It is not just the cost of residential property in London that's reaching unsustainable levels. The city’s commercial real estate is now following a similarly erratic pattern of boom-bust-boom.

With a prominent bank tower being repeatedly bought and sold by wealthy international buyers, and London’s office buildings now surpassing the height of the property boom prices in 2007, London’s extreme commercial real estate price is representative of the outrageous levels of wealth and expenditures in the British capital.

HSBC's Headquarters

In 2007, the international bank HSBC sold its headquarters in London to a Spanish buyer. The sale was made at the pinnacle of the property boom and was the single largest transaction of real estate in British history.

When the boom swiftly evolved to bust, the 44-story tower went back on the market and was bought by a South Korean pension fund. But now the prominent glass-fronted building that still serves as HSBC’s headquarters is back on the market again – a potent reminder of London’s erratic property landscape.

According to the real estate data and analytics firm Real Capital, the cost of London’s commercial buildings have surpassed their 2007 high point by 10%, and are not adjusted for inflation.

Discussing the spasmodic fate of HSBC's London headquarters to The New York Times, Simon Mallinson, managing director of Real Capital Analytics, said: “[The tower] traded right at the top, and then again at the bottom and now it’s right back up at the top. The tower is reflective of where the city is.”

A Generation of Renters

As Occupy.com reported earlier this year, London’s record-high house prices – which are currently tearing ahead at an annual growth rate of 17% – is burgeoning the gap between the city’s rich and poor. A combination of unrealistic property prices, extortionate rent and new restrictions on housing benefits has made living in London impossible for those on low or even average incomes.

A report compiled by the British Property Federation, which looked at who bought the 21,300 new homes built in London in 2013, revealed a staggering 61% were bought by investors. Now, many fear that as London’s homes become safe havens for people to get a good return on their money, the corresponding housing bubble will create a generation of Londoners stuck in rented accommodation.

However, as we see in the case of the HSBC tower being dragged off and on the market, the city's precariously high residential property prices are just part of the picture.

In 2013, commercial property amounting to £19 billion ($32 billion) was sold in London, compared to the previous record in 2007 of £17.9 billion ($30 billion), according to CBRE Global Research and Consulting. Neil Blake and executive at CBRE spoke of 2013 as a “storming year” and the “best they’ve ever had.”

Foreign Investors Flock to London

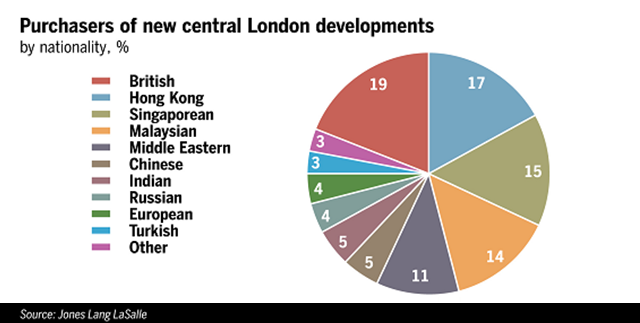

Now, with real estate rocketing more than ever before, foreign investors are crawling over the city. American investors in particular are keen to get a slice of London’s booming commercial property scene. For example, the U.S. investment company Blackstone, which bought London property during the economic downturn, recently sold its stake in two leading building groups and received lavish profits in return.

Oil wealth is having its impacts, too. In December of 2013, St. Martins Group, the real estate division of the Kuwaiti government, bought the London Mayor’s offices for approximately £1.7 billion ($2.9. The purchase was one of the largest commercial property transactions ever and added to Kuwait’s already vast pool of London real estate holdings.

Meanwhile, as foreign investors flock to London, the capital remains swathed in construction cranes as property developers work round the clock to keep up with the demand. So what does the city's ludicrous real estate market and preposterous levels of expenditure mean to the average Londoner?

John, who has been a London cabbie for eight years, has witnessed first-hand the capital’s changing property landscape. “A new building site seems to pop up every week at the moment – and it isn’t the likes of cabbies and bricklayers who are buying the buildings,” he told Occupy.com.

“They say the property boom helps the economy but whose economy? Certainly not mine or my mates,” John said.

Shops Closing Due to Unrealistic Rental Costs

And the impacts on average-sized businesses are being felt as well. On the one hand, glamorous, state-of-the-art buildings occupied by international banks are getting feverishly built, bought and sold. On the other, an increasing number of empty shops blight London’s high street. As a report by the London Assembly Economy Committee highlights, the number of empty shops in the city has risen to almost 3,400.

Not surprisingly, the prolific number of shop closures has been pinned to the astronomical rise in rent.

“High rents and other lease terms cause significant difficulties for high street businesses, and have contributed both to shop closures and to persistent vacancy,” writes the London Assembly Economy Committee.

Not only has the cost of renting commercial premises grown obscenely high, but many of the high street leases contain "upward-only" review clauses, meaning in effect that the cost of rent moves one way only – upwards.

All the while, Londoners struggling to get on the property ladder – and in many cases unable to afford even rented accommodation – are asking the existential question: Where is London’s future, and their future in it?

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments