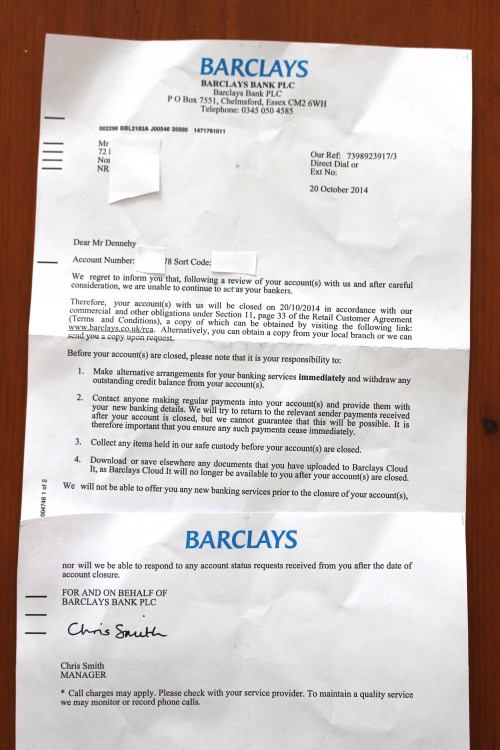

Barclays informed me via letter on October 23 that they had closed my account on October 20, and from that date forward I would lose access to my account and any assets held by the bank. The date on the letterhead is October 20, meaning it was guaranteed to reach me after I lost all access to my account.

Some facts: I live in the U.K.; I’ve had the account for a little over a year; until this week I never had any problem with the account, nor had I ever received notice of any problem with the sole exception of the aforementioned letter. Initially I used the account for a few transactions a month with progressively more activity over time.

It’s a fairly absurd situation and I’d like to document exactly what happened.

On Thursday October 16, I checked my online banking in the morning to see if a payment I was expecting had gone through. It had not. In the afternoon I attempted to check again but was locked out of the system with an error message and a customer service number to call. I called, waited on hold for an hour, and was told that there was a random review going on and if I wanted to check my balance in the meantime I could do so at any Barclays branch. I cycled to the nearest branch and inserted my card into the automatic teller. The machine ate my card and told me to seek assistance from bank staff, which I did. I was then told that the machines could not be opened during banking hours and to come back in the morning and everything would be fine.

The next day I went to the same branch. The same bank employee told me she had to find out what happened by calling a supervisor but was busy at that moment so she took my number and promised to call by the end of the day. She never called.

On October 18, I called the woman I had had spoken with the day before to ask what happened. She told me my account was under review and that it was normal and may take a few days or weeks to clear up, but not to worry. I asked if I could withdraw my funds. She told me that it would only be possible to withdraw funds that I had receipts for.

I was losing faith in that particular branch because each time they told me something it was later changed and they seemed less friendly, so I cycled to a different branch late that morning to attempt to withdraw my money. The woman I spoke with there was much nicer and made a phone call to try and figure out what was happening. After her phone call she suggested that Barclays “might terminate my account” but she wasn’t sure why, and in any case the outcome would likely be a few weeks away. She then allowed me to make a withdrawal and I withdrew almost my entire balance, about £300.

I heard nothing more from the bank until I received the letter by post. The terms and conditions cited in the letter (which are actually on page 30; the page they cite in the letter, page 33, is a cover page for the next section) are extremely vague. You may access the document here.

It states that the bank must give at least two months’ notice in writing before closing an account. However, accounts can be closed immediately if Barclays thinks the user has seriously or consistently broken the terms and Ccnditions. Obviously Barclays is using that very vague clause to close my account.

I noticed my online bank was suspended within a few hours of it happening and was extremely proactive, and I still was just barely able to get my funds. What if I did not log-on to check my balance that afternoon? In that case, I would not have known that my account was closed and I had lost all access to my assets until three days after it happened. I was never asked any questions, and every question I asked was met with extremely vague answers. Each time I was told there was nothing to worry about and the bank would contact me when there was resolution.

I don’t have any illusions that I personally can do anything to stop banks from engaging in bad practices, but I can document one small incident. I’m going to frame that letter.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments