To compare The Billionaire's Apprentice: The Rise of the Indian-American Elite and the Fall of the Galleon Hedge Fund to Barbarians at the Gate might be a little premature, but just as the latter captured the spirit of unfettered greed in the 1980s, the former captures the resurgence of the same during the mid-1990s and beyond, coinciding with the technology boom that fueled unprecedented growth, and corruption, on Wall Street.

It is also not a coincidence that the key player in the Galleon scandal, its founder Raj Rajaratnam, began his career during the same era as Barbarians, when the demand for Indian-Americans adept at numbers and science boomed in response to the American economy's shift from manufacturing to information technology. While Billionaire only hints at it, it is pretty clear that the collision of the opportunity that the 1980s presented with a ruthless opportunist like Rajaratnam was almost sure to produce mayhem sometime in the future.

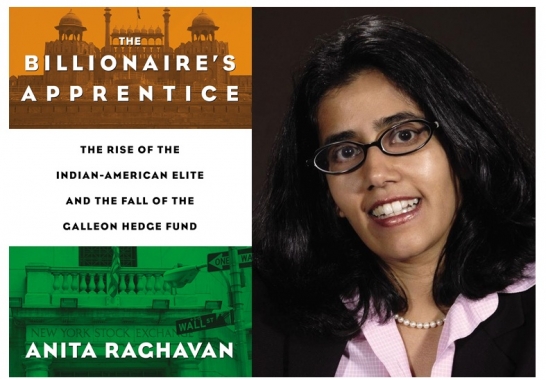

Therein lies the beauty of Anita Raghavan's tour-de-force book. Through meticulous research, copious history, vivid characters, and entertaining prose, Raghavan weaves together many different worlds, eras, and personality types to deliver a compelling view of the multicultural politics of today's Wall Street. Indian-Americans are not just the villains but the heroes of this saga as well, personified most directly by Rajaratnam and the former McKinsey consultant Anil Kumar on one side and SEC Assistant Regional Director of New York Sanjay Wadhwa and US Attorney for the Southern District of New York Preet Bharara on the other.

And straddling the murky area between these two extremes is the tragic Rajat Gupta, former head of McKinsey, board member of Goldman Sachs, Proctor & Gamble, American Airlines, and other blue-chip corporations, philanthropist, and arguably the most important role model for the Indian diaspora until his steep fall from grace. Gupta, of course, is the 'Apprentice' in the title and his character could not be more different (at least on the surface) than the master he winds up serving.

The book starts with Gupta's early life and introduces us to his father, who is a freedom fighter against the British Raj and whose experiences will impact his son's psyche, and eventually his destiny, half a century later. Raghavan shows the contrasts between Gupta and Rajaratnam expertly, while also using their stories as a vehicle to provide historical information on everything from McKinsey's role in starting the outsourcing trend in the US and the rise of the Indian Institutes of Technology, which would become crucial wellsprings of talent for American companies, to the dynamics of the hedge fund business and the inner workings of the SEC.Gupta is a highly cultured and polished man whose primary goal in life is the realization of social status. Rajaratnam, on the other hand, is a smart, brash, and greedy street fighter whose primary goal in life is the accumulation of wealth. He is also very similar to a mafia don (a parallel which Raghavan draws multiple times) in the way that he surrounds himself with an army of foot soldiers to do his dirty work and whom he first seduces, then entraps, and finally exploits. Gupta is a statesman whereas Rajaratnam is a robber baron. Gupta does not view his American experience through the lens of race while Rajaratnam has a serious chip on his shoulder about the color of his skin.

Yet it is precisely these differences that also highlight what the two men share - a hunger for more, and which brings them together. At first, as their respective careers evolve, it seems unlikely that their paths will ever cross meaningfully, but when they do, the two find in each other what they are themselves missing. For Rajaratnam it is the type of aristocratic profile and respect in the uppermost echelons of American society that he himself can never have despite his considerable fortune, and for Gupta it is the type of money that would make him untouchable and show others that he has finally 'arrived'.

As the investigation into Rajaratnam's systematic and pathological quest to secure inside information on companies that he can use to trade profitably on, unfolds, it becomes clear that his actions are not just the result of temporary arrogance but of a criminal mindset. One would think that a seasoned businessman like Gupta, who rubs shoulders with people like Bill Gates, would have the good sense to steer clear of someone like Rajaratnam, and certainly not enter into business with him, but he does. Gupta may be close to the top of the pyramid but in his mind he cannot reach the absolute top until he has what Rajaratnam does - an insane amount of money - and so the corruption begins.

The specific trades that finally bring down Galleon and Rajaratnam are many, including trades in AMD, Akamai, Hilton, Google, and most dramatically Goldman Sachs. It is this last that ties Gupta directly to insider trading since by the time that he gives Rajaratnam a tipoff on Warren Buffett's impending investment in Goldman, he is a substantial investor in one of Galleon's funds. Traipsing through this crazy circus are many others, including bankers, consultants, and industry executives whom Rajaratnam turns into informants for stock tips (and exchanges bizarre IMs with), Rengan, Rajaratnam's reckless and arrogant younger brother, whose hedge fund Sedna Capital first sets off alarm bells at the SEC and inadvertently puts Galleon in the spotlight, Preet Bharara, the up-and-coming US Attorney who catapults to fame on the back of the Rajaratnam conviction, and even Lloyd Blankfein, the CEO of Goldman, who abandons Gupta when the chips are down.

It is all fascinating and Raghavan, the former London Bureau Chief of Forbes, knows her stuff. While some of the detail and historical side-notes could have been left out without hurting the book, for the most part, Billionaire succeeds in making all of it engaging. The overarching theme of Gupta's corruption is developed slowly but builds to a very quick climax at the end, and includes a family secret that I will not give away. Suffice it to say that the secret circles back to the beginning of Gupta's life (which is also the beginning of the book) and raises his story to the level of Greek tragedy.

Finally, there are two questions which a book like this brings to the fore.

The first is why someone like Rajaratnam, who was worth $1.3 billion around the time of his illegal trades, broke the law for as little as $75 million in profits? Raghavan gives her answer by illustrating a pattern of unethical practices by the Galleon chief during his career, as well as an innate hubris bordering on sociopathy. If you combine this with his statements to Newsweek after his sentencing - in which he blames everyone but himself for his predicament, ranting against Indian cliques (he himself is Sri Lankan) and accusing the American justice system of racism - the picture becomes even clearer. Rajaratnam is a man living in a constant state of imagined persecution, which enables him to justify any action, however immoral or even unnecessary, to himself. The fact that he has been completely unrepentant further bolsters the likelihood of this diagnosis.

The second question which is asked is whether Rajaratnam's and Gupta's crimes will damage the stature of the Indian diaspora, and Indian-Americans in particular? Raghavan addresses this concern with a perfect quote from David Ben-Gurion:

"In order for Israel to be counted among the nations of the world, it has to have its own burglars and prostitutes."

As Indians permeate every aspect of American life from business to politics, and as more Indians rise to prominent positions in American society, it is inevitable that our community too will have its burglars and prostitutes. Indians as individuals are like everyone else, and some of us will rise to great heights, professionally and personally, while others will become victims to our own insecurities and weaknesses.

Moreover, let's not forget that for every Rajaratnam, there is a Bernie Madoff out there, and for every Galleon, there is an SAC Capital. The racial profile may change, but when it comes to money, the color that really matters is green.

In the meantime, Billionaire is a seminal work that captures the realities of race and greed in America with refreshing objectivity and efficiency, and a book that everyone should read.

Sanjay Sanghoee is a political and business commentator. He is a banker, has an MBA from Columbia Business School, and is the author of the thriller novel Killing Wall Street.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments