"Frackademia"—shorthand for bogus science, economics and other research results paid for by the oil and gas industry and often conducted by "frackademics" with direct ties to the oil and gas industry—has struck again in California.

It comes in the form of a major University of Southern California report on the potential economic impacts of a "fracking" boom in California's Monterey Shale basin that's hot off the presses, "Powering California: The Monterey Shale and California's Economic Future."

California Democratic Gov. Jerry Brown recently gave his cautious support to fracking, the toxic process via which oil and gas embedded deep within shale rock basins made famous by the documentary film "Gasland," currently a topic of contention in California. The new report gleefully says we could be witnessing 1849 all over again, the second-coming of a "Gold Rush," a term the co-authors utilize 9 times in the Preface.

The report, co-authored by a Los Angeles-based public relations firm, The Communications Institute (TCI), concludes that "development of the 1,750-square-mile formation in central California could generate half a million new jobs by 2015 and 2.8 million by 2020," as reported by The Los Angeles Times, which blared the headline, "Tapping California shale oil could add millions of jobs, study says."

Given California's population of 37,683,933 people, this would mean 7.4 percent of the state's citizens can gain employment and economic uplift from the industry. It would also shrink the 20.3-percent unemployment rate in the Golden State down drastically, to 12.9 percent.

"The Monterey shale would help stimulate the California economy to a significant extent," USC professor and co-author Adam Rose told The Times. "It's not just a benefit to the oil industry. These impacts ripple throughout the economy."

While a nice sentiment, the age-old questions quickly arise: who are the authors and who funded this study?

The answers to these questions, a DeSmogBlog investigation has revealed, paints an entirely different picture of the report's findings and how it came to such rosy conclusions.

Study Funded by Big Oil, Co-Author's Industry Connections Tell the Story

Off the bat, the report acknowledges financial support - though failing to disclose how much funding - from the Western States Petroleum Asssociation (WSPA). WSPA, "the oldest petroleum industry trade association in the United States," has a membership list that includes Chevron, ExxonMobil, Occidental Oil and Gas Corporation and Shell, to name several. All of these corporations are actively involved in exploration and prospective production of the Monterey Shale.

Just as importantly, one of the co-authors of the "study"— Fred Aminzadeh — is currently an oil and gas industry employee.

Aminzadeh serves as a Research Professor and Executive Director at USC's Global Energy Network (GEN) and Executive Director of USC's Reservoir Monitoring Consortium (RMC) and worked in various technical and management positions at Unocal—purchased by Chevron in 2005—for 17 years.

GEN, credited as one of the report's lead conductors, does not list its funders, but given the steep membership fee - ranging between $25,000-$500,000 per year—one can safely guess that at least some of its funding comes from the deep pockets of the oil and gas industry. In fact, BP America, ExxonMobil, Chevron, Anadarko and General Electric all have members sitting on GEN's Advisory Board.

GEN, according to its website, pays The Communications Institute to do PR work on its behalf and TCI registered the website the report was originally set to be published on, PoweringCalifornia.org. In essence, this piece of the puzzle serves as Exhibit A of this study serving more so as industry PR salesmanship than as legitimate scholarship.

RMC also does not list its funders, but its personnel, like GEN, are also directly tied to the oil and gas industry. All three members of its Technical Advisory Board have industry jobs. Andrei Popa works for Chevron; Kurt Strack is the President of KMS Technologies, an oil services corporation whose clients include BP, Chevron, ConocoPhillips, Shell and Saudi Aramco; and Wang Shangxu is a professor at the China University of Petroleum.

Prior to coming to USC and after his Unocal stint, Aminzadeh was the CEO of dGB Earth Sciences USA, self-described as a firm that offers "innovative seismic interpretation solutions to the oil and gas industry."

Though he conveniently leaves it out of the biography he included in the report, Aminzadeh, alongside the paycheck he earns at USC, also serves as Founderand President of FACT-Corp. FACT is a global oil and gas industry consultancy firm whose technology partners include dGB Earth Sciences, where he used to be the CEO, as well as clients such as Chevron, BP, Saudi Aramco and Eni.

Aminzadeh is also Chairman of the Advisory Board of both Western Standard Energy Corp. and is also on the Advisory Board of Saratoga Resources and formely served on the DOE Unconventional Resources Technology Advisory Committee from 2007-2008, right as the fracking boom was beginning in the U.S.

The latter committee was created under the dictates of the Energy Policy Act of 2005, which calls for the DOE to work with oil and gas industry stakeholders to "carry out a program of research, development, demonstration, and commercial application of technologies for...onshore unconventional natural gas."

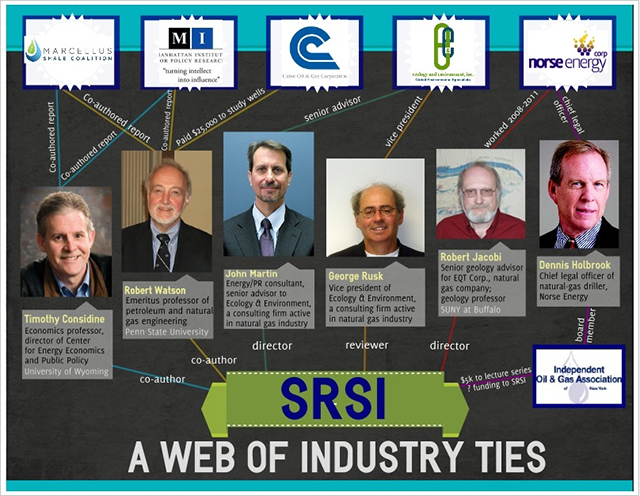

John Martin—former head of the now-shuttered SUNY Buffalo Shale Resources and Society Institute (SRSI), peer reviewer of the Inglewood Oil Field environmental impact assessment (done by the same contractor the Obama State Department used for the first TransCanada Keystone XL environmental review, Cardno Entrix) that concluded fracking in Los Angeles would have no negative ecological impacts, and head of his oil and gas consultancy firm JP Martin Energy Strategy—currently serves on the DOE Unconventional Resources Technology Advisory Committee.

Outside Reviewers Tied to Big Oil

The non-peer-reviewed "study" wasn't published in an academic journal, but rather was published "in association with" TCI - a PR firm - on its website. Though not peer-reviewed in accordance to conventional legitimate academic standards, the co-authors did thank three people for "taking the time to review this study."

Two of those three people, it turns out, also have direct ties to the oil and gas industry.

One of them is Harvard's Henry Lee. His CV details his past work as a consultant for General Electric, Gulf Oil and Texaco, the latter of which Chevron purchased as a wholly-owned subsidiary in 2002.

The other: Hillard Huntington, Executive Director of Stanford's Energy Modeling Forum (EMF), is one of 200 members of the National Petroleum Council (NPC). The NPC is a federally-chartered, corporate-funded advisory committee started by President Harry Truman in 1946, now overseen by the DOE under the dictates of the Federal Advisory Committee Act of 1972. Its purpose is "to advise, inform and make recommendations to the [DOE] with respect to any matter relating to oil and natural gas, or to the oil and gas industries."

NPC's membership includes former Chesapeake Energy CEO Aubrey McClendon, Chevron CEO John Watson, ExxonMobil former CEO Lee Raymond and current CEO Rex Tillerson, former Shell North America CEO John Hoffmeister, and TransCanada (of contentious Keystone XL fame) CEO Russ Girling, among many others.

Huntington's EMF is funded by the oil and gas industry as well, with partners including the likes of Saudi Aramco, American Petroleum Institute, BP America, Chevron, ExxonMobil and others.

Public Relations and Advocacy Costumed as Scholarship

USC's report is now the second case of "frackademia" in the state of California in the past half-year and another example of the oil and gas industry's public relations strategy espoused at the Nov. 2011 "Media & Stakeholder Relations: Hydraulic Fracturing Initiative" conference held in Houston, Texas.

At that same Houston conference in which Range Resources PR flack Matt Pitzarella admitted his company utilizes psychological warfare personnel and techniques in the communities in which Range operates, New York Independent Oil and Gas Association's S. Dennis Holbrook stated that it's crucial for industry to "seek out academic studies and champion with universities—because that again provides tremendous credibility to the overall process" because the gas industry is viewed "very skeptically" by the public.

SUNY Buffalo came under fire in the second half of 2012 for partaking in the industry's shady PR game made public at that Houston conference, ending its SRSI after months of outside agitation from critics. With time we'll see if the same endgame is in-store at USC.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments