As President Joe Biden prepares to fight for tax increases on the wealthy, in the UK the Conservative government has announced a controversial, manifesto-busting increase in National Insurance Contributions (NICs) – a form of social security payment that entitles people to certain state benefits.

The hike to this fundamental component of the welfare state will hit the lowest-paid the hardest.

Prime Minister Boris Johnson recently announced a £36 billion raid on workers’ incomes to fund the UK’s long-awaited and overdue reform on health and social care. In what will amount to the biggest tax hike in a generation, the new health and social care levy will see a 1.25 percent rise in NICs to fund the planned reforms.

The multi-billion-pound package, which will run over three years, will be used to help clear the national health service’s treatment backlog that was built up during the pandemic, and reform social care.

Manifesto breach

The announcement has been met with immense criticism, namely for its breach of Johnson’s manifesto pledge during the 2019 General Election campaign, which said, if elected, the Tories would not raise NICs, income tax or VAT.

Criticism has also been voiced that younger workers and families relying on welfare benefits will be hit the hardest by the increases to National Insurance, which will barely impact wealthy pensioners. The average 25-year-old worker today will have to pay an additional £12,600 over their working lives in extra NICs, while a pensioner relying on pensions for their income will pay no additional expense.

According to estimates from the Joseph Rowntree Foundation, two million families on low incomes will have to pay £100 more on NICs annually.

Since NICs are paid by both employers and employees, many have also warned that the measures may discourage companies from hiring workers on a permanent basis because of the higher NIC payments, thereby forcing employees into more precarious working conditions.

Universal Credit boost coming to an end

Little more than a week after dropping the tax hike bombshell, the Tory government announced another move that promises to be financially harmful to the poorest households.

In what has also been sold by the government as a vital “response” to the pandemic, Johnson announced that the £20-per-week boost to Universal Credit (UC) – the nation’s state welfare benefit to help those on low incomes and the unemployed – would come to an end in early October.

Universal Credit is claimed by more than 5.8 million people in England, Scotland and Wales. The £20-per-week uplift was introduced by the chancellor, Rishi Sunak, at the start of the pandemic. Reports show that by raising the basic element of UC by £20 a week has had a “huge impact on how people survived.”

Members of government have attempted to justify dropping the additional support for low-income and unemployed people, saying that as the economy opens up there needs to be a shift in focus toward getting people back to work. However, charities and economists are warning that a third of people on UC will end up in debt when the extra payment is removed.

Voicing similar warnings is the Health Foundation, which said that the cut could lead to poorer mental health and wellbeing for thousands of families.

Barely touching the deficit

At an economic level, financial experts warn that the Prime Minister’s plans to cut welfare benefits while raising taxes won’t make much of a dent in the deficit.

In response to Johnson’s speech in July 2021, when the PM outlined a plan to “level-up” the country, economists cautioned that the policies risked falling far short of what is required.

Thinking along these lines is Torsten Bell, chief executive of the Resolution Foundation think tank, who said: “It’s a matter of decades and trillions not years and billions.”

Others have said that the money raised through hiking NICs is nowhere near enough to fix the social care crisis that has resulted from decades of cuts to funding.

Between 2009 and 2016, for example, the number of people receiving publicly funded care fell by 400,000. The squeeze on local authority funding has resulted in councils resorting to a severe rationing of services to the elderly in need, with only the most extreme cases receiving help.

The shadow chancellor, Rachel Reeves, says the social health and social care levy won’t fix the crisis, and is not funded fairly.

“It is a broken promise, it is unfair, and it is a tax on jobs,” said Reeves.

For decades, the Conservative Party has positioned itself as a defender of low taxes. Going back on its position and breaking a key manifesto pledge that helped Johnson secure a landslide victory in the 2019 election could lose them support at the next election in 2024.

However, such a prospect doesn’t look especially likely given that the opposition, while decrying the unfairness of the new funding measures, has offered no real alternative to drum up the funds the NHS and social care urgently needs.

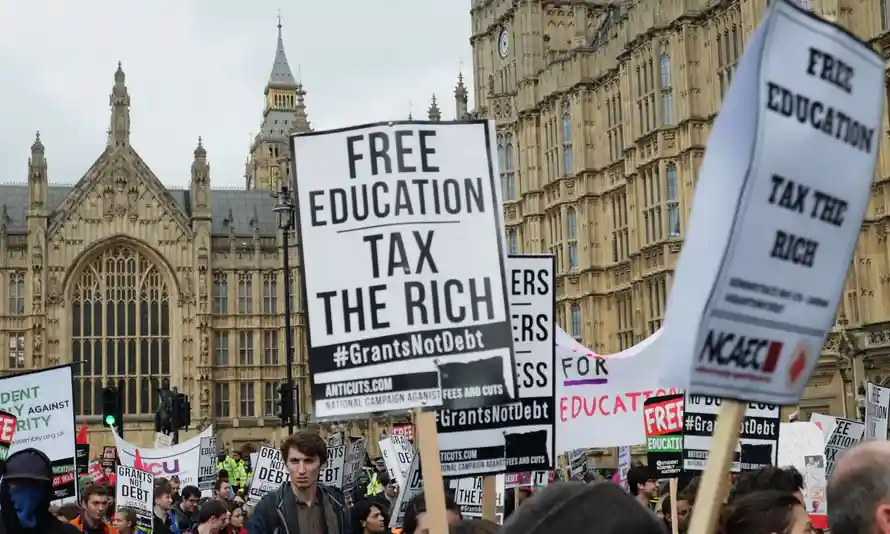

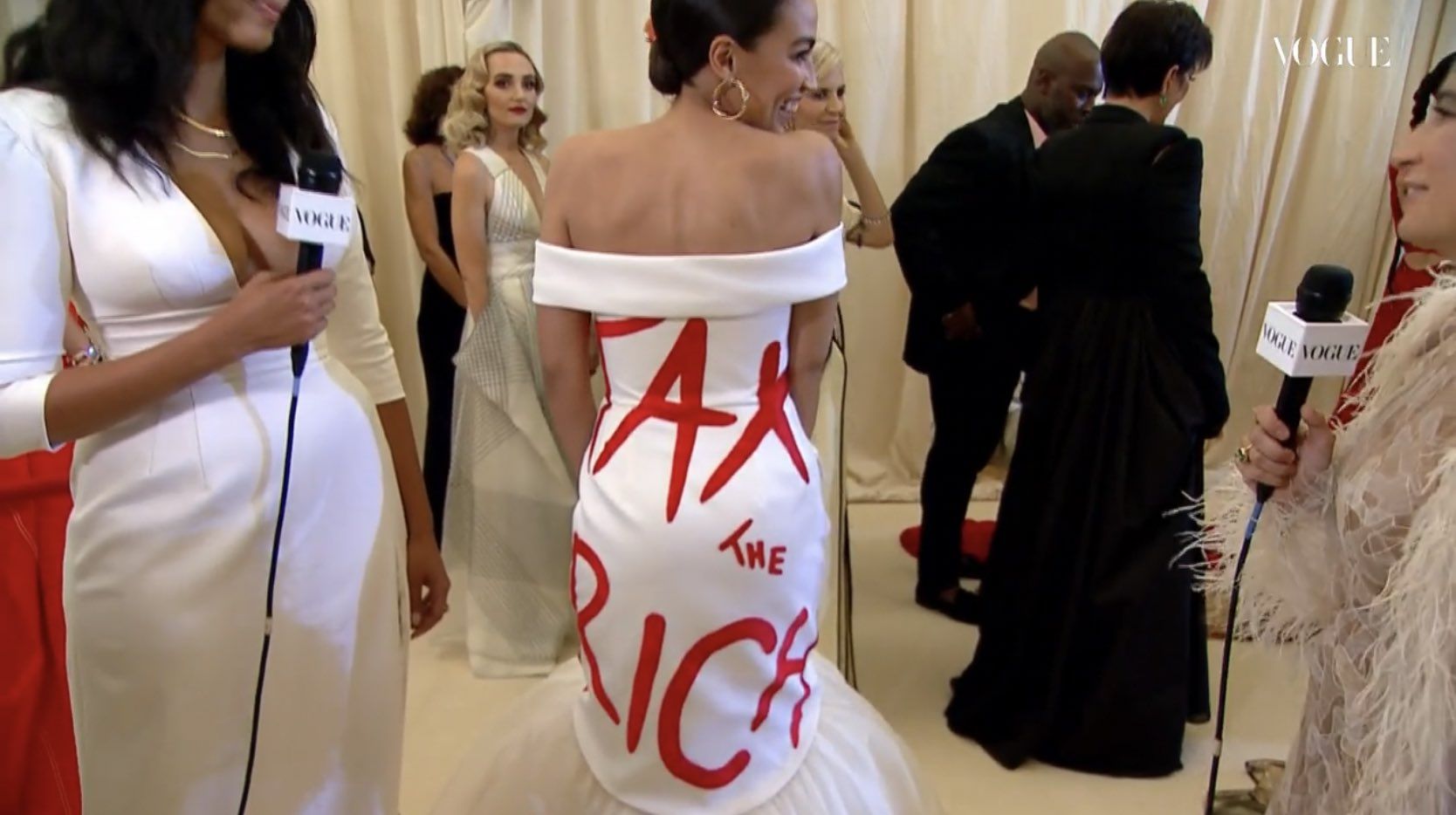

‘Tax wealth not work’

In response to the controversial increase to NICs, which will hammer the poorest sectors the hardest, there are growing calls for Labour to back a commitment to tax the rich as a way to provide a fairer system for funding reforms to health and social care.

Among the senior officials calling to tax the wealthy to pay for the reform is Andy Burnham, mayor of Greater Manchester, who recently asked: “How can it be right to ask ‘generation rent,’ already saddled with student debt, to pay for the care of a generation more likely to have generous pensions and to own their own homes?”

Burnham went on, “The fairest way of providing social care is on NHS terms through a national care service, and the fairest way of raising the funding to pay for it is by taxing wealth, not work. The government should be looking at reforming taxes and reliefs on assets, land, pensions, property and excessive earnings and profits before hitting younger, low-paid workers with the bill.”

The Trade Union Congress, a federation of unions in England and Wales, is making similar demands, saying increasing the Capital Gains Tax is a fairer way to fund social care. According to new research by the TUC, raising taxes on wealth and assets could help pay for a pay rise for 26,000 care workers in the East of England alone to at least £10 an hour.

US and Germany are fighting to raise wealth tax

Many who support taxing the wealthy point to the Democrats in the US and their plans to tax the rich. Democrats are attempting to push through a plan to pay for an extensive social policy and climate change package by raising taxes by more than $2 trillion, largely on profitable corporations and wealthy individuals.

Similar proposals are being put forward in Germany, where the finance minister, Olaf Scholz, a Social Democrat, has pledged to increase taxes on the wealthy to expand social programs if he is elected Chancellor in the forthcoming German federal election.

While the ultra-rich saw their fortunes soar in 2020, those on the lowest income brackets suffered the most financially. As policymakers look to replenish pandemic-depleted government coffers, the case for taxing the rich has never been so valid.

The US and Germany are among the nations showing a growing appetite for taxing the wealthy. Why can’t the UK join them?