Western countries are using aid to Africa as a smokescreen to hide the "sustained looting" of the continent as it loses nearly $60 billion a year through tax evasion, climate change mitigation, and the flight of profits earned by foreign multinational companies, a group of NGOs has claimed.

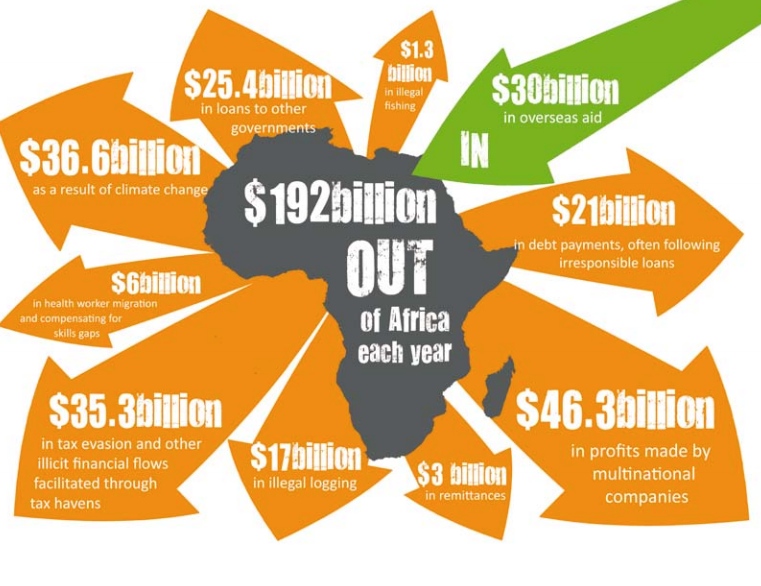

Although sub-Saharan Africa receives $134 billion each year in loans, foreign investment and development aid, research released on Tuesday by a group of U.K. and Africa-based NGOs suggests that $192 billion leaves the region, leaving a $58 billion shortfall.

The report says that while western countries send about $30 billion in development aid to Africa every year, more than six times that amount leaves the continent, "mainly to the same countries providing that aid."

The perception that such aid is helping African countries "has facilitated a perverse reality in which the U.K. and other wealthy governments celebrate their generosity whilst simultaneously assisting their companies to drain Africa's resources," the report claims.

It points out that foreign multinational companies siphon $46 billion out of sub-Saharan Africa each year, while $35 billion is moved from Africa into tax havens around the world annually.

The study, which also notes that African governments spend $21 billion a year on debt repayments, calls for the aid system to be overhauled and made more open.

It says aid sent in the form of loans serves only to contribute to the continent's debt crisis, and recommends that donors should use transparent contracts to ensure development assistance grants can be properly scrutinized by the recipient country's parliament.

"The common understanding is that the U.K. 'helps' Africa through aid, but in reality this serves as a smokescreen for the billions taken out," said Martin Drewry, director of Health Poverty Action, one of the NGOs behind the report.

"Let's use more accurate language. It's sustained looting – the opposite of generous giving – and we should recognize that the City of London is at the heart of the global financial system that facilitates this."

Research by Global Financial Integrity shows Africa's illicit outflows were nearly 50% higher than the average for the global south from 2002-11. The U.K.-based NGO ActionAid issued a report last year that claimed half of large corporate investment in the global south transited through a tax haven.

Supporting regulatory reforms would empower African governments "to control the operations of investing foreign companies," the report says, adding: "Countries must support efforts under way in the United Nations to draw up a binding international agreement on transnational corporations to protect human rights."

But NGOs must also change, according to Drewry: "We need to move beyond our focus on aid levels and communicate the bigger truth – exposing the real relationship between rich and poor, and holding leaders to account."

The report was authored by 13 U.K. and Africa-based NGOs, including: Health Poverty Action, Jubilee Debt Campaign, World Development Movement, African Forum and Network on Debt and Development, Friends of the Earth Africa, Tax Justice Network, People's Health Movement Kenya, Zimbabwe and U.K., War on Want, Community Working Group on Health Zimbabwe, Medact, Healthworkers4All, Friends of the Earth South Africa, JA!Justiça Ambiental/Friends of the Earth Mozambique.

Sarah-Jayne Clifton, director of Jubilee Debt Campaign, said: "Tackling inequality between Africa and the rest of the world means tackling the root causes of its debt dependency, its loss of government revenue by tax dodging, and the other ways the continent is being plundered. Here in the U.K. we can start with our role as a major global financial center and network of tax havens, complicit in siphoning money out of Africa."

A U.K. government spokesman said: "The U.K. put tax and transparency at the heart of our G8 presidency last year and we are actively working with the Organization for Economic Co-operation and Development to ensure companies are paying the tax they should and helping developing countries collect the tax they are owed."

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments