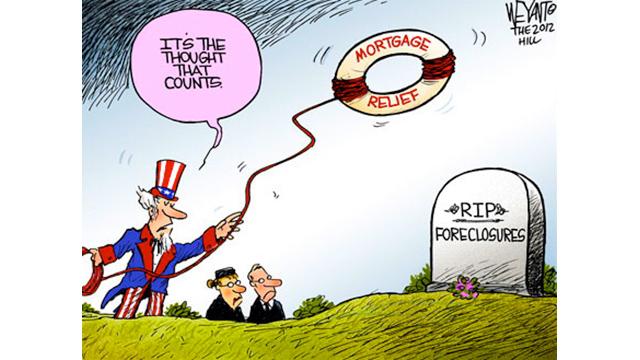

The numbers seem eye-popping. So many billions here for supposed mortgage abuses, so many billions there for questionable foreclosures.

But there’s more than meets the eye to the big legal settlements you’ve been reading about involving some of the nation’s biggest banks.

Actually, there’s less than meets the eye.

The dollar signs are big, but they aren’t as big as they look, at least for the banks. That’s because some or all of these payments will probably be tax-deductible. The banks can claim them as business expenses. Taxpayers, therefore, will likely lighten the banks’ loads.

There is nothing new about corporations reaping tax benefits from payments made to remedy wrongdoing. Every so often, though, the topic stirs outrage. After the Gulf of Mexico oil spill, for example, BP received a $10 billion tax windfall by writing off $37.2 billion in cleanup expenses.

With multibillion-dollar mortgage settlements making headlines this year and last, the question has come to the fore again. Why should taxpayers subsidize corporations that are paying to right sometimes egregious wrongs? That is a particularly weighty question, given the urgent need for tax revenue to offset the ballooning federal budget deficit.

Under federal law, money paid to settle a company’s actual or potential liability for a civil or criminal penalty is not deductible. But, this being taxes, the issue is complicated. As Robert W. Wood, a tax lawyer, said in a 2009 Tax Notes article, “The tax deduction for business expenses is broad enough to include most settlements and judgments.”

In an interview last week, Mr. Wood, who is also the author of “Taxation of Damage Awards and Settlement Payments,” said the test for deductibility boils down to whether the payment is a penalty or is meant to be remedial. “I don’t know the specifics on these mortgage settlements,” he said, “but if any of the lenders are putting a bunch of money into a pot that goes to help people, yes, I would assume that everybody will deduct that.”

Nevertheless, the deductibility test is not always clear. And companies naturally push hard for these tax benefits when they negotiate settlements with the government.

Unfortunately, the government rarely specifies what the tax treatment of a settlement should be, leaving enforcement to the Internal Revenue Service. One exception is the Securities and Exchange Commission. Since 2003, it has barred companies from deducting settlement costs as a business expense.

Senator Charles Grassley, the Iowa Republican who is a senior member of the Senate Finance Committee, has been critical of favorable tax treatments of settlements. I asked him last week about the issue as it relates to mortgage settlements.

“You can be sure the Wall Street banks consider tax consequences in negotiations and the government should, too,” he said. “Any portion of a settlement that’s intended to be a penalty should include language clarifying it isn’t deductible. Otherwise, the government’s punishment will have less sting than intended.”

It is to be expected that corporations, like any taxpayers, will do what they can to reduce their tax bills. And a 2005 report from the Government Accountability Office suggests that tax benefits in settlements are prevalent. Examining more than $1 billion in settlements made by 34 companies, the G.A.O. found that 20 had deducted some or all of the money from their tax bills.

But as Mr. Grassley suggested, the government can take deductibility off the table as an option. And occasionally it does. For example, a Justice Department spokesman said that there would be no deductibility of the $500 million penalty and fine portion of the settlement reached with UBS last month in regards to manipulation of interest rates.

Certainly, a settlement’s punitive effect is lessened by any tax sweeteners it generates. Perhaps that’s why it is rarely clear from the public announcements that some or all of the settlement amounts will be deductible.

Consider last week’s settlement between the government and large mortgage servicers over foreclosure abuses. Wells Fargo said in its news release that the bank would pay $766 million in cash and contribute $1.2 billion to foreclosure-prevention activities. But are those after-tax or pretax numbers? No mention was made, and a spokeswoman declined to comment other than to say that Wells Fargo “is a compliant taxpayer” that fulfills all its tax obligations.

Or consider the recent settlements over soured mortgages reached by Bank of America and Fannie Mae and Freddie Mac. These are almost certainly tax-deductible, Mr. Wood said, because these are probably considered deals between private parties, even though taxpayers own Fannie and Freddie.

So the deal announced last week by Bank of America to pay Fannie Mae $10.3 billion for a mortgage-related settlement, as well as the $2.62 billion in cash paid by the bank to Fannie and Freddie Mac in late 2010, probably generated, or will generate, significant tax benefits through deductions for the bank. A Bank of America spokesman declined to comment.

Phineas Baxandall, senior analyst for tax and budget policy at the United States Public Interest Research Group, a consumer-oriented nonprofit, and Ryan Pierannunzi, a tax and budget associate there, explored this issue in a report published last week.

The report, titled “Subsidizing Bad Behavior,” details the history of the practice and suggests that government agencies should follow the S.E.C.’s lead and disallow deductibility in settlements. Barring that, the authors said, regulators should disclose only the after-tax amounts of settlements, so that people understand how much money is really being paid.

In an interview last week, Mr. Baxandall noted that government agencies might not want to do that. “From the agencies’ point of view, unless the public or someone is pressuring them to do otherwise, they want a big number to tout,” he said. “Tax deductibility allows them to come out with a bigger number.”

Congress has tried to change this setup. In 2003, Mr. Grassley and two other senators introduced the Government Settlement Transparency Act.

It would have required that payments made by companies acknowledging actual or potential violations of a law would not be tax-deductible. The legislation never passed.

Bills have also been introduced in Congress that would bar deductibility on punitive damage awards arranged among private parties. Those have died, too. Past administrations have supported this idea, and the Obama administration has a proposal in its 2013 budget stating that no deduction would be allowed in such a circumstance. That proposal also states that when an existing insurance policy covered the payment of punitive damages, the amount paid would be considered income to the insured person.

Not a bad idea.

As settlements for corporate misdeeds pile up, perhaps it will get some traction.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments