moment we actually had the foolish hope that PennyMac would be a good thing. Now don’t laugh, but we thought they wanted to correct the past wrongs of their predecessor, Countrywide. They advertised themselves as willing to work with homeowners and reduce their monthly payments by as much as half. [But] we soon discovered who PennyMac actually was: the illegitimate offspring of Countrywide. Most of the executives that had populated Countrywide have moved their skills over to the new corporate venture, PennyMac, [although the former CEO] Angelo Mozilo was not invited.”

As Sherry soon found out, PennyMac’s words of willingness to help homeowners were just another form of deceit in order to buy time and uphold a friendly image while the company continued to fraudulently foreclose on people’s homes. As Sherry pointed out:

“PennyMac used the excuse stating that the ‘trial’ modification we had with CitiMortgage was not binding since it was only a trial. They stated that as a new servicer, they did not have to honor it – even though we were in litigation with Countrywide at the time of the supposed loan transfer. As we have learned, Countrywide is still tied to our property through MERS (Mortgage Electronic Registration Systems). We tried to get help from various oversight offices for the conflict of interest, to no avail. The fight for our home is not over yet. As of now, we are still in litigation.”

Many homeowners like Sherry are going through similar fights on a daily basis. Look through your window; look for that ‘FOR SALE’ sign on your neighbor’s lawn and stop for a moment. Try to think what we, as a society, can do to challenge and end these fraudulent foreclosures. Trust in our government is eroding every day, but trust in “We, the People” can grow as we unite in our demands for answers and justice. I asked Sherry about her views on the future of the foreclosure fraud arena and this is what she said:

“The Home Affordable Modification Program (HAMP) was a scheme put in place by our government, which was afraid if all the foreclosures were to have happened all at once it would cause the Wall Street banks to go under. We know it is fraud. They know it is fraud. We look to anyone brave enough to stand up to the fraud and defend the rights of the people. We hope against hope that there are still people in our government that are not corrupt. Meanwhile, we try to live our lives.

"I love my grandchildren. We have eight: two girls and six boys, and one great-grandson, making nine," concluded Sherry. "I wonder what kind of world we will leave them. What has our generation done? My husband and I continue to fight this battle, not just for our sake but for theirs. We want them to have more to look forward to than just a life of servitude. We want them to be able to dream a dream and achieve their dreams. “

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments