Significant savings of taxpayer dollars and sizable predicted profits were just two of the positive results of a 10-month study undertaken by the City of Santa Fe, New Mexico, moving the city one step closer toward creating America’s first new publicly-owned bank in almost 100 years.

The study concludes that a public bank for the city is both feasible and would have a positive financial impact of over $24 million for the city over a seven-year period.

“While the findings are impressive, they don’t surprise us – publicly-owned banks are inherently more efficient and profitable” than private banks, said Walt McRee, Chair of the Public Banking Institute, “and this study adds powerful new evidence that civic policy makers across the country should be paying attention to.”

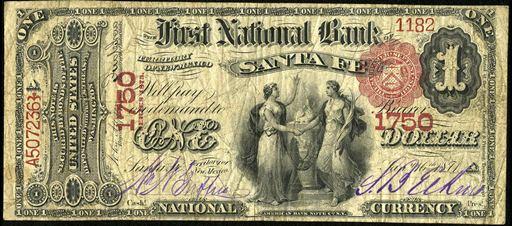

Santa Fe’s study was initiated to investigate an alternative to lagging city finances, a common reality of municipal managements around the country. The U.S.’s only public bank, the Bank of North Dakota, “has demonstrated in numerous ways that a public bank can help local governments greatly improve the financial climate of their communities,” McRee added.

Lead consultant Katie Updike, a former manager for the U.S. Farm Credit System and the Bank for Cooperatives, headed up the study with the assistance of Dr. Christopher A. Erickson, a professor of economics, applied statistics, and international business at New Mexico State University and an analyst at Arrowhead Center, a business development organization in the state. The authors write that a public bank in Santa Fe “has the potential to provide enhanced fiscal management, improved net interest rate margins, and a more robust local lending climate.”

"The projected fiscal and economic impact to the City exceeds $24 million in the first seven years, based upon assumptions of how much of the City’s deposits are deployed in self-funding and reduced collateral programs," the authors conclude.

Mike Krauss, Chair of the Pennsylvania Project, a statewide public banking initiative, said the study results are very important because the findings can reasonably be expected to apply to larger cities.

"It shows there are big benefits of a public bank for even small cities," Krauss said. "The benefits to larger cities, like Philadelphia or San Francisco, will be exponentially larger."

Nichoe Lichen, of Santa Fe's We Are People Here, agreed with Krauss. "It is Santa Fe specific but there is a lot of thinking that applies to other areas as well," she said.

Among the study’s most significant findings, McRee said, is that a city-owned public bank could allow Santa Fe to fund its own debt rather than relying on Wall Street lenders. “All across America, cities, counties and states are beset by costly and destructive lending practices by Wall Street banks,” McRee said, “and these interest costs and fees have seriously undermined municipal financial and civic stability.”

As the Santa Fe New Mexican reported last week, the city “estimates it could have saved $10 million since 2009 on its $80 million of current debt had the government been able to borrow from its own community instead of Wall Street.” The study concludes that by Santa Fe funding its own debt the “City could fund some of its own construction on capital projects, and manage its liquidity in more than one way. This would save the City money which could be used to fund City activities or mitigate taxes."

The study’s authors emphasize that creating a public bank in New Mexico’s small capital city would be a significant change in the financial structure of the region. Because of this, “it is critical that the City build the trust and capacity [in a public bank] steadily and professionally. This also has the added advantage of building the tools and the relationships with the community banks to enhance their ability to contribute to the well-being of the City and the community."

This prudent cautiousness is accompanied by widespread public support for Santa Fe to “use its cash deposits actively to fund at least the design and construction phase of infrastructure projects.” A Santa Fe Public Bank "promise[s] to reduce the current deficit projected by City management," they conclude.

“This is a benchmark moment in the growing national movement of cities and states who are asking the same questions as Santa Fe:” says McRee, “Can our communities benefit by investing our money locally rather than borrowing from private Wall Street banks?”

The Santa Fe initiative is one of dozens of other similar processes now underway around the country. The Public Banking Institute, a non-profit, non-partisan consulting and educational organization dedicated to the creation of new publicly-owned banks in the United States, provides support for these efforts.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments