One of the major conflicts of the era that is not often highlighted for public debate is whether we want an economy that privatizes government services and public resources and continues to concentrate wealth; or whether we want to develop an economic democracy that invests in the public interest and creates shared prosperity.

Journalist Ted Koppel summarized the privatization trend: “We are privatizing ourselves into one disaster after another…. We’ve privatized a lot of what our military is doing. We’ve privatized a lot of what our intelligence agencies are doing. We’ve privatized our very prison system in many parts of the country. We’re privatizing the health system within those prisons. And it’s not working well.”

The alternative, also growing rapidly albeit more quietly without corporate media coverage, is economic democracy. This is based on new models that give people greater control over their economic lives, share wealth in an egalitarian way and allow people to have more influence over the direction of the economy.

Privatization vs. Public Ownership

Privatization versus public ownership of services and resources is one aspect of this debate, but there are also a host of other issues that beg discussion. We will delve into many of these in detail in the Economic Democracy Conference of the Democracy Convention in Madison, WI from August 7 to August 11. Presenters who are deeply involved in their subjects will speak about big picture topics such as what money is, ending debt and creating a new economy to more hands-on topics such as creating socially-responsible businesses, alternative currencies, affordable housing, public banks, saving the post office, local investment, cooperatives and publicly-owned renewable energy.

The United States is moving on an aggressive, disastrous path of privatization of government services. Some recent examples include the Air Force considering the privatization of Cape Canaveral, NOAA privatizing satellite weather services and schools across the country privatizing education. Everything is on the table to be given over to private industry – airports, roads, health services and water.

Just think how capitalist profiteers’ mouths must be watering at these opportunities. The taxpayer spends hundreds of billions developing Cape Canaveral and space exploration or weather satellite technology, and then big business buys-in cheap and gets long-term profits.

The bamboozling of the American public from corporate-funded politicians speaking through the corporate mass media is hard to believe. At its root, privatization is about profit for a few at the expense of the many – the workers and people who need the services. How do they sell this scheme to the public?

One key is self-created money scarcity – which should not even be an issue. We say that money scarcity should not be an issue because Modern Monetary Theory (MMT) demonstrates that government has the power to create money. This video interview of economist Warren Mosler describes MMT and how countries do not ever face a risk of being unable to pay their debts but can use money in a functional way to meet the economic needs of their country. Money scarcity is a driving force, as a chairman of a major finance company said at a privatization conference, “Desperate government is our best customer. There will be a lot of desperate governments out there.”

An example of how scarce resources are pushing toward privatization is this health clinic in Chicago. The clinic lost federal funding of a grant that paid for free mammograms for Chicago women. To replace the funding they are seeking to privatize the clinic. Will privatized clinics that seek profit provide these free services? Another is the selling off of post offices across the country.

How do profiteers make money from providing government services? Some keys are job reduction, lower wages and fewer benefits for workers. These are consistently part of privatization, so the process further concentrates wealth at the top and weakens the middle class. In Louisiana where four LSU hospitals were privatized, thousands of good paying middle class jobs were lost. Hundreds lost their jobs permanently and those rehired were paid less with reduced benefits. While an examination of health services has not been reported on yet, profiteering often requires cutting costs that result in lower access to services.

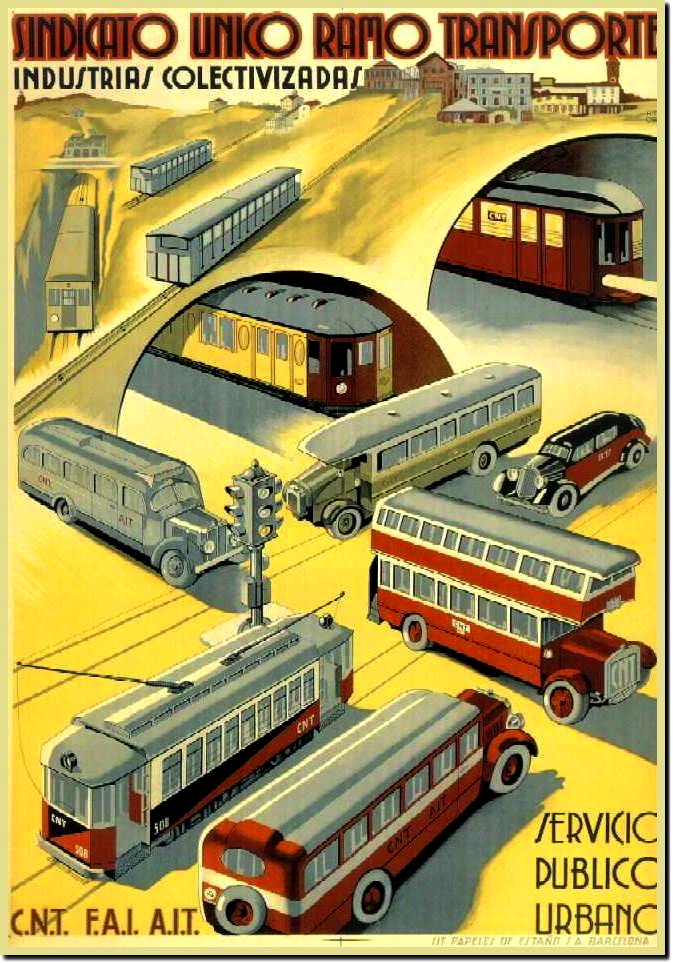

For these reasons, unions should fight privatization wherever they see it. In Washington, D.C. the union that represents transit workers is fighting plans to privatize bus service in the nation’s capital. The contract, which includes a new trolley system in DC, would cost $1.5 billion over 30 years. The union warns it would result in 200 bus drivers losing their jobs and less bus routes for passengers. He summarized the reality of privatization of public services:

“We must keep public transportation public,” said Local 689 President Jackie Jeter. “When you start privatizing routes, you lose your say. This is about giving the public their say.”

In fact, as has been seen in the growth of private prisons, governments need to be wary. Cut backs on food and services have led to prison riots in some states. As an editorial in the Toledo Blade noted “Audits in several states, including Ohio, have found that the vendor, the Philadelphia-based catering giant Aramark, has charged for meals not served, changed recipes to use cheaper ingredients, and skimped on portions. A 2001 audit by then-Ohio Auditor Jim Petro found that the state’s prison system paid Aramark for serving nearly 4.5 million meals, instead of the 2.8 million meals it actually delivered, adding more than $2 million to contract costs. On-site visits also found inexcusable sanitation conditions, a lack of training, and “a near riot” at breakfast over Aramark’s strict adherence to portion sizes.” When profit is the goal – workers and services will be reduced to increase profit.

Underfunding of the transportation system is one area that is providing great opportunities for privateers. For years the American Society of Civil Engineers has been warning that the U.S. infrastructure is crumbling. As Business Week warned in 2007 “[i]nfrastructure is ultra-low-risk because competition is limited by a host of forces that make it difficult to build, say, a rival toll road. With captive customers, the cash flows are virtually guaranteed.” Who is going to build a rival road? Where will the commuters go when tolls rise?

When transportation is privatized, corporations control the transportation infrastructure which is a life blood of the economy. Control is ceded to private equity firms, out-of-state investment banks, global construction companies and the shareholders of these corporations. The big Wall Street banks – Goldman Sachs, JPMorgan and Citigroup – are major players in roads for profit schemes. Profit becomes the overriding concern, not the needs of the public.

One important example in the news this week was the potential bankruptcy in Detroit. Many cities face cash shortfalls as cities have been underfunded for decades by state and federal governments and have very little ability to raise money. In Detroit, the mayor has been replaced by an unelected city manager, Kevyn Orr, and the governor announced the bankruptcy of the city. Many see this as an opportunity for profiteers to buy city property at desperate-sale prices (prices, set by an unelected city manager) – a feeding frenzy for privatizers.

Labor unions, city workers and workers’ pensions will be hit hard. Frank Hammer, a labor organizer in Detroit tells Real News:

“There have been a lot of conversations under the emergency manager, and certainly now under bankruptcy, about all the city assets that can be put up in a fire sale to help the city, supposedly to help the city pay off their debts. So they’re talking about, for example, selling what’s a very cherished public park in the middle of the Detroit River called the Belle Isle. They’re talking about selling that. They’re talking about selling the art collection that’s housed in the Detroit Institute of Art, which is apparently worth millions, and so that they’re going to just have a feeding frenzy privatizing what previously were understood to be public assets.”

Michigan radio reports that everything is on the table, water, sewage treatment, art work, parks – the privatizing profiteers are waiting to see what Orr offers.

Robert Reich points to Detroit as an example of the bankruptcy of America’s social contract. Racial and economic divides have resulted in many urban areas losing their financial base as wealthy whites moved to the suburbs. While Detroit is one of the poorest areas of the country, the Detroit Metro area “is among the nation’s top five financial centers, the top four centers of high-technology employment, and the second-biggest source of engineering and architectural talent.”

In Birmingham, Michigan, just across the border from Detroit, $94,000 was the median income last year; and in nearby Bloomfield Hills the median was more than $150,000. In Detroit, 1 out of 3 residents are in poverty, and the median income is $26,000. Writers from New Economic Perspectives point out that the real solution to all the Detroits in the country is for the government to serve as employer of last resort and create a full employment economy.

If government policy treated the Detroit region as all one, there would be no bankruptcy and there would be enough resources to allow the area to take care of itself. To Reich it is like big banks selling off their bad assets and writing off the loss. The difference, of course, is that when you talk about a city you are talking about people – hundreds of thousands of people. Detroit exemplifies the wealth divide in America, and the destruction of the social contract that included social services, decent jobs and a more fair economy.

Some Corporate Functions Should Be Made Public ServicesIn fact, if the goal of the United States was a stronger economy for all, better services and a fair economy, we would be discussing turning some private functions into public services, accountable to the voters. For example, The Roosevelt Institute reported this week that the United States ranks poorly in Internet services. In the US, the internet is more costly and slower than the rest of the developed world. Why? Because government has allowed the Internet to be controlled by a series of monopolies like Verizon, Comcast, Time-Warner and AT&T that do not compete with each other. This allows Internet providers to charge whatever they want and provide whatever services they like. Of course, the corporate media is putting out a different message as revealed by two-New York Times OpEds cited in the report by corporate interests that were published in one week.

Roosevelt points out that while Europe and Asia are upgrading, the U.S. has no plans to do so. Right now, “the U.S. is behind South Korea, the UAE, Hong Kong, Japan, Taiwan, Latvia, Lithuania, Norway, Sweden, Slovakia, Bulgaria, Portugal, Iceland, Denmark, Estonia, Finland, and Norway. Very few Americans have the option to buy fiber to the home connections at reasonable prices.”

Shouldn’t communication, like transportation, be a government service? It is essential infrastructure for the economy and if it were run as a public service that put the needs of the people and the economy before profit for shareholders, we could create a plan to upgrade and expand Internet with lower costs.

This week showed us another area where privatization and inadequate regulation needs to be reconsidered – big Wall Street financial institutions. Many Americans see the big Wall Street banks as getting away with fraud, racketeering and money laundering and others go further and recognize the obscenities of capitalism. Bank profits are up in a big way – even though unemployment is stuck at high levels, wages are shrinking and more employees have part-time or temporary jobs. Why? For banks, there is no money scarcity. They have easy funding of low-interest money from the Federal Reserve; and they are protected if their investments go bad by the federal government (i.e. the taxpayers). For example, Simon Johnson reports that JPMorgan has $200 billion in equity but a balance sheet of $2.5 trillion (under U.S. accounting standards) and $4 trillion (under international standards).

This highlights a problem with Modern Monetary Theory as it applies to the U.S. – in the U.S., the Federal Reserve creates money and provides it to banks at low interest or banks create money through highly leveraged loans. Real MMT would have the government creating money and using it to fund projects that serve the public interest, e.g. infrastructure, teachers, nurses, social workers, mass transit and greening of the economy – not going into the balance sheets of banks and bonuses and big salaries of their executives.

More people are seeing that the Dodd-Frank financial reforms were insufficient and are calling for more. Economic writer William Grieder points out “When Barack Obama boasted that his administration had put an end to ‘too big to fail’ banks, it was probably the biggest fib of his presidency. The legislation known as Dodd-Frank did no such thing but its passage effectively closed the subject.”

But now he sees a new season of reform, pointing to a proposal by Democrat Elizabeth Warren, Republican John McCain and Independent Angus King for a 21st Century Glass-Steagall Act to separate risky investment finance from traditional banking. The proposal would require a five-year transition period for banks to downsize and undo their maze of risky connections to shadow banking.

That is not the only reform proposed. Democrat Sherrod Brown and Republican David Vitter seek to increase capital requirements on the biggest banks up to 15%. While their bill did not get a hearing, the Federal Reserve has increased requirements for the biggest 8 banks to 6%, up from the 3% agreed upon by international regulators, i.e. banks must have $6 to lend $100.

Others are talking about alternative regulations if Dodd-Frank fails, including greater regulation of derivatives, providing greater competition to risky investments through prominent offerings of safe investments, postal banks providing limited consumer financial products and re-making of the regulatory structure to create a single mega-regulator to prevent race-to-the-bottom regulations.

This week, a new scam of Goldman-Sachs was revealed, a scheme which raised aluminum prices costing consumers $5 billion over the last three years. Goldman bought an aluminum storage company three years ago, since then the average wait time at the storage facility has gone up more than 20-fold, from six weeks to 16 months, resulting in more revenues for storing the aluminum. This means everything that uses aluminum, including the cost of beer, has increased. This was caused by the government loosening regulation so that banks that invest in commodities can also own operations like delivery, storage and inventory.

During her final days in office, SEC Chair, Mary Schapiro approved a plan that would allow JPMorgan, Goldman Sachs and BlackRock, a large money management firm, to buy 80 percent of the copper available on the market on behalf of investors and hold it in warehouses. What do you think will be the impact on copper prices? The Fed can end all this if it declines to extend the exemptions that allowed Goldman and Morgan Stanley to make major investments in nonfinancial businesses, but pressure will be needed to make that happen.

Pressure Building From Below

That pressure is building. There are many positive signs. Occupy and its offshoots are taking action to both oppose policies that go against the public interest and to build new systems that protect people and the planet. The newest project is the Occupy Money card that can be used as a debit card without financing the big banks. Another is to stop the transnational corporate power grab, the Trans-Pacific Partnership, through www.FlushTheTPP.org.

People are taking action to solve the still problematic housing market. An investment fund, Boston Capital, is buying distressed houses and then selling them back to homeowners at a reduced cost of 40%. The city of Richmond, California is seizing underwater houses threatened with foreclosure through eminent domain and selling them back to homeowners at an affordable rate.

More broadly, this week Delaware, among the most pro-corporate states and the home of one million corporations, became the 19th state to enact laws permitting “Benefit Corporations.” These corporations allow companies to put people before profit. Their charter mission includes serving the public interest, not just making profit. Whether B corporations will be akin to “green washing” or real change toward public benefit remains to be seen.

Likewise, there are businesses that do take corporate social responsibility seriously, as Mohamed Yunus describes. He also states that “most of those companies don’t believe in CSR; they do it because it has become a cost of doing business. We can’t argue with good actions, no matter what motive drives them. But at heart such corporations are still the same soulless, profit-driven entities.” Time will tell whether CSR is beneficial overall or hides the harmful practices of some large corporations.

We do know that we are in a time of transition, an era that will define the next economy. The effects of the neo-liberal economic agenda of privatization simultaneous with de-funding of public assets and services are becoming more obvious. People are fighting back in a number of ways. And greater awareness of economic democracy and modern monetary theory is growing.

One thing is clear: it is going to take action from below to create an economy that puts people and the planet before profits.

Kevin Zeese, JD, and Margaret Flowers, MD, are participants in PopularResistance.org; they co-direct It’s Our Economy and co-host Clearing the FOG shown on UStream TV and heard on radio.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments