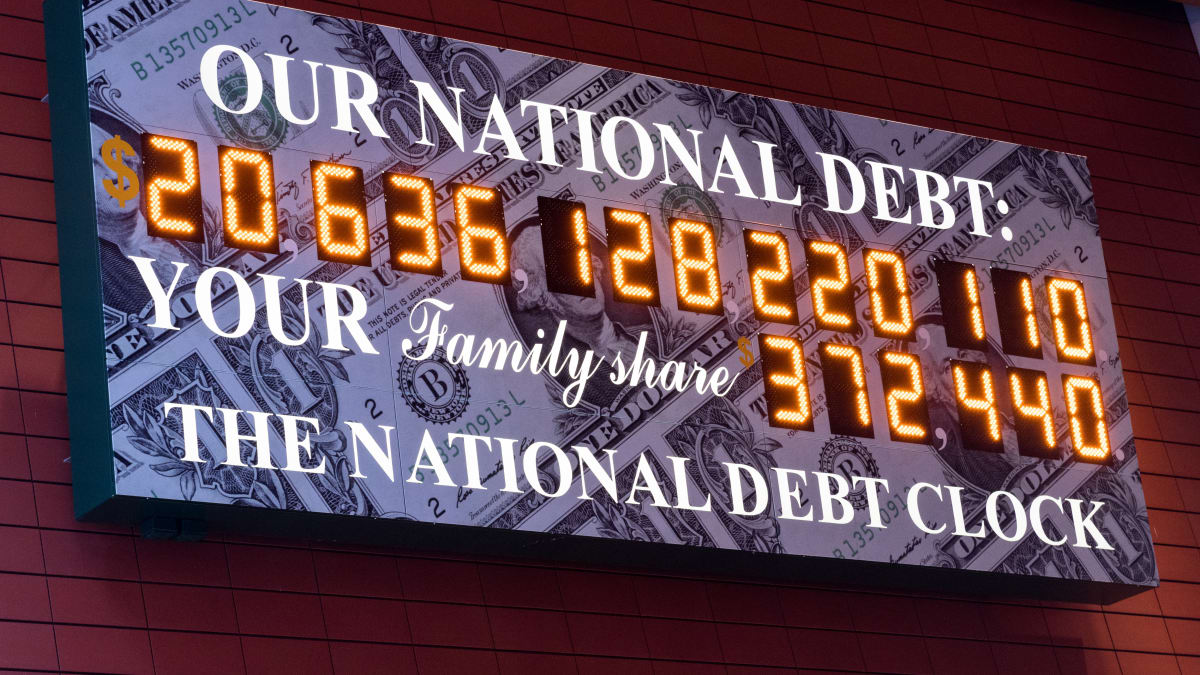

As pundits predicted, the new Republican majority in the US House of Representatives is already scaremongering about the national debt, likely in order to extract cuts to safety net programs like Medicare and Social Security. President Joe Biden is refusing to negotiate with House Republicans on raising the debt ceiling, insisting (correctly) that not doing so would endanger the global economy.

“We are very divided right now. We have $31 trillion of debt. The responsible thing to do would be to get with Republicans and negotiate a way [to raise the debt ceiling],” said Rep. Nancy Mace (R-South Carolina) in a recent appearance on NBC’s Meet the Press.

The clock is ticking until June, when Treasury Secretary Janet Yellen estimates the debt ceiling will need to be raised in order to avoid a default. Republicans insist that cuts to Medicare and Social Security must be agreed upon before they’ll agree to a debt ceiling increase – which Republican presidents have done without incident 49 times since 1960. To his credit, former President Donald Trump, who signed off on three debt ceiling increases without offsetting spending cuts, has joined Democrats’ calls to leave Medicare and Social Security alone.

“Under no circumstances should Republicans vote to cut a single penny from Medicare or Social Security,” Trump said in a video message.

It’s likely Trump realizes coming for Medicare and Social Security would be extraordinarily bad politics. In May of 2021, an AARP poll found that approximately 85% of respondents “strongly oppose” cuts to earned benefits programs as a solution to the deficit.

So if both Trump and Biden are in agreement on protecting Medicare and Social Security, how did things get to this point?

Medicare and Social Security don’t contribute to the deficit

The context of the debt ceiling negotiations that is almost always overlooked in major media discussions on the topic is the nature of the national debt, and the structural funding of Medicare and Social Security. The truth of both is inconvenient to the austerity narrative often propagated by both Fox News and CNN.

“We don’t have a tax revenue problem. It’s clear that we have a spending problem,” said Rep. Wesley Hunt (R-Texas) on the January 19 episode of Fox & Friends.

“We have these crazy deficits, crazy national debt, it’s $30 trillion right now… isn’t it time that Congress takes this seriously?” CNN host Jake Tapper said to Rep. Ro Khanna (D-California) on January 15.

But even if one were to want to tackle the deficit, going after Medicare and Social Security wouldn’t be the right approach. As Reuters explained, Social Security only pays out benefits through the Social Security trust fund, which is funded entirely by payroll taxes. Both employers and employees collectively contribute 12.4% to the trust fund, which will be fully funded through 2037. At that point, approximately 80% of benefits will still be paid.

The program’s opponents in both parties point out that 2037 is fast approaching and are pushing for cuts to benefits, though that’s also a false crisis: As Senator Joe Manchin (D-West Virginia) recently pointed out, the cap on paying into Social Security is just $160,200, meaning that even millionaires and billionaires only have to pay the 6.2% Social Security tax on earnings up to $160,200.

Manchin is far from the only lawmaker calling for the cap to be increased. Proposed legislation from Senators Bernie Sanders (I-Vermont) and Elizabeth Warren (D-Massachusetts) would raise the cap to $250,000. Another proposal would raise the cap to $400,000. And if the cap were removed entirely, a December 2021 report from the Congressional Research Service (PDF link) estimated that the program would be solvent for several more decades, if not indefinitely, depending on changes to the payroll tax rate.

Likewise, Medicare isn’t a deficit contributor. Just as both employers and employees contribute 6.2% toward Social Security, they also contribute a 1.45% Medicare tax from each paycheck to keep the program funded. And unlike Social Security, there’s no wage cap on paying into that fund.

The financial troubles attributed to Medicare are likely in regard to its Hospital Insurance program, which is projected to reach its limit in 2026. At that point, Medicare would still pay 89% of benefits. According to a 2019 report from the Center on Budget and Policy Priorities (CBPP), prolonging that program is as simple as raising revenue and slowing cost growth. One easy solution to protect Medicare is repealing the section of the 2017 Trump tax cut package that removed the penalty for not buying health insurance, which increased the number of uninsured patients, which increased the amount Medicare pays for uncompensated care. The CBPP also proposes reinstating the Independent Payment Advisory Board, which was projected to help slow the growth of increasing costs.

Medicare parts B and D, which address physician/outpatient health services and prescription drugs, respectively, each have a funding mechanism that keeps them both paid for in perpetuity. Beneficiary premiums, which make up 25% of funding for Medicare parts B and D, and general revenue contributions, which make up the remaining 75%, are set at levels to keep those programs permanently funded.

However, if House Republicans are truly concerned about the general revenue contributions to Medicare, there are several solutions the Center for Medicare Advocacy (CMA) has proposed to lower administrative costs. In August of 2017, the CMA laid out a comprehensive approach to bolstering the financial security of Medicare that involves a combination of letting Medicare negotiate prescription drug prices (which lowers what the government pays for medication), making payments into Medicare Advantage plans be closer in proximity to payments for traditional Medicare (preventing the government from further subsidizing private insurance companies), lowering – not raising – the eligibility age for Medicare (putting younger, healthier people in the risk pool, lowering costs across the board), and allowing the Affordable Care Act to truly do its job in eliminating waste and fraud within the Medicare system.

Given their record, it’s safe to assume House Republicans will not opt to eliminate the Social Security pay-in cap or allow Medicare to negotiate the cost of prescription drugs, as their feigned concern over both of those programs – just as their feigned concern over the national debt – is in bad faith. A long-held ideological goal of the Republican Party is to, as GOP strategist Grover Norquist once famously said, “reduce [the government] to the size where I can drag it into the bathroom and drown it in the bathtub.” Once you accept that Republicans are always going to undergo debt negotiations in bad faith, it becomes easier to understand the truth about the national debt: It doesn’t matter, and it can go unpaid forever.

The national debt doesn’t matter and it can go unpaid forever

In her New York Times bestselling book The Deficit Myth, author Stephanie Kelton – who was chief economist for the Senate Budget Committee Democrats at the time Senator Sanders was chairing it – explained that, unlike households, governments with the power to issue their own currency don’t need a balanced budget. Because the Constitution grants Congress the sole authority to “coin money,” the federal government doesn’t need to offset spending with taxes. When funding is appropriated by Congress, the Federal Reserve simply makes an electronic entry into the US Treasury’s ledger, which allows the US Treasury to spend.

Unlike household debt, government debt is different. Theoretically, the government could pay off the national debt tomorrow by minting a $31 trillion coin. However, federal debt as it is understood in global financial markets is simply US Treasury securities. As the St. Louis Fed wrote in December of 2020, US dollar-based bank deposits are only insured by the FDIC up to $250,000, meaning many institutional investors prefer to instead hold US Treasury securities. In The Deficit Myth, Kelton refers to Federal Reserve Notes (the paper in our wallets) as “green dollars” and US treasury securities as “yellow dollars,” which are basically just green dollars but with interest attached.

This means the national debt is essentially US treasury securities payable in legal tender. And as a currency issuer, the US government could simply print the money to pay any debt that gets called in. This makes US Treasury securities a safe, valuable, low-risk investment for banks, world governments, and other institutional investors in global markets. And it also means that involuntary default is essentially impossible, since the US government has sole control over the US money supply.

“Government debt is just the money the government spent into the economy and didn’t tax back. That’s all the national debt is. It’s a historical record of all of the times that they made a net deposit, spent more than they taxed out, and the bonds are the difference between those,” Kelton told Barron’s in 2018. “One of the greatest cons ever perpetrated on the American people is this notion that the national debt belongs to us, that we are responsible in our individual capacity for a share of it.”

As the St. Louis Fed wrote, our national debt is actually a good thing that can increase wealth around the world.

“While a household has a finite lifespan, a government has an indefinite planning horizon. So, while a household must eventually retire its debt, a government can, in principle, refinance (or roll over) its debt indefinitely…

“To the extent that the national debt is held domestically, it constitutes domestic private sector wealth. The extent to which it constitutes net wealth can be debated, but there’s not much doubt that at least some of it is viewed in this manner. The implication of this is that increasing the national debt makes individuals feel wealthier…

…[W]e might want to look at the national debt from a different perspective. In particular, it seems more accurate to view the national debt less as form of debt and more as a form of money in circulation.

Investors value the securities making up the national debt in the same way individuals value money—as a medium of exchange and a safe store of wealth. The idea of having to pay back money already in circulation makes little sense, in this context.

The St. Louis Fed points out that while debt itself is not a concern, the servicing of that debt is, in that the interest attached to US Treasury securities has a “carry cost.” This is where the raising of the debt ceiling comes in. It’s simply an accounting maneuver that the US undertakes in order to continue to service our debt, which continues to make US Treasury securities a prime investment in global financial markets. However, not doing so could damage the US’ credit rating, stir concern among the markets about the safety of US Treasury securities, make the US dollar less valuable, and raise interest rates even further, costing potentially millions of jobs and even possibly triggering another recession.

Getting Americans to understand the nature of government debt is tricky, and politicians often find it easier to simply misconstrue it as a bad thing that personally affects Americans’ finances. But Americans’ finances could indeed be personally affected if elected officials put our earned benefits on the chopping block all just to undertake a simple accounting maneuver.

Carl Gibson is a freelance journalist and columnist whose work has been published in CNN, the Guardian, The Washington Post, Barron’s, Business Insider, the Houston Chronicle, the Independent, and NPR, among others. Follow him on Mastodon @crgibs.mastodon.social.