The year 2020 has caused many white people to realize we live in a racist system. The Green New Deal is about systemic change for all, and deconstructing racism must be front and central in this agenda.

Dodd-Frank reform

Follow:

-

An Invitation to Crisis: Loosening the Volcker Rule, Regulators Court Disaster

This is how financial crises begin – with subtle, incremental regulatory changes that few notice when they occur but which can have calamitous consequences when taken to their logical extreme.

-

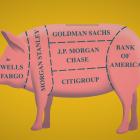

Why the Only Answer is to Break Up the Biggest Wall Street Banks

If the Fed's latest proposal to water down the Volcker Rule goes through, we’ll be nearly back to where we were before the crash of 2008.

-

Republicans Are Planning to Unravel Wall Street Reform

The deceivingly titled "Economic Growth, Regulatory Relief, and Consumer Protection Act" is a terrible bill that favors banks over people and allows the same risk in our financial system that the Dodd-Frank law eliminated.

-

No-Fault Crash: A New Book Explains How Financial Big-Wigs Skated after the Subprime Disaster

As Jesse Eisinger writes in his new book, the Justice Department “has lost the will and indeed the ability to go after highest-ranking corporate wrongdoers.”

-

You Can’t Be Serious: Debunking The Dangerous Arguments Against Dodd-Frank

Dodd-Frank, however imperfect, isn’t just about protecting average folks from reckless, predatory finance. It’s also about protecting Big Finance from itself.

-

Why Republicans Want to Kill the Consumer Financial Protection Bureau

The CFPB isn’t being targeted because it has failed. It has been targeted because it is succeeding – as of July it had returned $12 billion to more than 37 million victims of illegal banking practices. It must be defended at all costs.

-

Here's What Wall Street Reform Looks Like Under A President Sanders

Breaking up big banks, reinstating the Glass-Steagall Act, restructuring credit rating agencies, and holding bankers accountable for their crimes would begin to address some of the most relevant issues.

-

Fed's Kashkari, in first speech, suggests radical Wall St. overhaul

Neel Kashkari, the Fed's newest policymaker and a former Goldman Sachs exec who helped manage the government's rescue of the financial industry, called on lawmakers this week to take radical action to rein in banks and protect taxpayers.

-

A Law Abused: Why Dodd-Frank Is Killing Off Community Banks

The legislation was supposed to end "too big to fail" and promote financial stability, but Dodd-Frank’s “orderly liquidation authority” has replaced bailouts with bail-ins and threatens the existence of banks with assets under $1 billion.

-

Two Big Reasons Hillary Clinton Isn’t Taking Elizabeth Warren’s Revolving-Door Dare

Cozy with Wall Street, Hillary hasn't endorsed the Financial Services Conflict of Interest Act prohibiting government officials from accepting “golden parachutes” from their former employers for entering public service.