It’s starting to happen, as teachers around the country are fighting back against income and wealth inequality. At least 3 of every 4 Americans have been cheated out of a share of U.S. productivity since the 1980s. The approximately one of four Americans who have prospered, especially those in the top 5%, generally don’t seem to care much about inequality, and instead hang onto delusions about their own self-worth and the struggles of people who “don’t work hard enough.”

From various trusted sources come maddening facts about the relentlessly expanding wealth divide. Inequality is a perversion of human conduct, as most of society’s new benefits have derived from automation, and thus from decades of public input, taxpayer funding, and government research. But the beneficiaries are those who are well-connected to the corporate and financial processes exploiting that growth, mainly through stock ownership.

The rest of America has been left behind, but their voices are getting louder.

1. In Just the Last 3 Years, the Richest 5% Gained an Average of $800,000 While the Poorest 50% Lost Wealth

This information comes from the 2017 Global Wealth Databook. Incredibly, the richest 5% of Americans increased their average wealth from about $4 million to nearly $5 million since the end of 2014.

Meanwhile, the average household wealth of the poorest 50% actually went down by about $200. The middle class (50%-90%) increased their wealth by anywhere from $6,000 to $26,000 during that financially productive time.

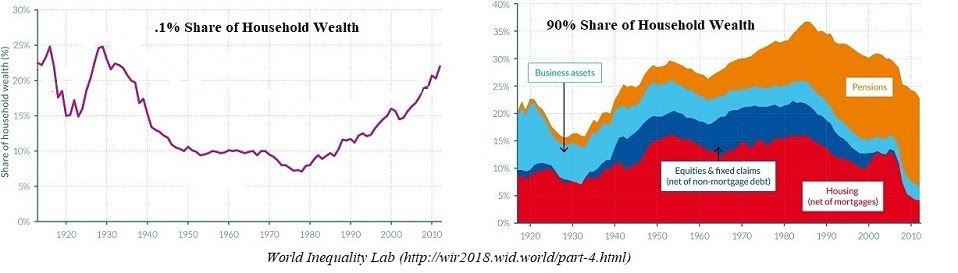

2. The Wealth Owned by 90% of Us in the 1980s Has Been Redistributed to the Richest .1%

The charts below from the World Inequality Lab reveal this terrible truth about the past 35 years:

-

The richest 125,000 households owned 7 percent of the wealth then 22 percent now.

-

The poorest 112,000,000 households owned 37 percent of the wealth then 23 percent now.

-

So nearly 15 percent of our nation’s total household wealth – $14 trillion – has been transfered from middle-class America to people with an average net worth of $75 million.

3. Businesses Cheat on Taxes Even More Than We Thought We Knew

It was recently reported by Sam Pizzigati that only 1 percent of wage-based income goes unreported on federal tax filings, while the percentage for self-reporting entities ranges from 16 percent for partnerships to a stunning 63 percent for nonfarm proprietors. The overall tax gap (difference between what’s owed and paid on time) is estimated to be close to a half-trillion dollars per year. That’s nearly half the entire safety net.

Yet even though every IRS auditing hour spent on large corporations uncovers over $9,000 of unreported taxes, our government has cut 18,000 staff positions in the past eight years.

While regressive sales taxes and state taxes and property taxes continue to hack away at the dwindling wealth of America’s 90%, and while our schools beg for funding for teachers and infrastructure, the biggest beneficiaries of our country’s prosperity are spending their money on tax avoidance strategies.

But they’re beginning to hear the voices of people who won’t take it anymore.