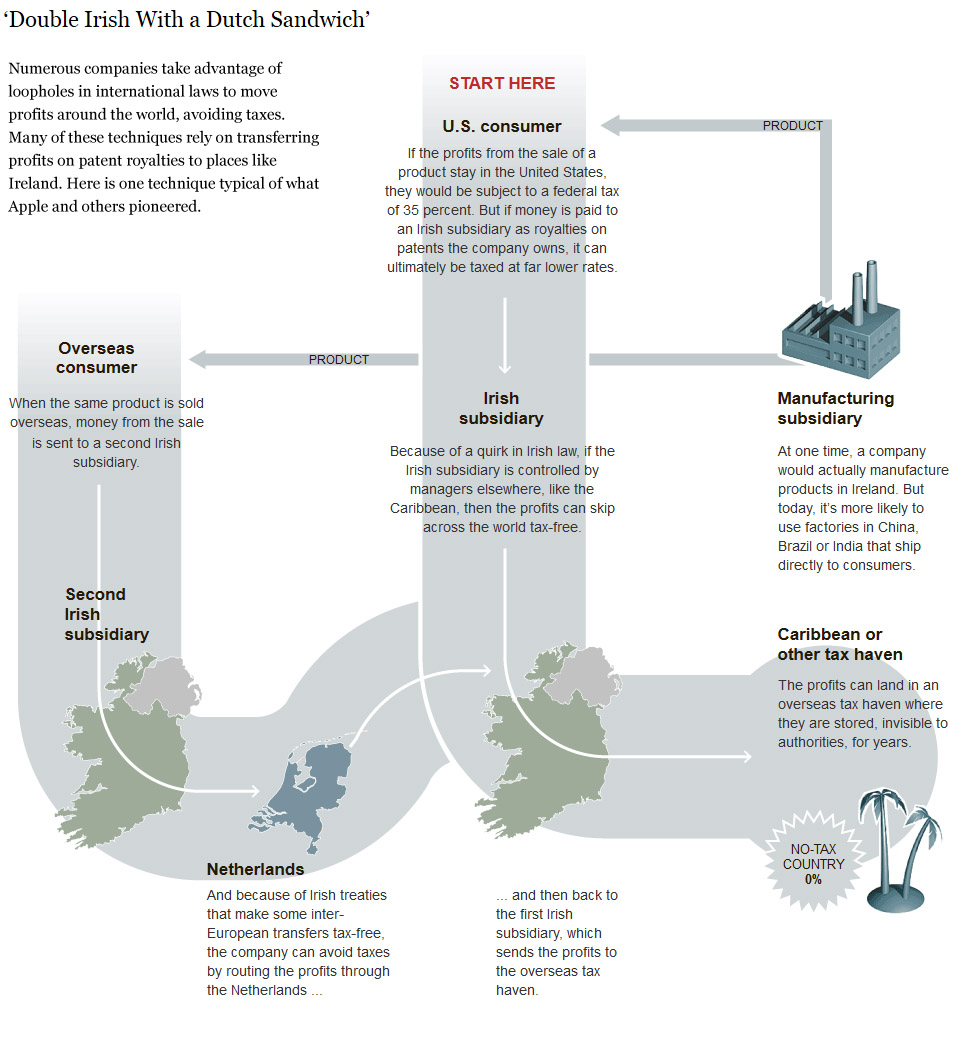

Senate investigators have found that Apple avoided paying taxes on "tens of billions" of dollars over the past four years by taking advantage of U.S. and Irish tax loopholes. In fact, Apple didn't pay taxes (to any country) on a whopping $74 billion over the past four years, after setting up a subsidiary in Ireland that controls its entire international operation.

According to the Wall Street Journal, "Irish tax law only considers companies residents of the small European country if they are managed and controlled there, and Apple manages them from the U.S."

Effectively, Apple paid no taxes on its international profits to anyone. And they didn't break any laws while doing it.

In a statement Monday, Apple said that it "welcomes an objective examination of the U.S. corporate tax system, which has not kept pace with the advent of the digital age and the rapidly changing global economy."

In other words, Apple welcomes your feeble attempts to try to get them to pay taxes.

Meanwhile, on Tuesday, Apple’s CEO Tim Cook came out firing during his Congressional grilling, declaring, “we pay all of the taxes we owe, every single dollar.” A blistering senate investigation accused Apple of shady tax dodging, helping it avoid $13.8 billion in taxes.

In his opening testimony, Cook affirmed Apple’s position that “we don’t rely on tax gimmicks” to avoid paying any taxes (for a review of how Apple stashes cash oversees, see our previous post).

Cook had supporters on the panel, especially Senators Clare McCaskill and Rand Paul, a known libertarian who favors dramatically lowering the corporate tax rate.

Paul wigged out on his fellow senators, accusing them of vilifying a great American company for fulfilling their responsibility to maximize shareholder value.

McCaskill admonished Paul for his accusations against his senate colleagues, but made sure to note that “I. Love. Apple…I harassed my husband until he converted to a MacBook.”

Cook, for his part, lobbied for a simpler U.S. tax code, which he said should be “revenue neutral, eliminate all corporate tax expenditures, a reasonable tax rate on moving foreign cash back to the U.S. We make this recommendation with eyes open, knowing it would probably raise our own tax payouts.”

Cook admitted his tax recommendation, “fully recognizing that this would result in an increase in Apple’s U.S. taxes.”

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments