The attorneys general of Maryland and the District of Columbia filed a federal lawsuit against President Donald Trump on Monday, accusing him of violating provisions of the Constitution intended to protect against corruption and seeking to uncover the tax returns that the president has thus far been unwilling to release.

The suit focuses on the president’s continued ownership of his family’s business empire, control of which Trump said he handed over to his two adult sons. But far from the blind-trust standard adopted by past presidents, Trump continues to receive some information about the Trump organization, including profit reports, from his sons.

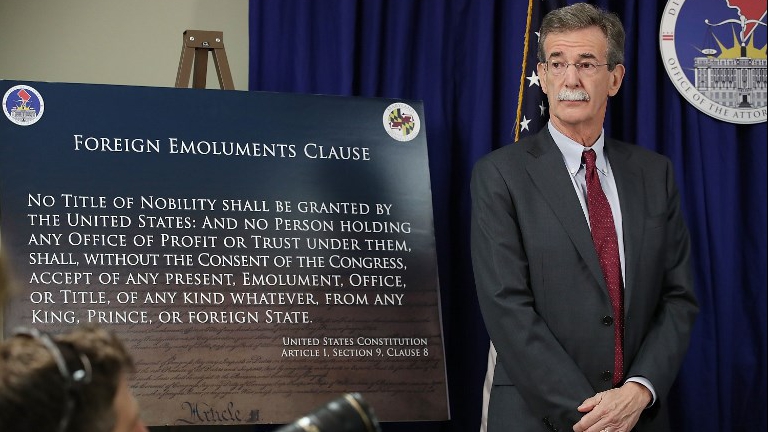

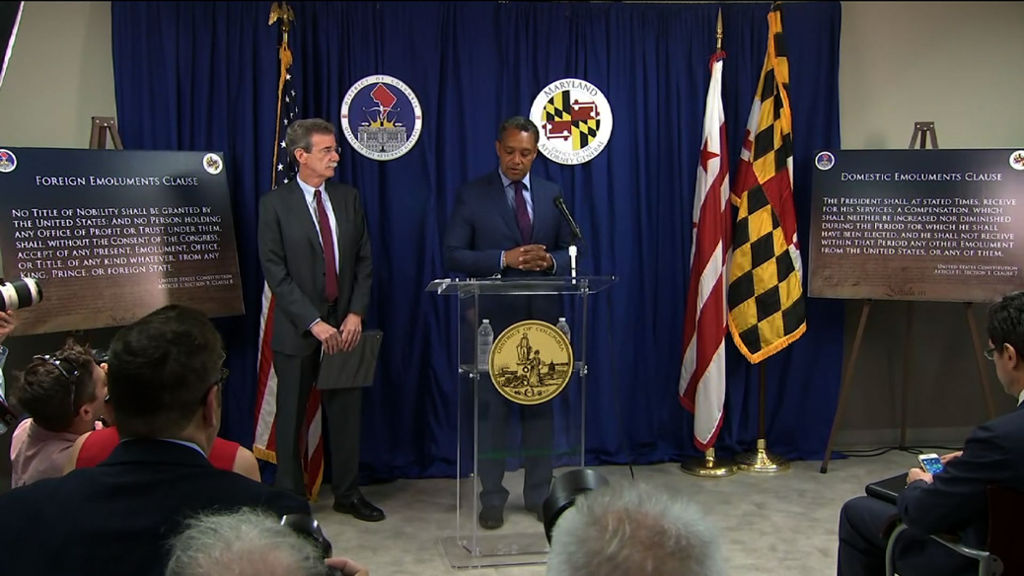

The lawsuit, brought by D.C. Attorney General Karl Racine and Maryland Attorney General Brian Frosh, both Democrats, was filed Monday morning in U.S. District Court in Greenbelt, Maryland.

The case focuses primarily on allegations that Trump’s business dealings violate the Constitution’s foreign emoluments clause, which prohibits payments to U.S. officials from foreign government sources.

“The suit alleges that President Trump is flagrantly violating the Constitution,” Racine said at a news conference in Washington on Monday afternoon. “Never in the history of this country have we had a president with these kinds of extensive business entanglements.”

In February, Maryland's General Assembly gave Frosh the authority to sue the federal government without the approval of Gov. Larry Hogan, a Republican, or the legislature, currently controlled by Democrats.

The president’s tax returns, which Trump has refused to release despite a decades-long tradition of presidential candidates releasing them, will be sought through the discovery process if the case is allowed to proceed, Frosh said.

“We will be seeking the president’s financial information, including his tax returns,” the Maryland official said.

The lawsuit accuses Trump, via his businesses, of being “deeply enmeshed with a legion of foreign and domestic government actors.” His continued ownership of the Trump organizations constitutes “unprecedented constitutional violations,” the complaint says.

Even if the attorneys general were to get access to Trump’s tax returns, it’s unlikely the documents would be made public through this suit, since such records are typically subject to confidentiality restrictions imposed by the courts.

The suit invokes several anti-corruption provisions in the Constitution, including the foreign emoluments clause and another part banning presidents from supplementing their salaries with other payments from the U.S. government or state governments.

At a news conference in January before his inauguration, the president and his legal team announced that the Trump Organization would donate money earned at its hotels from foreign governments to the U.S. Treasury. But last March, the Trump Organization announced that it would not begin making those donations until 2018, an announcement that was followed in May by another one in which the organization declared that it will be “impractical” to single out foreign guests in order to transfer their payments to the Treasury.

The new suit has been assigned to Judge Peter Messitte, an appointee of President Bill Clinton.

Lawyers from Citizens for Responsibility and Ethics in Washington, a nonprofit watchdog group that goes by the acronym CREW, will act as outside counsel to the two attorneys general in their lawsuit against the president. In addition to its work with Racine and Frosh, CREW has brought its own lawsuit to bear against Trump over alleged constitutional conflicts, a case that the Justice Department moved late last week that the courts should throw out.

Plans for the suit were first reported by the The Washington Post.

Originally published by Politico

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments