The decision by the French government to tax millionaires by 75% on earned income for people earning more than €1m a year in an attempt to lower government deficit is an unusual and much awaited measure. It should be imitated by governments such as the U.S. that have to confront similar problems but seem to be at a loss on the best way to do it.

The new measure is expected to affect only 2,000 taxpayers. However, a new 45% income tax on those earning more than €150,000 will also be implemented. The new austerity measures will also affect the middle class, since a third of the savings will come from cuts to public spending.

“Many problems are brewing in France,” said Nouriel Roubini, a New York University economist. He is particularly concerned about the effect that reduced government spending and efforts to balance the budget will have a negative impact on growth.

According to Roubini, “[French President François] Hollande was not elected by his base to pursue austerity and reforms, but rather to boost growth and hiring in the public sector.” Although he admits that his proposals are risky, Hollande seems confident that an austere 2013 budget will eventually lead to renewed growth down the road.

Roubini believes that the French economy is facing many problems, such as rising unemployment; policy decisions that are creating concern in the business community, such as the high tax on the wealthy; and relatively low government revenues which, together with economic contraction, will put further pressure on the deficit.

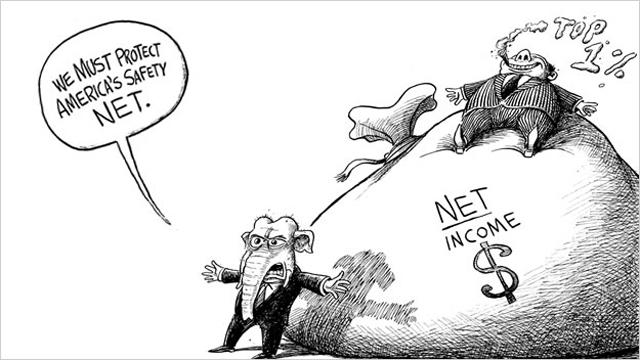

As the French increase the taxes on the wealthy to 75%, which would be unimaginable in the U.S., Republican leaders continue to insist on the need to cut taxes for the rich as a way of activating the economy and produce more jobs. However, a recent report from the Congressional Research Service (CRS) shows that cutting taxes on the wealthy doesn’t lead to either more jobs creation or faster economic growth. As the CRS stated,

“There is not conclusive evidence, however, to substantiate a clear relationship between the 65-year steady reduction in the top tax rates and economic growth. Analysis of such data suggests the reduction in the top tax rates have had little association with saving, investment, or productivity growth. However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution.”

The claim that taxes on the wealthy creates jobs is proven wrong when one considers that, thanks to the tax cuts on the richest members of society, banks, businesses and corporations are sitting on record amounts of cash. At the same time, Mitt Romney, one of the advocates of lower taxes for the richest, has plenty of his money in Swiss bank accounts and off-shore tax heavens including Bermuda and the Cayman Islands.

It has been argued that the wealthy do not create jobs by getting more money but rather it is consumers’ consumption the engine that creates jobs. The rich don’t need to buy the things that make the economy grow because they already have most of those things. It is clear that the more consumers there are the more economic activity there is.

Writing for the Congressional Research Service in Taxes and the Economy: An Economic Analysis of the Top Tax Rates Since 1945, Thomas L. Hungerford writes, “The share of income accruing to the top 0.1% of U.S. families increased from 4.2% in 1945 to 12.3% by 2007 before falling to 9.2% due to the 2007-2009 recession. The evidence doesn’t suggest necessarily a relationship between tax policy with regard to the top tax rates and the size of the economic pie, but there may be a relationship to how the economic pie is sliced.”

Unlike the French leaders, by advocating continuing less tax to the wealthy, Republican congressional leaders show that they are not interested in a more equitable slicing of the economic pie.

The French have given the world wonderful examples of their culture: how to make a good croissant, how to enjoy a wonderful cuisine and the beauty of fashion. Now they have added one more, perhaps the most important of all: How to tax a millionaire.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments