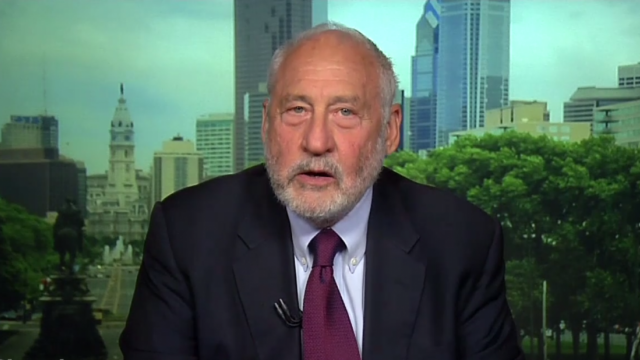

Nobel economist Joseph Stiglitz said U.S. tax law that allows Apple Inc. to hold a large amount of cash abroad is “obviously deficient” and called the company’s attribution of significant earnings to a comparatively small overseas unit a “fraud.”

“Our current tax system encourages companies to keep their money abroad, opens up a vast loophole through what is called the transfer-pricing system that allows them not only to keep their money abroad but, effectively, to escape taxation,” Stiglitz, who advises Hillary Clinton’s presidential campaign, said in a Bloomberg Television interview with Tom Keene.

Stiglitz was speaking in response to a question about whether policy makers like Clinton and Senator Elizabeth Warren, a Democrat from Massachusetts, could develop a plan to encourage companies like Apple to bring their accumulated foreign earnings back to the U.S. Under current law, companies can defer U.S. income tax on their foreign earnings until they repatriate them, or return them to the U.S.

About $215 billion of Apple’s total $232 billion in cash is held outside of the country, third-quarter earnings results showed this week.

Apple is making use of existing gaps in the U.S. tax system to shift its U.S. taxable earnings overseas to low-tax Ireland. Proposed U.S. Treasury regulations are aimed at curbing so-called earnings stripping, and European tax regulators are examining the company’s tax practices.

"Wrong" Incentives

“Here we have the largest corporation in capitalization not only in America, but in the world, bigger than GM was at its peak, and claiming that most of its profits originate from about a few hundred people working in Ireland -- that’s a fraud,” Stiglitz said. “A tax law that encourages American firms to keep jobs abroad is wrong, and I think we can get a consensus in America to get that changed.”

Apple has a corporate structure that allows it to transfer money to low-tax jurisdictions, and one of those is Ireland, where the corporate tax rate is 12.5 percent — far below the U.S. top statutory rate of 35 percent. The European Commission, the European Union’s executive arm, is probing whether Ireland violated the bloc’s state-aid rules by helping Apple lower its Irish tax liability.

Apple, which declined to comment on Stiglitz’s remarks, has firmly denied using any tax gimmicks, telling an E.U. tax panel in March that it had paid all of its taxes due in Ireland. Apple employs 5,500 people in Ireland, according to its website.

In Senate testimony in 2013, Apple Chief Executive Officer Tim Cook advocated a change to the corporate tax code which would “eliminate all corporate tax expenditures, lower corporate income-tax rates and implement a reasonable tax on foreign earnings that allows the free flow of capital back to the U.S.,” adding that such legislation would increase Apple’s U.S. taxes.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments