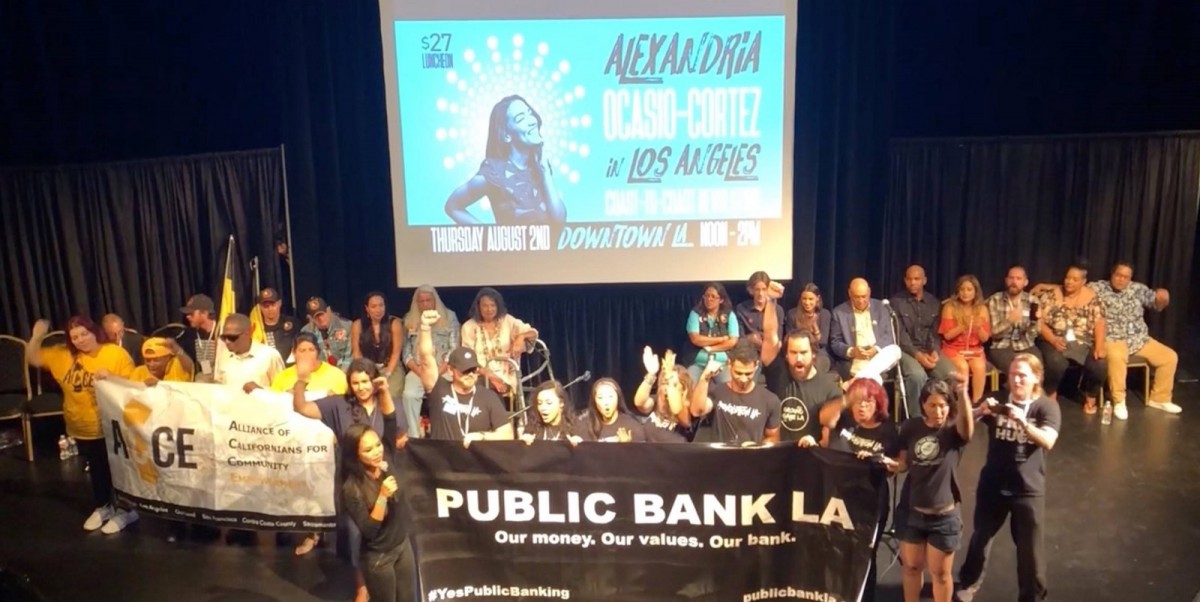

Grassroots organizers with Public Bank LA, Alliance of Californians for Community Empowerment, Democratic Socialists of America — Los Angeles, and the Bernie Sanders Brigade gather at City Hall in May 2018 for a Citizens’ Lobby Day for Public Banking.

Leading the nation on progressive policies is what we do as Angelenos. From setting the boldest mass transit and electric vehicle targets in the nation to divesting the city’s funds from Wells Fargo, Los Angeles is not only the tip of the spear of the West Coast resistance to Donald Trump, but a place where some of the most enlightened measures are emerging to lead our country forward.

Why, then, should the city’s leadership to establish a public bank in Los Angeles be any different?

In his monthly column for the The Los Angeles Times, Harold Meyerson, editor-at-large of the American Prospect, penned an October 3 editorial in support of public banking (“Why Los Angeles should start a public bank”). But in a September 20 piece, the paper’s editorial board widely missed the mark (“Charter Amendment B is one of the most ill-conceived, half-baked ballot measures in years. Vote no”).

Which side should voters believe?

The editorial board came down solidly on behalf of Wall Street, offering a full-throated defense of the Big Bank status quo. But Angelenos are no longer interested in business-as-usual politics. They want to see progressive reforms in the people’s best interest — and creating a city bank run by the people of Los Angeles is the clearest example of that.

First, the problem: Los Angeles taxpayers currently pay Wall Street banks over $200 million in fees and over $1.1 billion in interest every year. The giant banks that extract wealth from Los Angeles — JPMorgan Chase, Wells Fargo, Bank of America, etc. — are the same ones regularly in the headlines (of the Los Angeles Times no less) reaching out-of-court settlements and paying billions in fines for perpetually defrauding the public.

Now comes the solution. Across California, municipalities are seeking to create city-managed public banks to cut ties to Wall Street much like they cut ties to the Trump administration, whether on climate, immigration or other issues. Charter Amendment B, on the ballot for Los Angeles voters in November, is another step in the direction of creating a more self-reliant, locally administered economy.

The Municipal Bank of Los Angeles (MBLA) provides a public option for handling the City’s finances. Instead of billions of our tax dollars sitting in checking and short-term investment accounts in Wall Street banks, earning zero interest and costing the city fees to manage, a public bank recirculates the money back into our local economy, putting those dollars to work for the people of L.A.

As a wholesale, or “banker’s bank,” the MBLA would not have physical branches, ATMs, or any of the associated brick-and-mortar costs of traditional retail banks. Rather, a municipal bank would create partnerships with community banks and credit unions to provide services to businesses and consumers. Through this type of public bank, we can cut our borrowing costs in half while doubling our power to invest in our communities with low-income housing, critical infrastructure projects, clean energy and more.

The language of the ballot measure is straightforward: “Shall the City Charter be amended to allow the City to establish a municipal financial institution or bank?” Charter Amendment B is the first step in allowing the city to explore alternatives to Wall Street financing. This is not a blank check; it is just one of many steps in the legislative process and will be followed with state-level legislation to create a license for municipal banks in cities across California. Any proposed bank must be authorized by the State’s Department of Business Oversight to assure compliance with strict rules on risk, capitalization, and general business practices.

As concerned Angelenos, many of us have done our homework. The Los Angeles Times editorial board has not. Their editorial was not responsible, serious journalism. It was a hit piece designed to scare away voters who could set a national precedent by passing Charter Amendment B.

They could have cited the Bank of North Dakota (BND) as a model to emulate, with its decades of healthy profits and successful loan programs which, after nearly a century, continue to benefit the people of the state. In fact, BND outperforms Wall Street: It is more profitable than Goldman Sachs and has a better credit rating than JPMorgan Chase. Thanks to its public bank, North Dakota was the only state that survived the economic collapse of 2008 without going into red ink.

Considerable work has gone into laying the groundwork for the Municipal Bank of Los Angeles. For over a year, Public Bank LA, an all-volunteer advocacy group, coordinated with banking and policy experts nationwide to explore how to establish a democratic bank that could operate with lower risk exposure than any of the Wall Street giants. Key to that democratic structure is the creation of a multi-chambered board of directors to provide a balance of power between financial experts, bank workers and community leaders — modeled after Germany’s highly successful Sparkassen, a system of 400 municipally-owned public banks. We also created the California Public Banking Alliance, a network of public banking advocacy groups working on state-level legislation to create a regulatory framework for municipal and regional public banks across the state.

Consider the alternative: without a city-owned bank, our public funds will continue to be exposed to the reckless and fraudulent behavior of too-big-to-fail banks that caused the Great Recession. Charter Amendment B paves a path for Los Angeles to recapture public dollars, mitigate harm from risky investments, and assert local control over our community’s finances. Public banking could also help relieve unbanked and underbanked populations that currently account for half of all Black and Hispanic households, according to a recent report from the city’s Chief Legislative Analyst.

Charter Amendment B and the call to establish a Municipal Bank of Los Angeles has been endorsed by over 100 social justice, labor, environmental, political and community organizations and leaders, including the California Democratic Party, the Los Angeles County Democratic Party, the Los Angeles City Council and Our Revolution National. Voters next month need to ask why private multinational banks still manage our city’s public dollars — and charge us exorbitant interest rates in the process — when a healthy alternative exists.

Wall Street, banking lobbyists and their allies don’t like this measure. But the people do.

Vote YES on Charter Amendment B.

For more information about what Charter Amendment B entails and how a public bank of Los Angeles will be created, visit publicbankla.com.

Originally published on Medium