This is the third installment in a series examining the activities and individuals driving the Bilderberg Group. Read the first part hereand the second part here.

This article looks at the published lists of participants attending recent Bilderberg meetings, specifically ones that took place between 2008 and 2014. From these lists, we're better able to understand the relevance of Bilderberg meetings to specific institutions, ideologies and powerful sectors of society connected with global economic governance. As such, the following articles in this series examine financial markets, banks, technocracy, finance ministries, central banks, the IMF and the European Union.

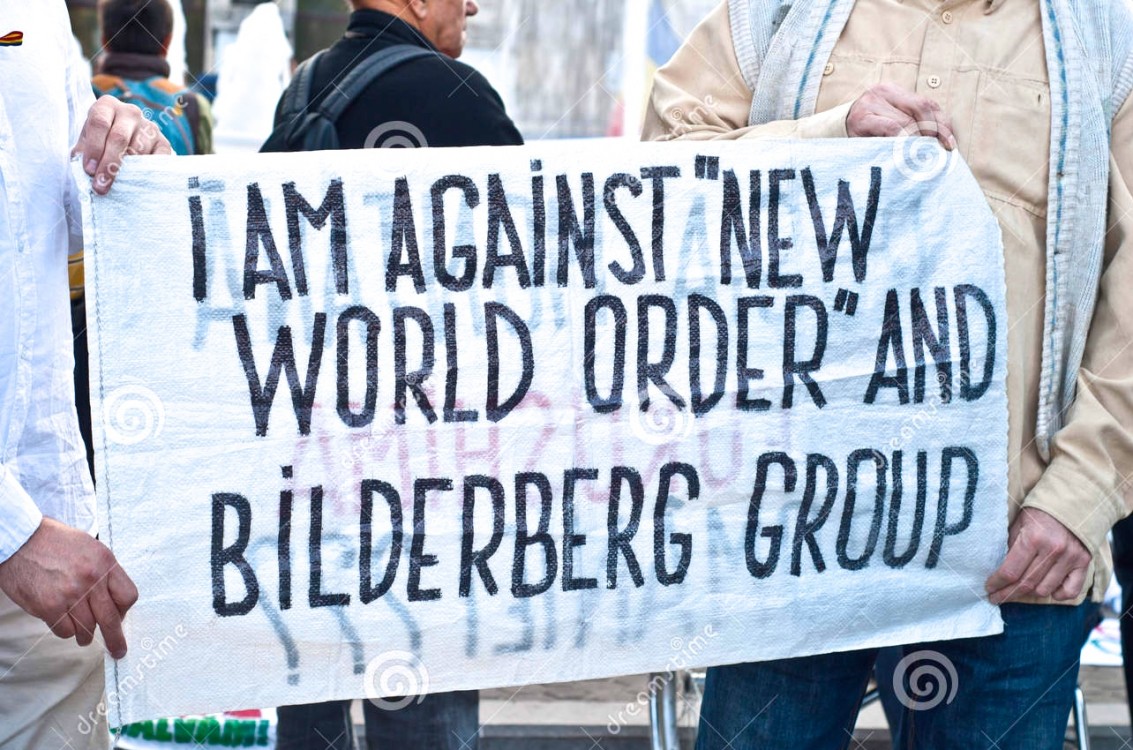

When discussing the Bilderberg group, its meetings and their impacts, there is one major problem: the meetings are held in secret. When 130 of the world’s most influential individuals and institutions get together behind closed doors for a “private chat,” the public is left unaware of what was said, debated, agreed or decided. The official website for Bilderberg publishes recent lists of attendees as well as a press release of the "topics" due to be discussed.

With no details added, the list for the 2014 meeting’s topics included, “Is the economic recovery sustainable?”, “What next for Europe?”, “China’s political and economic outlook,” and “Current Events.” This is essentially all we have to go on in our efforts to discern what was debated and discussed behind the scenes.

So, instead of engaging in speculation about what was or was not discussed at Bilderberg meetings, let's instead look at the individuals and institutions that are frequently represented there. What role do those groups play in society? What is their history and evolution as institutions and individuals? What ideologies do they embrace and propagate? Seeking the answers to these questions raises further inquiries: what do these individuals, institutions and ideologies tell us about our society? What do they tell us about power and how it is organized, exercised and expanded?

Bilderberg and Financial Markets

Some people suggest we may judge others by the company they keep. After all, who we choose as friends says a great deal about ourselves. Applying this logic to the Bilderberg Group, we see a body whose activities and internal discussions remain largely secret, which we can get to know better by examining the membership and guests it invites.

Bilderberg’s official website provides a press release for each meeting held between 2010 and 2014. In all of these meetings, issues such as the financial crisis and regulation, the European debt crisis, economic recovery and growth, austerity and global economic governance are relevant throughout. With membership drawn primarily from North America and Western Europe, the financial and economic turmoil of the past several years has been a consistent topic of discussion and concern for Bilderberg meetings.

Within all of these issues, “financial markets” play an extremely important and influential role. Given that Bilderberg represents the interests of some of the largest and most powerful banks and financial institutions in the world, the meeting provides a forum where "financial markets" are duly given a powerful voice.

But before we address the relevance of these financial market leaders, let's briefly define what “financial markets” are. The Financial Times Lexicon calls them a “generic term for an exchange that facilitates the trading of financial instruments, such as stocks, bonds, foreign exchange, or commodities.” In other words, “financial markets” create and collect vast sums of money (or debt) and move it around in order to collect more money and debt. Financial markets manage the investment and exchange of money and debt.

Many major institutions and actors shape financial markets. There are individual financiers, such as billionaires George Soros and Warren Buffett, who are able to move financial markets with words and actions. There are also major global banks (the “too big to fail” financial institutions), insurance companies, holding companies, asset management firms, sovereign wealth funds, exchange traded funds, wealth management firms, hedge funds, private equity companies, credit ratings agencies, consulting and accounting firms, and central banks, among others.

Despite – or because of – their many different areas of operations and institutions within financial markets, the power of these groups is heavily concentrated, largely globalized and highly destructive.

Roger Altman

But don’t take my word for it. Instead, take the word of a Bilderberg Steering Committee member, Roger C. Altman, who has attended every meeting since 2010. Altman is the chairman of Evercore, which claims to be the “most active independent investment bank” in the United States. He was a former partner at Lehman Brothers in the 1970s, became a fund-raiser for then-Governor Jimmy Carter, and later served as an Assistant Treasury Secretary in the Carter administration from 1977 to 1981, during which time he oversaw the $1.5 billion government bailout of Chrysler Corporation.

Altman returned to Wall Street in 1981, working for Lehman Brothers. The New York Times noted that apart from his stint in the Carter administration, Altman “spent the 70s and 80s on Wall Street, growing very wealthy.” He became close with the chairman of Lehman Bros., Peter G. Peterson, who founded the major investment firm Blackstone in 1987, today one of the world’s largest independent asset management firms managing nearly $300 billion in assets.

Altman joined Blackstone at its founding as Vice Chairman, staying until 1993 when he was appointed as Bill Clinton’s Deputy Treasury Secretary. One of Clinton’s closest economic advisers at the time, Gene Sperling, commented that Altman was “one of the six or seven people who is always consulted on any significant economic position.”

Altman left the Clinton administration in 1995 and founded Evercore that same year, where he has remained until the present. He is currently also a director of Conservation International, a member of the Council on Foreign Relations, the Steering Committee of Bilderberg, and regularly writes columns for the Wall Street Journal, New York Times and Financial Times. In 2006, Altman served as an adviser to Hillary Clinton for her presidential campaign. Today, Evercore manages over $14 billion in assets and has handled over $1.4 trillion of transactions for major global corporations, investment agencies and the super rich.

What does all this mean? It means when Roger Altman writes articles that are widely distributed and read by the key decision-makers and those who shape the global financial markets, he speaks not simply as an observer but as an active participant and player. His words carry weight – like in December of 2011, a month after the democratically elected leaders of Greece and Italy were removed from office. The EU elite replaced those countries' leaders, who had displeased the financial markets, with economic technocrats and bankers who swiftly imposed ruthless austerity measures that punished their populations into poverty in order to pay the interest on debts to banks.

Altman wrote in the Financial Times that financial markets were “acting like a global supra-government” with the power to “oust entrenched regimes where normal political processes could not do so. They force austerity, banking bail-outs and other major policy changes,” and their influence “dwarfs” that of major global institutions like the International monetary Fund (IMF), he wrote. Indeed, the markets “have become the most powerful force on earth,” and when those markets flex their muscles, “the immediate impact on society can be painful” with high unemployment and collapsing governments.

But, he added, “the longer-term effects can be often transformative and positive,” at least for the interests of banks. Ultimately, Altman concluded: “Whether this power is healthy or not is beside the point. It is permanent... there is no stopping the new policing role of the financial markets.”

Martin Wolf

Martin Wolf, another frequent Bilderberg participant, is considered to be perhaps the most influential financial journalist in the world, being the chief economics commentator and associate editor at the Financial Times. He is consistently rated among the 100 most influential "thinkers" in the world, with “a devoted following among top economists, politicians, and financiers." Wolf himself once explained: “I’m writing for the people who are doing these things, who are running these things.”

Lawrence Summers, another top economist, former Treasury official and occasional Bilderberg participant, has referred to Wolf as “the world’s preeminent financial journalist,” and the economist Kenneth Rogoff called him “the premier financial and economics writer in the world.” Mohamed El-Erian, former CEO of the world’s largest bond trader, PIMCO, stated that Wolf was “by far, the most influential economic columnist out there,” and the current governor of the central bank of India, Raghuram Rajan, commented: “You cannot measure influence, but you can feel influence... And I think [Wolf] has it.”

Wolf himself acknowledged, “I don’t know if there’s any significant central banker I don’t know.” As the New Republic explained in a profile, Wolf’s audience and readership “are some of the top earners, spenders, and decision-makers in the world,” noting that he was “staggeringly well-connected within the elite circles he is writing for.”

No doubt, Wolf’s consistent presence at Bilderberg meetings, and at the World Economic Forum, has helped to secure that access and maintain those connections. Thus, when Wolf writes about issues related to financial markets, his commentary holds far more weight than when outside or more critical voices speak up. This is all the more notable when Wolf defines and criticizes what he perceives as the primary problems of financial markets, and the financial system as a whole – which he did in 2011, writing that “an out-of-control financial sector is eating out the modern market economy from inside, just as the larva of the spider wasp eats out the host in which it has been laid.” (Wincott Annual memorial lecture, Oct. 24, 2011).

The Super-Entity

Combining the analyses of these two prominent Bilderberg members who have strong connections to leading global financiers and regulators, we can thus understand financial markets as something of a global parasite – one with unprecedented power to determine the fate of nations and peoples through investments and exchanges of money and debt. Financial markets, in other words, represent a global parasitic social structure in which power is gained and exercised through the manipulation of numbers on screens.

At the core of financial markets are what Swiss scientists have called the “super-entity,” composed of 147 of the world’s top transnational corporations, primarily banks and insurance companies concentrated in the United States, Western Europe and Japan, which collectively own each other through shareholdings.

As a group, these 147 corporations own roughly 40% of the entire network of the world’s top 43,000 transnational corporations. One of the financial researchers commented, “In effect, less than 1 per cent of the companies were able to control 40 per cent of the entire network.”

Many of these institutions are frequently represented in Bilderberg meetings, including JPMorgan Chase, Goldman Sachs, Barclays, Deutsche Bank and AXA. Collectively, these are the leaders in financial markets and the overlords of Roger Altman's “global supra-government.” The leaders and advisers to these banks who have been represented at Bilderberg meetings, and the influence and views they hold, will be the focus of the next installment in this series.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments