College grads should be getting ready to live the American Dream and buy a house of their own. But they’re being held back by their crushing debt loads, meaning that fewer single family homes are being built. Students got caught in a housing market spiral: many parents who had once used home equity to help finance college costs had to pull back when the market tanked, leaving students to take on more debt, which is now getting in their way of owning their own homes. According to Bloomberg News, at the height of the housing boom, about $7 billion of equity was cashed out to pay for education.

Bloomberg News also reports that young people hold the majority of student loan debt, but their rates of homeownership have cratered:

Two- thirds of student loans are held by people under the age of 40, according to the Federal Reserve Bank of New York, blocking millions of them from taking advantage of the most affordable housing market on record. The number of people in that age group who own homes fell by 4.6 percent in the fourth quarter from the third, the biggest drop in records dating to 1982. […] The issue is being exacerbated by an explosion in the $150 billion private market for student debt with interest rates for some existing loans surpassing 12 percent. Unlike mortgage holders, borrowers have little hope of refinancing at lower rates.

While a survey found that nine out of ten people want to own their own home, rental demand is at a ten-year high. So while housing construction is starting to rebound, the type that these young people would be building, single family homes, fell 4.8 percent in March. Rather than buying, many are renting – or crashing on their parents’ couch. That’s bad news for the housing market and the economic recovery.

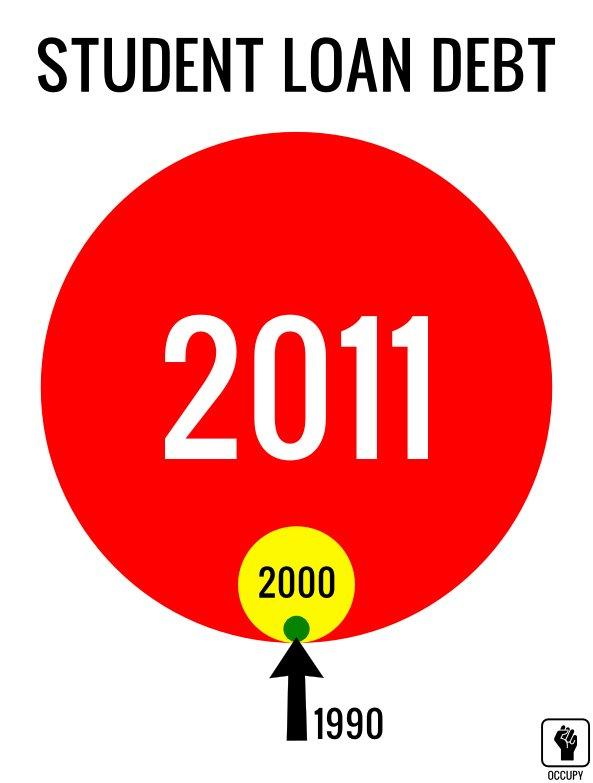

This is all happening at a time when total student debt has inched past $1 trillion. The problem isn’t just that recent grads may be wary of taking on mortgage debt when they already carry such huge burdens. The debt itself likely hampers their ability to get a mortgage in the first place, since due to a high debt-to-income ratio.

Congress could do something small to ease this situation: keep interest rates on federal loans from doubling, as it did last year. But even that won’t be enough to deal with such high amounts of debt that are taking a big toll on the economic recovery.

Originally published by ThinkProgress.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments