In an unprecedented move, Denmark agreed Thursday to sell 19 percent of its state owned energy company, DONG Energy, to U.S. investment giant Goldman Sachs – a decision so unpopular it caused Denmark's governing Socialist People's Party to quit the coalition government.

The purchase gives board positions and veto power to Goldman Sachs on important, strategic energy decisions for the country, one of the world's leaders in developing renewable energy. The news set off a storm of protest this week in Denmark.

Around 190,000 people have already signed a petition rejecting the state energy company's sale to the Wall Street firm, which is widely referred to Danish media as a “financial vulture“ and “vampire squid“ due to its outsized role in provoking, then profiting off, the global financial crisis.

Goldman Sachs seized control of nearly one-fifth of Denmark's DONG Energy for around $1.45 billion. The total value of the company is estimated at $5.7 billion, though many analysts and economists say this amount is far too low and that it is actually worth much more.

The Danish minister of finance, Bjarne Corydon, who is a member of the governing Social Democrats, defended the sale despite heavy criticism and the fracturing of his coalition government.

“I repeat, that it is very positive, that both Danish and internationally recognized investors have trust in DONG Energy´s strategy,“ said Corydon earlier this week. “I am sure that the new investors will contribute positively to adding value to DONG Energy for the benefit of all stock holders, [and] also the State.”

A unnamed spokesperson for Goldman Sachs also defended the purchase, saying: “This is a long term investment, and we support the current leadership strategy of the company's activities, including the big investments in renewable energy.”

Government Disagreements

Many politicians, including several from within the government, deeply opposed the sale. Former Prime Minister Anders Fogh Rasmussen, also a Social Democrat, has consistently stood up to criticize the privatization of the country's energy firm.

“Goldman Sachs has no specific competence in the energy area, but it goes after extreme profit, which cannot be reached through long term investments and practical production,” Rasmussen told the Danish newspaper Politiken. ”The company has its expertise in speculation, and this is terrifying.”

Members of the Socialist People's Party went even farther, saying that the deal went against the core values of the state. They believe the key infrastructure should always stay in the hands of the state: within the grasp of democracy and taxation, where the service that the state delivers, not profit, is the priority.

Most of the right wing Danish opposition is, on the contrary, in favor of the deal. So far, two Danish pension funds have committed to buying five and two percent, respectively, of DONG Energy on top of the 19 percent purchased by Goldman Sachs. Four other pension funds have offered to buy shares as well – though the finance minister labelled those offers “unserious,” despite that they were higher than what was offered by Goldman Sachs.

Tax Avoidance

Tax fears played a factor in the decision, too. While Danish tax authorities are already struggling to tax other multinational companies, the government officially agreed to sell DONG Energy to a Goldman Sachs-controlled daughter company – a desktop company – in Luxemburg, with ties to a business in the Cayman Islands.

Unsurprisingly, this has caused the public and many officials to project that Denmark will never see any tax money at all, even as Goldman Sachs profits handsomely from the sale.

Veto Might Harm Green Energy

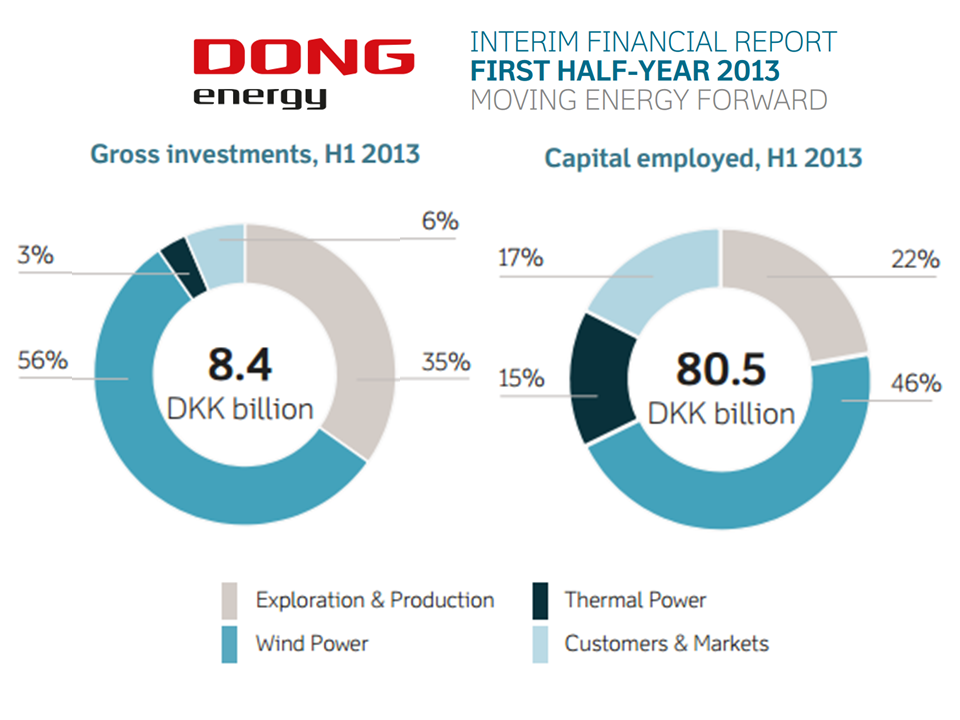

Other concerns center around the bank's veto power on the board. One of the arguments for selling part of DONG Energy was that it needed funds to expand and reinvest in ocean-based wind farms to create more renewable power. The government defended the Goldman Sachs veto, saying it was important for the bank, as a minority stockholder, to have veto power over a majority stock holder.

This raises fears, of course, that if green, renewable energy isn't as immediately profitable for Goldman Sachs as fossil fuels, it's not unlikely that the corporation will use its veto to block the promotion of clean energy development.

Likewise, the deal comes with a guarantee of profit for Goldman Sachs. If the energy stock loses value, or if DONG Energy is not listed on the stock exchange by 2018, the state agrees to cover any financial losses to the corporation. On the other hand, Goldman Sachs gains full profits for their shares at all times.

Denmark Loses Out

Economists have suggested that the Danish state, with profit in mind, could have well lent DONG Energy the money it needed to invest and pay off certain loans, without selling the company outright to a multinational bank. They also argued that if Goldman Sachs was willing to invest in DONG Energy, it must be worth more than many people expect – and therefore the Danish state should itself invest more rather than sell it off.

They have also openly criticized Danish officials for being out of their league when dealing with Goldman Sachs. The Danish habit of debating and weighing decisions “peacefully” does not match up, they say, with the cynical, calculating speculation of Wall Street, which is why the deal likely will not be in Denmark's economic interest in the long run.

Some have already estimated the country could lose hundreds of millions of dollars through the sale, which was voted on and approved by the Danish government on Thursday despite public demonstrations against it – and vocal opposition from within government itself.

The Socialist People's Party representative on the financial council, the authority required for approval, voted in favor of the sale even as the party pulled out of government leaving a fractured coalition – and confirming fears of a rightward, pro-business trend engulfing the country.

Recently, the party was pressured by two other government coalition members to vote in favor of lowering corporate taxes and cutting welfare payments to the country's poorest. The DONG Energy debate has spawned heated discussions about the future of Danish governance – a future that most Danes will oppose handing over to Goldman Sachs.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments