Apple paid less than 2% tax on profit made outside the United States last year.

The iPhone and iPad maker paid $713 million in overseas corporation tax on foreign profits of $36.87 billion through the end of September. That translates as a tax rate of 1.9%, compared to a headline corporation tax rate of 35% in the U.S. and 24% in the U.K.

The details were revealed in Apple's 10K filing with the U.S. Securities and Exchange Commission (SEC). Apple has not broken any laws by arranging its tax payments this way, but it is likely to reignite debate about the astonishingly small amount of tax U.S. multinationals pay in the U.K.

Google, Amazon and Starbucks will be hauled before the Commons public accounts committee on Monday to explain why they pay so little tax to the exchequer.

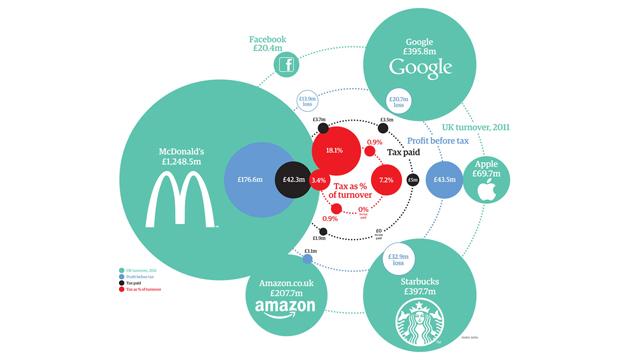

Analysis by the Guardian found that Google, Amazon, Starbucks and Facebook have paid just $48 million in tax over the past four years despite generating more than £4.8 billion in sales.

Margaret Hodge, who chairs the committee, said: "We want to ask them for an opportunity to explain why they don't pay proper levels of tax in the U.K."

Matt Brittin, the managing director of Google, has claimed to be too busy to attend the committee.

Prime Minister David Cameron has said he is "not happy with the current situation" of Apple, Google, Facebook, eBay and Starbucks avoiding nearly $1.43 billion in taxes.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments