We have all been shafted by overdraft fees from our bank at one time or another. It’s an annoyance and a frustration, especially for those of us who don’t have much money to begin with. It's also a constant puzzle: if one doesn’t have $5, how is that person going to pony up an extra $35 for the fee? Yet banks continue to charge fees and rake in money, making $35 billion on overdraft fees in 2014.

To get a better handle on the problem of overdrafts, we need to understand the history of such fees and reframe how we look at them – shifting our perspective to see overdraft costs as a sort of a loan, rather than a fee.

Evolution of the Overdraft Fee

After World War II, American society changed in many ways, including the way people borrowed money. Credit and how it was issued began to change, as pawning and open-book credit – in which goods are shipped with the recipient promising to make payments – declined in usage, and were replaced with other forms of loans such as payday loans, credit cards and overdraft protection.

But it wasn’t as if everyone had access to overdraft protection; rather, it was generally reserved for high-income customers who were experiencing short-term problems. Over time, more and more people gained access to overdraft protections, with “banks and credit unions [offering] ‘courtesy pay’ or overdraft features” starting in the mid-1990s, “so that consumers could overdraw their checking or debit accounts, for a fee.” What was important, at the time, was that people were accruing these fees on their own. However, this would change in the new millennium.

In 2003, The New York Times reported that around 1,000 banks were “encouraging customers with low balances to overdraw their checking accounts, allowing the banks to skirt credit laws and collect billions of dollars in new fees.” Banks were now actively encouraging people with little money to spend beyond their limit, then pay massive amounts in fees.

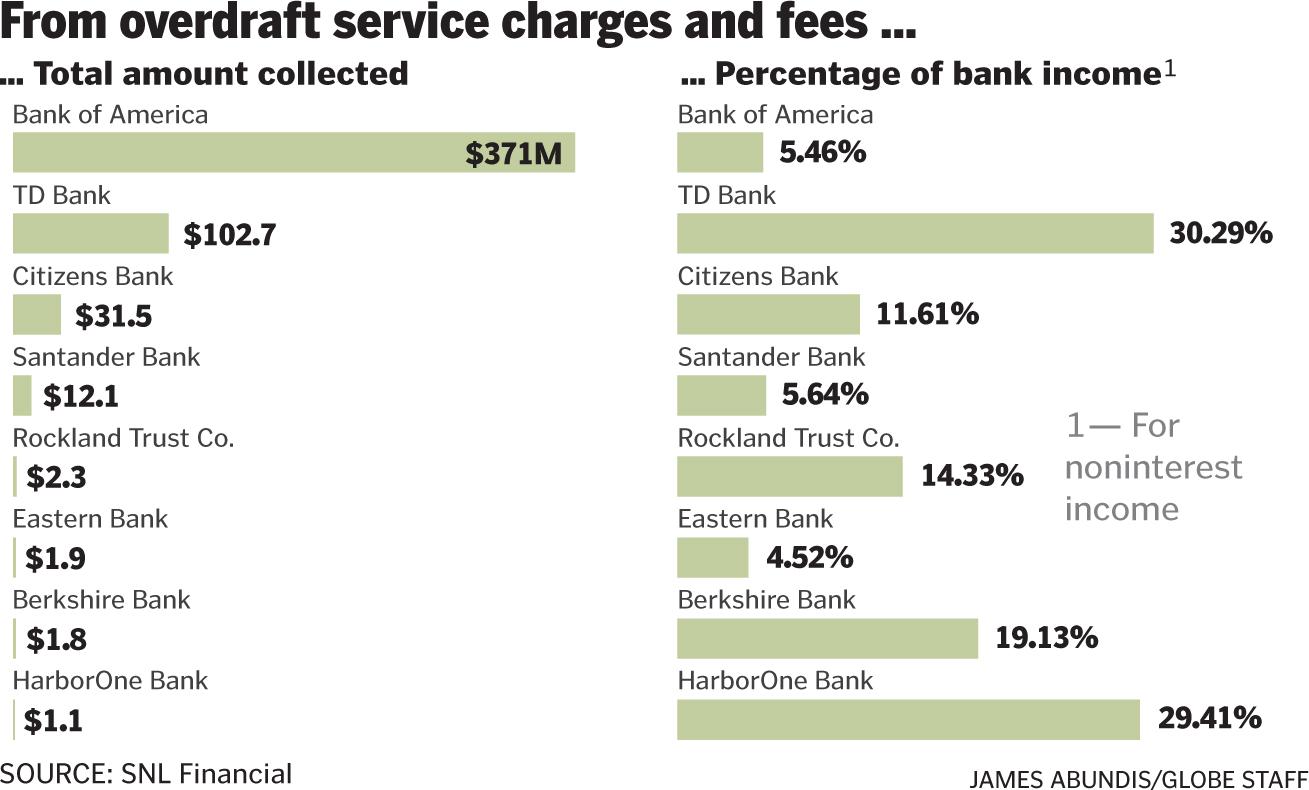

From the banks’ perspective, of course, this all made sense. As USA Today noted in 2005, overdraft fees “provide a more stable source of income to banks than products tied to fluctuating interest rates.” And according to a 2006 FDIC survey, “overdraft fees on average represent 6% of total net operating revenues of FDIC-insured banks.” However, only a small group of banks were making real money off of overdraft fees. Data from SNL Financial showed that during the first quarter of 2015, the country's three largest banks – JP Morgan Chase, Bank of America and Wells Fargo – “collectively generated $1.14 billion from overdraft fees and related service charges,” and those same banks were also the ones that collected the highest ATM fees. So, not only were some banks actively encouraging people to get overdraft fees – but they were making a killing in the process. And the field of players has only widened since.

Bank Swindles

There are a number of other problems with overdraft fees. For one, they are similar to payday loans and they perform like credit cards, but worse. A 2005 report from the Consumer Federation of America found that overdraft fees were like payday loans in one basic sense: people without enough money to make ends meet until the next payday were effectively given a cash advance by being able to overdraw their accounts, similar to using a credit card. Yet, with credit cards, banks aren’t allowed to take funds directly from a person’s account in order to pay off the debt. Not so for those who overdraw their accounts with a debit card, who “lack this protection. A bank can use the right of setoff when a customer creates an overdraft with a debit card to repay itself immediately when the customer deposits funds into the account.”

And of course, the repayment doesn’t just include the general costs, but also the overdraft fees that are applied to the account.

The report found that in many cases, banks allowed people to overdraw on purpose when customers paid in checks that resulted in overdrawn accounts, “knowingly permit[ting] consumers to electronically withdraw funds at the ATM or to make purchases at point of sale,” or “pay pre-authorized debits despite the lack of funds in the consumer’s account.” In addition, the banks didn't tell consumers about better, cheaper alternatives available to them.

For example, on its website, Citizens Bank’s overdraft protection language sells its credit or savings account transfer overdraft protection product as a service offering "convenience and peace of mind." On the other hand, Citizens Bank sent an addendum to its deposit disclosure in late 2004 describing the account’s "courtesy" overdraft provisions and informing consumers that overdrawing a check, ATM or debit card transaction would incur a fee of between $25 and $33 each, depending on the number of days the account remained overdrawn. This disclosure did not inform consumers that they could purchase optional savings account overdraft transfer coverage for $3 per month, or apply for an overdraft protection line of credit that cost $20 annually, both of which could be more affordable for consumers.

It seemed things might improve for consumers in 2010 when the rules regarding overdraft fees changed. Starting in July of that year, banks were “required to allow debit card customers to opt-in to overdraft fees rather than automatically enrolling card users in programs that charge $20 to $30 whenever there are insufficient funds to cover purchases.” This meant that if one didn’t have the necessary funds to complete a transaction, that person's debit cards would be declined at the register.

Unfortunately, banks found a way around this law: by engaging in bank fee manipulation, as revealed in August of that year when a federal judge ordered Wells Fargo “to pay California customers $203 million in restitution for claims that it had manipulated transactions to maximize the overdraft fees it charged.” Rather than dealing with each transaction in the order it was received, Wells Fargo put through the largest to smallest transactions, resulting in people paying increased overdraft fees. The next year, Bank of America paid out $410 million for the same reasons.

The bank fee manipulation continued in the years that followed, with Forbes reporting on the findings of a 2012 Consumer Financial Protection Bureau (CFPB) report that confirmed the activities were still ongoing. But according to many, the situation could still get much worse. The Center for Responsible Lending compiled a report July of 2013 that found that while the average banks were charging an overdraft fee of $35, some banks “also add a ‘sustained overdraft fee’ once the account has remained overdrawn for several days. At some banks, this is a one-time additional fee in the $35 range; at others, it is a fee in the $6-$8 range charged daily until the account balance is returned to positive.”

While some banks have put limits on these sustained fees, it “still [allows] for daily fees in the hundreds of dollars,” according to the report. In short, not only are people’s bank fees being manipulated so that they're forced to pay more money in overdraft fees – but unless they can come up with the money quickly, their debt grows.

Targeting the Neediest

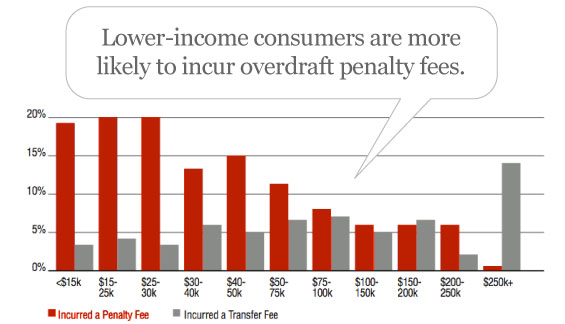

So who exactly suffers most from overdraft fees? In 2008, the FDIC found that “9 percent of checking account customers bear about 84 percent of overdraft fees.” That evidence pointed to overdraft fees disproportionately impacting low-income and young customers. A CFPB report in 2014 reinforced the fact, revealing that “8 percent of customers incur nearly 75 percent of all overdraft fees” and “10.7 percent of the 18-25 age group [have] more than 10 overdrafts per year.”

What effectively occurs with overdraft fees is that the poor subsidize the rich. The Economist reported that “according to the FDIC low income (people who earn less than $30,000) earners are nearly twice as likely to have paid an overdraft fee,” and it wasn’t uncommon for many of these low-income people to rack up fees to the point where they couldn't pay them all. When this occurs, banks close the indebted accounts, making it extremely difficult for people to open new accounts at other banks. This essentially shuts off whole parts of the population from formal banking, forcing them to turn to services like pre-paid cards, which “charge for all kinds of things checking account customers are used to getting for free: loading funds on to the card, point-of-sale purchases, talking to a customer service representative, cutting a check,” or check cashing, which “can incur an average of 3-5% of the check amount in fees, regardless of the nature of the check.”

The costs associated with either of these options easily surpass what it would have cost someone to maintain a regular checking account. So, what is to be done? For starters, find alternatives to overdraft fees by asking your bank about a linked line of credit or an affordable small-dollar loan. Though the best solution, naturally, would be to get rid of overdraft fees altogether, freeing millions of people from the worry of debt and its potential long-term effects.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments

Comments

Long replied on

Banks are practically rigging

Banks are practically rigging alot of things. One of the main-everyday thing they are rigging are transactions. That's how I got 3 overdraft fees overnight because they processed all the expensive shit I spent first to get me close to $0 as possible and then process the smaller ones to get the overdraft fees. I knew the order of how I spend money and even deposited some money that day too.