Do “financial services” include banking? Not according to the Trump administration, whose new rule, issued earlier this month by the Treasury Department, argues there is a difference — and then cites the alleged difference as a means of extending lucrative tax breaks to the banking industry. The new rule represents more than semantic hairsplitting and hands a huge windfall to the banking industry.

At issue is the Trump tax bill’s treatment of so-called pass-through income — or income that is gleaned from partnerships, LLCs and S corporations. The 2017 Republican tax legislation dramatically slashed tax rates on income from such entities, generating a firestorm of criticism that it was a giveaway to real estate moguls like Trump, U.S. Senator Bob Corker (R-TN) and other Republican backers of the legislation who have such entities in their personal portfolios. (The criticism became known as the “Corker Kickback” scandal.)

To reduce some of the cost of the overall tax cut bill — and to mute some of the specific criticism of the pass-through sections — GOP lawmakers included provisions prohibiting certain kinds of businesses from qualifying for the pass-through tax cut. One such business was “financial services,” and its removal countered assertions that the bill could enrich big banks.

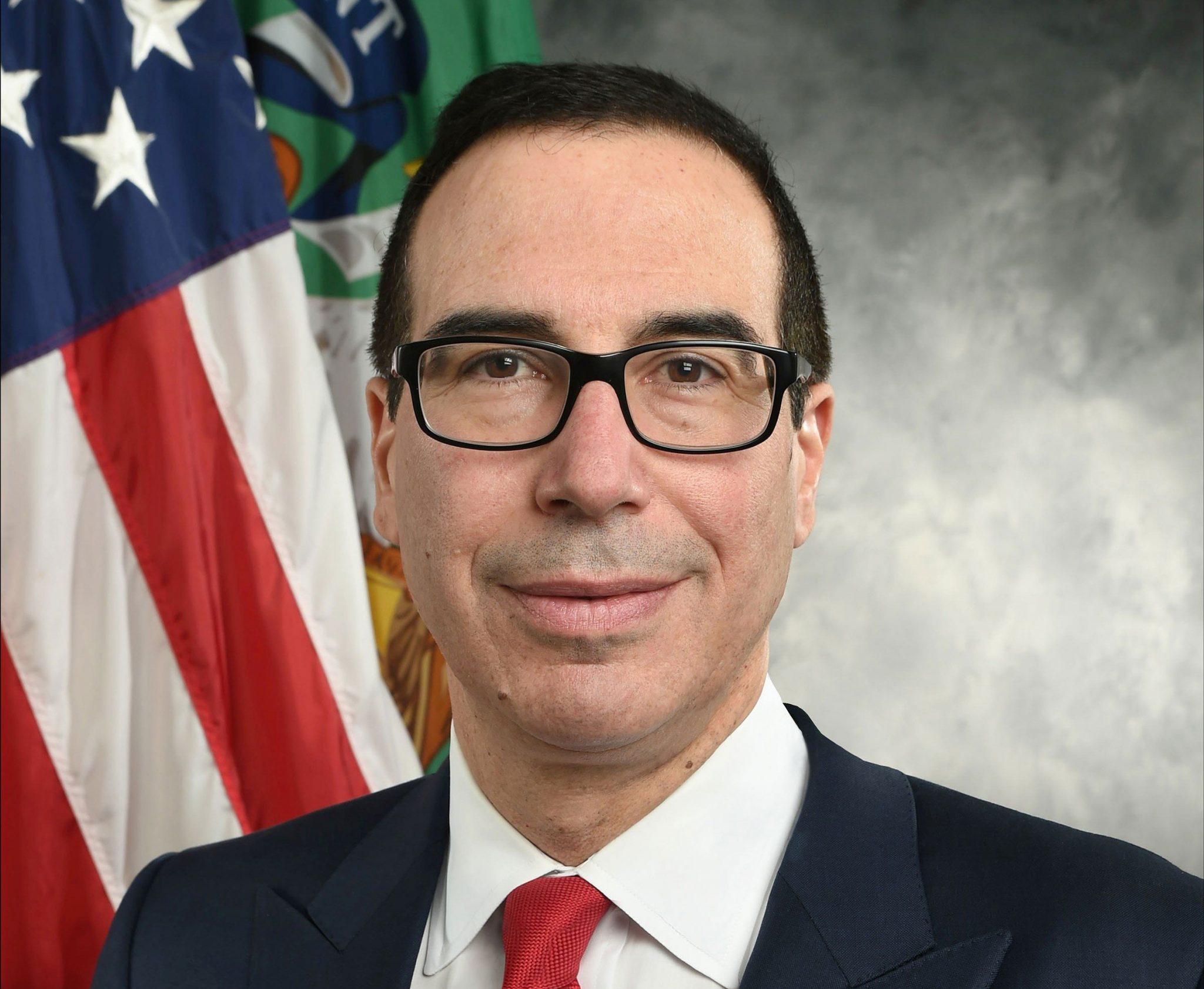

However, less than a year after passage of the tax legislation, the Treasury Department, headed by former banker Steve Mnuchin, issued the proposed rule whose fine print asserts that “financial services” actually do not include banking. If that interpretation of the tax bill stands, hundreds of banks operating as S corporations — as well as their owners — could claim the tax cut.

“This is illustrative of the rigged process behind the bill, which was rushed through Congress without a single public hearing,” the Center for American Progress’ Seth Hanlon told Capital & Main. Hanlon served on President Obama’s National Economic Council. “How many members of Congress, let alone members of the public, understood that ‘financial services’ didn’t mean banking, and therefore that bankers would get a massive tax cut? This is the opposite of real tax reform.”

Banking industry lobbyists pushed for the interpretation — acknowledging that the bill generally blocked pass-through tax cuts for businesses in financial services, but arguing that “financial services are, however, clearly something other than banking.”

“We had extensive discussions with Congressional staff and various members in both the House and Senate,” wrote the American Bankers Association, Independent Community Bankers of America and Subchapter S Bank Association in a letter to the Treasury Department. “In the course of these discussions, we were assured repeatedly that S Banks would qualify for the lower tax rate for pass-through businesses.”

The Trump Treasury Department not only sided with the lobbyists, but in the fine print of its new rule, which is now subject to a public comment period before it goes into force, echoed their views.

“Commenters requested guidance as to whether financial services includes banking,” the Treasury Department said, referring to the banking industry. “The Treasury Department and the IRS agree with such commenters [that] financial services should be more narrowly interpreted here.”

The department then concluded that its interpretation “limits the definition of financial services to services typically performed by financial advisers and investment bankers…This includes services provided by financial advisers, investment bankers, wealth planners, and retirement advisers and other similar professionals, but does not include taking deposits or making loans.”

Tax attorney David Miller of the Proskauer law firm told Capital & Main: “The interpretation is consistent with denying the flow-through deduction only to labor-intensive industries. Banks tend to be capital, and not labor, intensive.”

“Treasury’s decision delivers a benefit to roughly 2,000 banks around the country that qualify as S corporations,” said University of Chicago tax law professor Daniel Hemel. “It’s a safe bet that most of the S corporation shareholders benefited by today’s decision will fall into the upper reaches of the top one percent — not many middle-class folks own a bank. The notion that ‘financial services’ excludes banking should be quite a surprise to members of the House Financial Services Committee, which thought that it had jurisdiction over banking.”

Hemel calculated that banks would end up reaping a big payout from the interpretation.

“If you assume a return on assets of around one percent and S corporation bank assets in the range of $400 billion, then the move reduces the total tax liability of S corporation bank shareholders by $300 million per year for 2018 through 2025,” he said. “We’re talking about something like $2.5 billion total. Small in comparison to the magnitude of the rest of the December 2017 giveaway, but $2.5 billion isn’t chump change.”

Steve Rosenthal of the Urban Institute said that while the Treasury Department fine print explicitly solidifies the tax cut for bankers, he said he believes the interpretation does not contradict congressional intent.

“I thought Congress gave away the house in the legislation, and I spoke to Hill staffers who said subchapter S banks are going to get a 20 percent deduction, and so I don’t think the new Treasury rule runs contrary to what Congress wanted,” he told Capital & Main. “This is definitely a huge giveaway — I just think it was Congress that did the original giveaway.”

Originally published by Capital & Main