The small Scandinavian country of Denmark has a global reputation when it comes to being at the forefront of renewable energy and green technologies. But the country's old-fashioned diesel trains, which are among the last of their kind in Northern Europe, have not been replaced for decades. Now, a plan to tax big carbon emitters threatens to do that, and more.

The Danish government recently announced a $5.2 billion investment to modernize the country's rail system and put new trains on the tracks to replace the old ones. The new trains will be high speed, electrically driven, and will pollute far less. It represent the biggest single investment in infrastructure in Denmark’s history and will reduce CO2 emissions significantly.

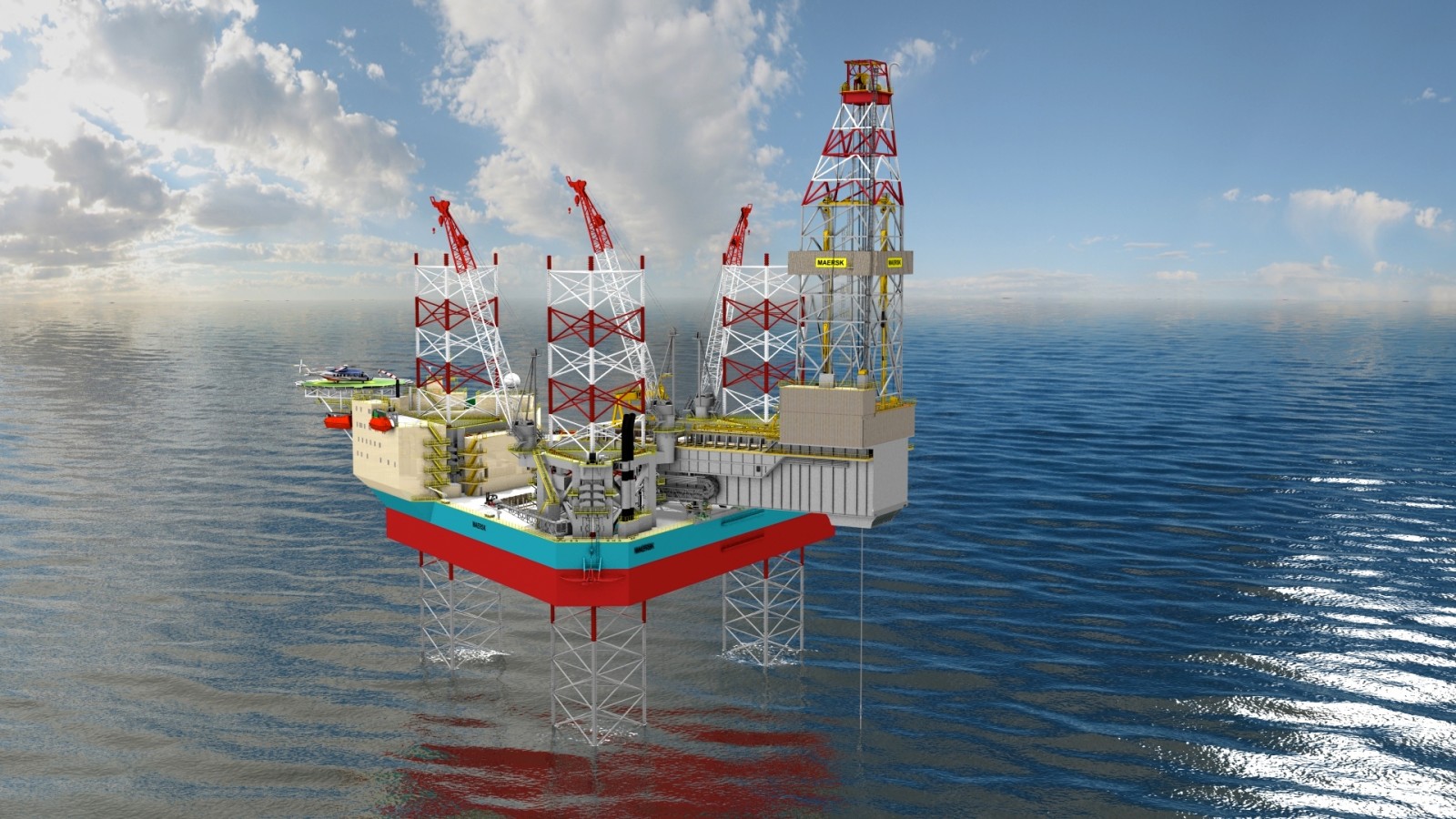

Funding for the project will come from restructuring the country's resource taxation system: by forcing 11 oil companies that drill in the seabed of Denmark's North Sea to pay a higher tax.

The area has brought billions into the pockets of oil corporations for decades. Today, the companies pay different tax percentages depending on their original terms of negotiation. With the new plan, they will all be taxed at the same level — around 61 percent — and it is to few people's surprise that the companies are protesting the increase.

Moving Investments Elsewhere

After the tax hike announcement, the German-owned company Bayerngas and the American-owned Hess threatened to pull out investments from Denmark. According to Arne Westeng, director of the Bayerngas Danish branch, the new tax is nothing short of unfair.

“It will unfortunately have the consequence that we can't count Denmark as a safe place to invest in. We therefore have to say, to all who ask us, that we have to advice them [against] investing in Denmark due to hostilities towards foreign companies and because of the big uncertainties about the framework of taxation in the country,” he said in a written statement.

Earlier, the company had been looking forward to a deal where it could subtract all taxes based on its investments. In that case, Denmark would not have seen any tax money based on the billions of dollars worth of oil drilled out at the earliest in 2018.

The Danish state may loose approximately $4.2 billion in tax revenues due to lost investments, and lost jobs that the investments would have created, added Westeng. Bayerngas has since announced it will be moving its future drilling investments to Norway and England.

No Loss for Denmark

Rebutting the oil industry line, Denmark's Climate Minister Martin Lidegaard say he does not think the Danish state will lose money by taxing oil companies higher. On the contrary, he believes that even if Bayerngas and Hess stop investing, others will take their place so long as there are still huge profits to be extracting oil.

It is in the interest of Denmark, Lidegaard said, to force the oil companies to pay to help fund the infrastructure they also benefit from by operating in the country -- including the establishment of a new and improved railway system and better trains.

“When we make the calculations, we look at how much oil there is out there, and how much that will be profitable to extract," Lidegaard said. "Our expectations are that there is oil, and that it will be profitable even with the new taxation to extract it -- no matter who does it.”

He added, "I am sorry if Bayerngas feels that we have treated them badly, but I am not afraid that Denmark will become an area that no one will invest in,” pointing out that Norway, where Bayerngas wants to move its investments, has a higher tax on oil extraction than Denmark.

Finally, said Lidegaard, it is in the interests of the Danish people to impose the tax. “It is a delicate balance. On the one side, we have to make sure it is attractive for the private companies to invest. On the other hand, we have to secure that Danes are getting the most out of it. It is their oil, after all.”

Many Benefit from Improved Infrastructure

From the point of view of the Danish population, the tax money will have a certain positive impact. Calculations from the country's Economic Council of Labor Movement show that the new infrastructure project will create around 20,000 new jobs, mainly in the construction of the railway system.

The new train network will be cheaper to run and much cleaner because the diesel trains will be taken out of service -- and because many more will be encouraged to take the train instead of going by car or plane, once there is a cost parity. Surveys show that once the time it takes to travel between major cities decreases, more people will choose trains in the future.

Earlier Tax Deals

One of the big stones in the shoe of Denmark's tax planners is the deal worked out by the former Danish government, in 2004, which gave an exclusive tax deal to Chevron, Shell and Maersk Oil. After negotiations, the former Minister of Economy and Commerce, Bendt Bendtsen, gave the companies a taxation rate 23 percent lower than the rate originally put forward by an expert committee. The committee was tasked with finding a level tax where companies would see a high profit, and the Danish state would receive a high yield as well.

Besides getting a lower oil tax, those companies were given contracts that ensured they would be compensated if any future government should raise taxes in the next 40 years. The clause made them practically immune to any change in taxation that the Danish government could choose to make. Economists estimate that the special tax deal and the immunity for those corporations cost Denmark as much as $23 billion in lost tax revenues.

Corruption Charges Against Former Minister

Speculations about the competence and political independence of the negotiator, Bendt Bendsten, were also raised after the 2004 deal was struck. Bendsten was later accused of corruption on several counts; he has admitted that he received expensive travel, expensive hunting and golf tours, tickets to expensive events and other lucrative gifts from big companies, including a Formula 1 race trip to Belgium paid for by Shell, one of the three companies that got the exclusive deal.

Bendtsen was cleared of corruption charges, but fined for tax avoidance based on the so-called gifts he received. According to Bendtsen, the only purpose of the trips and the tours was work. “I have had incredibly many meeting with people from the business world. It was my job as Minister of Commerce. I have met people from the business world in my office, over a lunch – and yes, also on the golf course and during hunts,” he said to the Danish newspaper BT.

Scandal aside, other oil companies are now protesting that they won't be seeing the same deal as Chevron, Shell and Maersk Oil. The German state of Bavaria, home to Bayerngas, has started pressuring the Danish government, as has the German embassy in Denmark, arguing that the new tax is unfair.

Special Deal for Hess

The American-owned company Hess, headquartered in New York City, is also rumored to have received special treatment. When other oil companies were ordered to pay the new tax of 61 percent, Hess was apparently given a choice to stay out of that deal and only pay 27 percent.

According to a source close to the negotiations, the special tax deal for Hess was offered for “political” reasons that have not yet been made public.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments