Raising concerns about possible ethics violations and corruption, the Paradise Papers revealed two top members of the Trump administration, Commerce Secretary Wilbur Ross and Secretary of State Rex Tillerson, have ties to tax havens, and that during Ross's confirmation hearing, he failed to disclose business dealings with Russians who are directly connected to Russian President Vladimir Putin.

The Paradise Papers are a trove of more than 13 million leaked documents, published Sunday, detailing tax avoidance and shady deals among some of the world's richest individuals and multinational companies. The documents include decades of corporate records from the offshore law firm Appleby. They were obtained by a German newspaper and shared with journalists associated with the International Consortium of Investigative Journalists (ICIJ) and other media organizations.

The files show that while Tillerson, the former CEO of fossil fuel giant ExxonMobil, directed a Bermuda-based joint venture that conducted gas and oil operations in Yemen, Ross still holds stake in a shipping company that is partially owned by Putin's son-in-law and "a Russian tycoon sanctioned by the U.S. Treasury Department as a member of Putin's inner circle."

The revelations have raised concerns among lawmakers and ethics experts.

The watchdog group Common Cause has called on the Commerce Department's inspector general to launch a full investigation into Ross's offshore investments. The group's president Karen Hobert Flynn said Monday, "These latest revelations are part of a disturbing pattern of Trump administration officials seeking to hide their links to Russian business interests and members of Vladimir Putin's inner circle."

The records and related reports come less than a week after it was revealed that the first federal charges were filed in the ongoing investigation into whether the Trump administration colluded with the Russian government to influence the 2016 presidential election.

Richard Painter, who served as the ethics chief under former President George W. Bush and is currently vice chairman of Citizens for Responsibility and Ethics in Washington (CREW), said, "It's a very, very troubling situation."

In an episode of the Center for Investigative Reporting's Reveal podcast published Sunday, Painter explained, "If United States government officials have offshore entities, it may be very difficult to detect payments from foreign governments or sovereign wealth funds, and profits from dealings with those entities that are a violation of the Constitution."

"We want good relations with China and Russia," Painter added, "but we don't want our senior government officials dealing with large companies in those other countries at the same time as they're holding positions of trust in the United States government."

Rex Tillerson, Secretary of State

In the late 1990s, before rising to the position of CEO, Tillerson served as president of Exxon Yemen as well as director of Marib Upstream Services Company, which was incorporated in Bermuda in 1997. Marib Upstream Services' partners included the state-owned Yemen Gas Company and a company owned by ExxonMobil and the Texas-based Hunt Oil, which was run by Tillerson's close friend Ray Hunt.

The Guardian, which received access to the records, reports ExxonMobil and Hunt Oil "ran a $5bn venture to export 61m barrels of natural gas a year from fields in Marib, western Yemen. Hunt had discovered the fields in the mid-1980s and brought in ExxonMobil to help develop them."

"Yemen later moved to nationalize the gas-drilling operation, banishing the ExxonMobil-Hunt firm when its 20-year exploration contract expired in 2005," the Guardian notes. "The Texans claimed they were entitled to an extension and sued Yemen for $1.6 billion. The case was arbitrated at the International Chamber of Commerce, where Yemen prevailed."

The records reveal the details of just one instance of ExxonMobil operating subsidiaries in tax havens. Last year, Citizens for Tax Justice released a report that found while Tillerson served as ExxonMobil's CEO, the company's 35 tax haven subsidiaries held an estimated $51 billion offshore.

This case is similar to one detailed in documents leaked late last year—shortly before Tillerson became the United States' top diplomat. Those records divulged that in 1998, Tillerson directed ExxonMobil's Russian subsidary, which was based in the Bahamas, a well known tax haven. The revelation elevated concerns about Tillerson's commitment to U.S. interests and his ties to the Russian government and Putin, who bestowed upon him an Order of Friendship in 2013.

Wilbur Ross, Secretary of Commerce

Ross helps to guide U.S. trade and manufacturing policies—including sanctions—as head of the Department of Commerce. When he was nominated, the billionaire investor vowed in an ethics filing that he would divest from 80 companies and partnerships, while keeping his stake in nine others that held assets in "real estate financing and mortgage lending" and "transoceanic shipping."

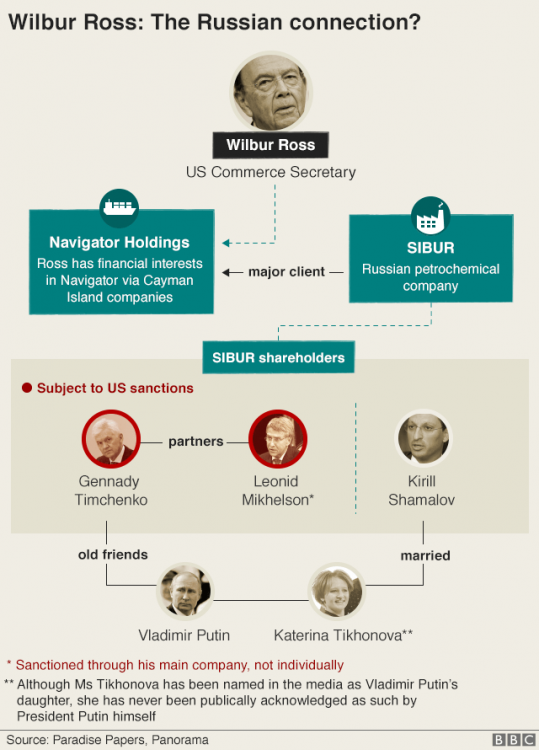

Though the assests were not specified at the time, the leaked records reportedly reveal that Ross retained his stake in the shipping company Navigator Holdings, which is incorporated in the Marshall Islands and counts among its biggest customers Sibur, a Russian gas and petrochemical company.

Using information from the files, the BBC mapped Ross's relationship to Navigator and Sibur, the company shareholders' ties to Putin.

Ross told the BBC that he's never met the Sibur shareholders and that because the U.S. has not sanctioned Sibur, "there's nothing whatsoever improper about Navigator having a relationship with Sibur." A Commerce Department spokesperson told ICIJ reporters that Ross "recuses himself from any matters focused on transoceanic shipping vessels, but has been generally supportive of the administration's sanctions."

Other Trump ties

Ross and Tillerson were among several Trump advisers, cabinet members, and donors who, according to the leaked records, used offshore tax havens to conduct business. While the Guardian published a report describing how several wealthy individuals with connections to the U.S. president have utilized tax havens, ICIJ illustrated 13 influencers' ties to Trump with an interactive:

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments