With around a billion people in countries from Japan to Bangladesh using their post office networks to save, send, and manage money, and up to 40 million Americans forced to pay extremely high rates for such services, we’re long past due for post office-based financial services for Americans.

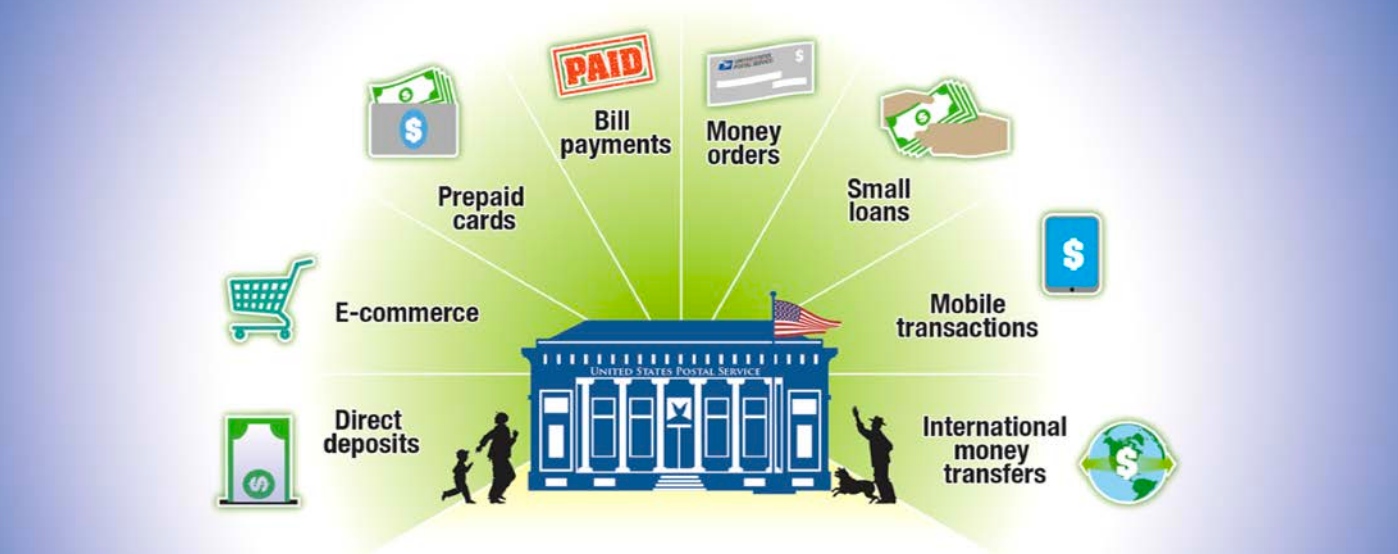

In an editorial for Huffington Post, Senator Elizabeth Warren has proposed a plan for United States Post Office-based financial services including small savings accounts, debit cards, small-dollar loans, e-commerce payments, government-to-citizen payments, authentication, and financial counseling. Warren's proposal is based on the Office of Inspector General, United States Postal Service's January 27, 2014 report: "Providing Non-Bank Financial Services for the Underserved.", which notes that "Transparency and accountability over fees, processes, and other critical aspects of financial services help posts to make their offerings appeal to customers who might be wary of doing business with some traditional banks."

These services do not radically depart from the issuance of international money transfers and money orders. The services would save working people millions of dollars and provide consistency and day-to-day security for those currently underserved by banks. That's a good enough reason to support them – as is the way postal financial services offer alternatives to exploitative payday lenders.

The services Warren suggests are also important first steps in the ongoing process of democratizing our economy, building institutions that bypass big banks and unethical financiers, and preserve community commons. Those who are cautious about transitioning to public banking can support Warren's measure as an exploratory step, while those fully committed to a new economy can embrace it as an affirmation of policy makers' willingness to support public economic services.

Warren's proposal occurs in a context of state- and city-level efforts to create public banks in Vermont, Pennsylvania, Washington,California and other states. It also comes at a time when voices are rising in support of the postal service.

Warren has once again proven herself bold in comparison to many national elected officials. The absurd Postal Accountability and Enhancement Act and the the Carper-Coburn bill to eliminate services, combined with the suspicious selling off of postal properties, make Warren's advocacy particularly refreshing.

Post offices can do much more, of course. They do in Japan, where Japan Post Bank provides citizen banking and helps fund that nation's federal budget. We need to explore the potential of postal development banks. The National Association of Letter Carriers hasproposed a national infrastructure bank that issues bonds and guarantees long-term, low-interest loans to governments and small businesses – initially funded by citizen savings accounts through the United States Post Office.

The big banks are already attacking Warren's proposal. They are coming forward with the usual generalities: the government can't be in the financial business; the proposal would kill jobs; the post office is losing money. But the big banks' arguments are wrong and citizens of other countries know this; over 1 billion people worldwide utilize their nations' postal sectors for financial services. And more Americans are learning about the potential of financial service as public utility.

Americans see through the deliberately insolvent model imposed on the postal service by the Postal Accountability and Enhancement Act, and are tired of the self-justifying positions of the bank and payday lending lobbies. Advocates of postal financial services, and public banks, should answer those arguments head-on. The Public Banking Instituteprovides resources to do this, and advocates like Ellen Brown and Richard Eskow have amassed facts, figures and history demonstrating the viability of Senator Warren’s proposal.

There is a compelling case to leverage the vast post office network here in the United States. Post offices are placed where the people are, unlike banks, which are placed where the money is. Having a people-centered network of reasonably-priced financial services will go a long way towards bringing tens of millions of Americans into a stable and responsible financial system.

Senator Warren deserves credit and support for giving a boost to a great idea. Publicly accountable, accessible financial service makes good sense. Those wishing to learn more should read the Post Office Inspector General's report here.

Matt Stannard is Director of Media and Communications at the non-partisan Public Banking Institute.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments