Congratulations, class of 2014!

Not for graduating — though that's nice, too — but for earning one of the more dubious distinctions in recent memory: You've officially been named "the most indebted class ever."

According to the Wall Street Journal and data compiled by analyst Mark Kantrowitz, the average loan-holding 2014 college graduate will have to pay back $33,000. That's up from around $31,000 in 2013 and under $10,000 in 1993.

What does this mean for your future? Luckily, a college education is still a worthwhile investment. Not only are college grads generally more employable, they earn significantly more than their degree-less counterparts.

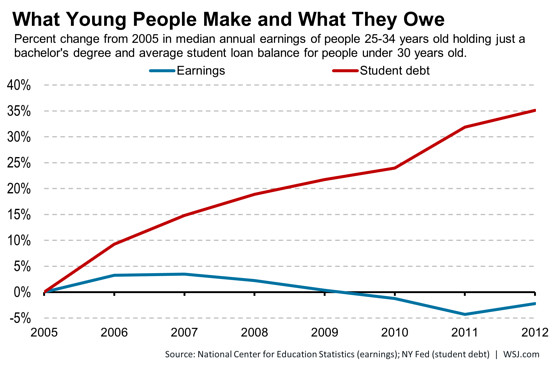

The problem arises when you consider the widening rift between average post-college salaries and how much students go into debt to earn them. Between 2005 and 2012, for instance, average student loan debt jumped 35%, adjusting for inflation, while the median salary dropped 2.2%.

This alone is disheartening. But added to the oft-cited mantra that you should never borrow more for college than you can expect to make in your first year of employment and you're looking at choppy seas ahead. For the time being, matters seem manageable — according to 2012 data, the median salary for a someone holding a B.A. was $46,900, while the "average student loan balance" for people under 30 stood at $21,000. But things are definitely getting worse, and recent and future graduates will increasingly have to shoulder the burden.

Here's more terrible news: This situation sucks for everyone.

Along with the growing numbers of Broke Phi Broke grads, recent evidence suggests that America's $1.1 trillion student loan debt crisis is messing up the economy. The New York Times reports a sound correlation between average debt and the plummeting number of 27- to 30-year-olds taking out home mortgages.

It makes sense: The more money you owe, the less you have to spend on a down payment. But considered on a grander scale, the pattern of fewer mortgages — whatever the cause may be — also spells bad news for future economic growth. The housing industry has always been instrumental helping the United States recover from past recessions, but since 2008, it's made less than half its normal economic contribution — a fact partially attributable to the decreased investments from young people.

So what can be done about this? You can try "rocking the vote," but it probably won't get you far. The federal government seems pretty committed to its slew of moronic multi-billion dollar investments, whether it's our massive prison system or the trillion dollar F-35 fighter jet program. And colleges are just fine continuing to jack up tuition costs like it's going out of style.

Basically, no one cares about your problems. But take heart, graduates, and consider the silver lining: Your "most indebted" title will almost certainly be overtaken by the class of 2015!

Meanwhile, from Huffington Post, Sallie Mae Torments Faithful Student Borrowers After Co-Signers Die:

Seven borrowers who had been paying their Sallie Mae student loans on time for years were unexpectedly threatened with asset seizures after a Sallie Mae contractor demanded they immediately repay tens of thousands of dollars simply because a family member had died.

Regina Kibler, a retiree who lives off payments from her late husband’s life insurance policy, spent days agonizing over how to help her son, Christopher, pay back nearly $22,000 neither had. Samantha Flora hired a lawyer to fight attempts to recoup some $20,000 from her dead grandmother’s estate that have turned members of her family against one another.

Tony Muzzatti, a 31-year-old Washington, D.C., resident who works in television and who owed Sallie Mae about $60,000, was asked to make a $10,000 down payment in January following the 2012 death of his grandmother, despite six years of on-time payments to Sallie Mae.

Valerie Terray and Karen Saxe, sisters who each had been repaying their loans for the past seven years, enlisted their husbands as they spent hours pleading with debt collectors before they finally begged their mother’s congressman to help. Cathryn Keller endured weeks of frantic calls from aggrieved family members who thought she was to blame for the stress Sallie Mae had caused her 82-year-old widowed grandmother. Tom Cimochowski’s aunt offered to take out a second mortgage on her house.

All were victims of what the Consumer Financial Protection Bureau calls “auto-defaults,” or the largely legal practice of immediately declaring borrowers’ private student loans in default after the death or bankruptcy of a loan co-signer.

Since an April report by the CFPB highlighted the troubling practice, the financial services industry has spent four weeks on the defensive, arguing that borrowers who face the demands are often delinquent on their debts, or are just out of college and thus unable to shoulder the burden. What’s more, they argue, borrowers should’ve known they could face auto-defaults because it’s detailed in their loan contracts.

But the experiences of seven Americans, who independently contacted The Huffington Post to share their stories, documents, correspondence and conversation notes detailing their interactions with Delaware-based Sallie Mae and its debt collector, Simm Associates, suggest that the practice ensnares even good borrowers who have faithfully repaid their student loans on time for years.

Seemingly out of nowhere, they’re treated like deadbeats and face financial ruin based on what seems to them an arbitrary demand to immediately pay up.

“Co-signer issues like auto-defaults are another example of predatory practices by private lenders,” said Anne Johnson, executive director of Generation Progress, a Washington advocacy organization linked to the Center for American Progress.

State and federal regulators are increasingly concerned that in certain cases, auto-defaults appear to violate consumers’ legal rights, underscoring the many challenges borrowers face in the historically under-regulated student loan market. Federal banking regulators, including the Federal Deposit Insurance Corp., are warning financial institutions to keep close tabs on their contractors.

“The practice may in fact have a legitimate business use, but it appears it’s not always exercised thoughtfully,” said Rohit Chopra, the consumer bureau’s student loan ombudsman.

'The Bad Practices of One Company'

Financial industry executives seem to agree. Some executives said there was no good business reason for a lender to place the account of an on-time borrower with a good repayment history into default simply because a co-signer had died.

“That is 110 percent correct,” said Richard Hunt, chief executive of the Consumer Bankers Association, a Washington trade group that represents many of the nation’s largest lenders, including Bank of America, Citigroup, and Wells Fargo. “If a customer has had an unblemished record, the bank should do everything possible to ensure the borrower is able to repay without putting them into default.”

Hunt argued that the CFPB’s report was effectively “penalizing the entire industry based on the bad practices of one company,” which he said was Sallie Mae. “That’s what’s so frustrating -- [the consumer bureau] painted the whole industry with the same brush and left a black mark on the entire industry.

“I’m not aware whatsoever of any of our members participating in this type of process,” Hunt said.

Consumer complaints lodged with the CFPB, the seven borrowers’ experiences, and interviews with other financial industry executives appear to back Hunt’s assertion, suggesting that Sallie Mae -- the nation’s largest lender and servicer of private student loans -- is the financial industry’s most energetic and frequent user of auto-defaults.

Navient Corp., the servicing and debt collection arm of Sallie Mae until the company recently split itself into Navient and Sallie Mae Bank, said it has changed its practices.

“After reviewing our process for responding when a co-signer dies, we updated our policy in March and May of this year,” said Patricia Christel, a Navient spokeswoman. “We are working to better communicate with the primary customer in the event a co-signer dies, including a look at the primary customer’s credit and payment history, before we take any action. We are implementing more flexibility in repayment for those who have made 12 months of payments. We have changed our practices so the cosigner’s estate would not be obligated when the borrower has a [12-month] track record of on-time payment."

Christel added, “We believe these changes will help our customers successfully pay back their student loans, which is our ultimate goal as a company.”

To test the extent of the policy change, HuffPost provided Navient with a description of the seven borrowers' repayment histories at the time they were contacted by the company's debt collector, Simm Associates. Christel said that under the new policy, none of the seven would've been contacted as a result of the death of his or her co-signer.

"While I cannot comment on specific customers without their permission, based on the description of the scenarios you provided, all of these examples would have continued in repayment without any changes to their loan or outreach to the estate," Christel said.

Martha Holler, a Sallie Mae spokeswoman, said the company has “updated over time how we assist in such a situation out of a desire to help customers resolve student loan issues in a manner that is courteous, humane and does not cause further stress of burden.”

Of the seven borrowers who contacted HuffPost, just one has loans currently owned by Sallie Mae Bank, Holler added.

'This is Not Happening'

Jeff Simendinger, who co-founded Simm Associates in 1991 with his father in their Delaware home, said his firm has “absolutely nothing to hide” and asked HuffPost to share his direct office telephone number with aggrieved borrowers.

“The notion of us threatening to seize assets or levy bank accounts or sue people is very concerning to me because this is not happening,” Simendinger said. “I know what we’re doing here and we’re not threatening anyone. We’re doing the best job we can and we’re not actively collecting on individuals who are not delinquent.”

Simendinger added that if federal regulators were to review his firm’s practices, he was “absolutely, 110 percent sure” that Simm Associates would be vindicated.

To Samantha Flora, a 28-year-old from Hancock, Michigan, who works in marketing and design, Navient’s policy change and Simendinger’s assurances seem empty.

On April 17, her parents received letters from Simm demanding they pay $19,793.41 within 10 days or Simm, acting on Sallie Mae’s behalf, would file a claim for that amount against her grandmother’s estate, according to the family. Her grandmother, Caroline Cooper, died Oct. 17 at the age of 92.

Cooper had co-signed two private student loans to enable Flora to graduate in 2010 with a bachelor’s degree from Columbus College of Art and Design. After Cooper’s death, Flora’s parents in November sent Sallie Mae a copy of the death certificate and asked the company to remove Cooper’s name from Flora’s loans, the family said.

Her loan documents, like those of others, state that borrowers with a steady repayment history can have co-signers taken off their loans.

They expected Sallie Mae to honor their request. After all, Flora had been diligent in making her monthly payments since fall 2010. Early on, she said, there were a few months where she was late by a few days, but she was never charged a late fee. She said she later authorized Sallie Mae to withdraw her required payment directly from her checking account every month.

In April, the family received letters from Simm, threatening to report Flora’s default to national credit reporting agencies, the family said. In its report, the consumer bureau said borrowers often face hurdles when trying to have their co-signers removed from their loans.

There was less than $1,000 left in Cooper’s estate against nearly $25,000 in debt. Her home, which is up for sale, may fetch about $65,500. But Flora’s father, Roy Cooper, a retired 62-year-old who lives in Ewen, Michigan, with his wife after a 30-year career helping to make Buick cars for General Motors, is one of Caroline Cooper’s seven children.

His youngest sister, alarmed by the possibility that Simm and Sallie Mae will take half of what’s left of their mother’s estate after her debts are repaid, is threatening to sue him and his daughter, Flora.

Simm employees told Flora and her parents they couldn’t discuss her sterling repayment history with Sallie Mae because they weren’t authorized to look at it. Sallie Mae’s representatives told the family they couldn’t confirm that the company had referred her account to Simm.

Flora has since hired a lawyer to challenge Simm and Sallie Mae. She said it’ll probably cost her hundreds of dollars, if not more.

“We don’t have the money to pay off Sam’s loans,” Roy Cooper said. “If we tried, we’d lose everything.”

Threats, Tears

Cathryn Keller, 25, of Charleston, South Carolina, had a similar experience. The veterinary technician’s grandfather, Alan Capenhurst, had co-signed some of her student loans. He died in February 2012 at the age of 82.

About four months later, Keller’s mother mailed a copy of the death certificate to Sallie Mae and asked for Capenhurst to be removed as the co-signer. Keller had been repaying her loans since 2006. She paid off the accumulating interest while in school -- and had been late three times with her monthly payment, each by a week or less. Her last late payment was in 2010.

On Oct. 3 of last year, Keller’s grandmother received three letters from Simm Associates. The firm wanted her to pay $10,431.48 to extinguish her Sallie Mae loans. Simm employees told her it didn’t matter that she was current on her loans.

“They told me, ‘We're going to get you. We're going to get your grandfather’s assets. We’re going to go after your grandmother,’” Keller said. “I started to cry.”

During the next few weeks, Keller fought with family members, who accused her of not repaying her student loans and of causing her widowed grandmother unnecessary grief. Keller's grandmother often cried when describing Simm’s efforts to other family members.

Keller blitzed Sallie Mae with phone calls, and during one of them, she said, a customer service representative apologized to her for what she was going through, assured her that her accounts were in good standing, proclaimed her a responsible borrower whose payment history demonstrated she no longer needed a co-signer, and told her she was not alone in experiencing her Simm ordeal.

Keller shared that with Simm’s employees, who quickly told her that Sallie Mae’s employees didn’t know what they were talking about.

Then, almost as suddenly as Simm appeared, Simm said it would back off.

Keller, like Tom Cimochowski (whom HuffPost profiled last month), relied on Internet message boards filled with detailed information on Simm and Sallie Mae’s practices that were uploaded by Christopher Kibler, a 35-year-old New York lawyer whose mother, Regina, was told she had to pay nearly $22,000 or Simm would seize a part of her dead husband’s life insurance policy.

Kibler’s record of on-time payments to Sallie Mae stretched back to July 2011. His father, who had co-signed some of his loans, died in April 2012. His estate was officially settled and closed with the local probate court in July 2013. A month later, Simm demanded Regina Kibler pay off Christopher’s Sallie Mae loans.

Internet Activist

Christopher Kibler filed complaints with the federal consumer bureau and attorney generals in Delaware and Illinois. In response to his complaint with the CFPB, Sallie Mae said it would recall his loans from Simm Associates.

Kibler, who said what Simm and Sallie Mae put his mother through was “morally repugnant,” told other borrowers that in order to beat back Simm and Sallie Mae, they had to file complaints with government authorities.

Keller took Kibler’s advice. She researched Simm on the Internet, then filed complaints with the federal consumer bureau and New York attorney general. Simm responded to the complaints.

In an Oct. 31 letter, Charles Boarman, Simm’s general counsel, said that Sallie Mae referred Keller's accounts to Simm on Sept. 25. After Keller explained her situation to Simm, the debt collector shared her information with Sallie Mae.

“Sallie Mae has reversed its decision to place the account with Simm for collection and has recalled the accounts,” Boarman wrote in his letter. “Simm regrets any concern that its collection efforts caused to Ms. Keller or her family.”

“I’m still so mad about it,” Keller said. She said she wishes she could refinance her loans with another lender so she never again has to deal with Sallie Mae.

Like Keller and Flora, sisters Karen Saxe and Valerie Terray also requested to have their co-signer, their father, John Schulien, removed from their Sallie Mae private student loans after his death.

Saxe, a 31-year-old science teacher who lives in Washington, D.C., began repaying her Sallie Mae loans in early 2006. She’s never been late on a payment. She has authorized Sallie Mae to automatically withdraw the monthly payment amount from her checking account.

Terray, 33, of Alexandria, Virginia, also began repaying her Sallie Mae loans in 2006 and had never missed or been late on a payment. Like her sister, Terray had authorized Sallie Mae to automatically withdraw the monthly payment from her bank account.

Their father died in January 2010. But neither the sisters nor their mother, Janice, thought to remove his name from their Sallie Mae loans until they received letters from the lender informing them that its emails to his account were bouncing back.

On Oct. 4 of last year, Janice Schulien sent Sallie Mae a copy of her deceased husband’s death certificate, along with a note asking that his name be removed from her daughters’ accounts.

Six days later, she got three letters and a phone call from Simm demanding she pay $18,662.60 in order to prevent Simm and Sallie Mae from seizing her assets.

Schulien panicked. Saxe and Terray were terrified of what the companies could do to their mother. Their husbands were furious.

Complaints, Congress

Saxe, Terray and their two husbands scoured the Internet for information on debt collection, applicable laws and any details on Simm Associates. They repeatedly pleaded with Sallie Mae, but Sallie Mae wouldn’t help them. The same thing happened when they tried Simm.

On Oct. 25, the Terrays filed a complaint with the Consumer Financial Protection Bureau. On Nov. 13, Devin Hewitt, who works for Sallie Mae’s Office of the Customer Advocate, responded in a letter.

“I understand your frustration and I apologize for any distress this issue may have caused you,” Hewitt wrote. “Please understand that Simms & Associates will continue to attempt to collect on your cosigner’s estate even though your account may be current. While Simms & Associates completes this process your student loans will be serviced by Sallie Mae as normal. This means that you must still make your required monthly payment on or by the due date each month.”

In other words, it didn’t matter to Sallie Mae that Valerie Terray was current on her loans. Simm, which Sallie Mae referred to as Simms in its letter, would still try to collect on the debt from her mother. All the while, Terray still had to make her required monthly payments.

The two sisters didn’t think the consumer bureau was going to help them. On Nov. 18, they tried their mother’s representative in Congress, Rep. Brad Schneider (D-Ill.). Schneider’s office contacted Sallie Mae on their behalf.

Two months later, on Jan. 16 of this year, their caseworker in Schneider’s office emailed Terray’s husband, Alex. Sallie Mae had agreed to recall their loans from Simm.

Over the next few weeks, they continued to receive phone calls from Simm. Eventually, the calls stopped.

“I would not recommend anyone do business with Sallie Mae,” said Wayne Saxe, Karen’s husband. “The company’s business practice is to target the spouse of the deceased, and to pick on the weak and the poor.”

Both the Terrays and the Saxes said they were fortunate to have jobs that enabled them to dedicate hours to calling Sallie Mae and Simm and to research their situations.

“If we didn’t have that flexibility," Wayne Saxe said, "we would’ve been screwed in a very profound way."

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments