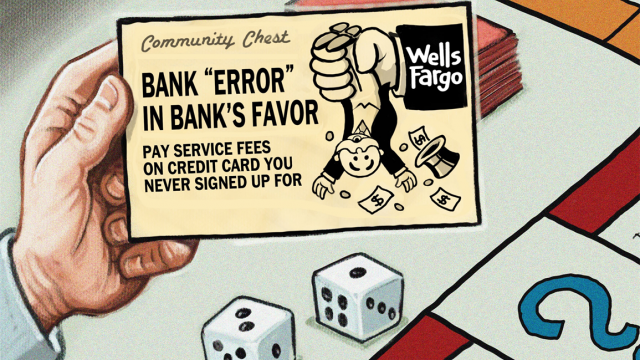

It has been and continues to be an interesting week for Wells Fargo, with widespread coverage from mainstream news outlets; John Stumpf, Wells Fargo’s CEO, going before Congress on September 20; and a $185 million settlement announced with the Consumer Financial Protection Bureau.

Interesting, then, that despite all of the monies paid in fines to the CFPB, Wells Fargo still denies any allegations of wrongdoing. Per usual goes the refrain: “Here is $185 million, but we didn't do anything, we swear!”

Yeah? Then what about that part where the bank fired 5,300 low level employees for their egregious, criminal acts committed in order to meet Wells Fargo’s unrealistic sales goal pressures. They were going to lose their jobs anyway if they didn't commit a crime, so what did they have to lose, right?

One hundred eighty five million dollars is what the bank takes in in a day or two. Wells Fargo will be compensated by insurance for the losses, and will receive a nice tax write-off. All the while, needless to say, it is likely the bank will continue with business as usual.

But it doesn't have to be that way.

Since the crash of the financial system brought on by a handful of mega-banks and toxic Wall Street greed, we see the exact patterns again and again and again. The media has finally taken notice of Wells Fargo's accounts shenanigans and the criminal behavior perpetrated by employees and management. But the bigger game, and by far the larger detriment, still lies in the mortgage fraud executed by the big banks – among which Wells Fargo was arguably the worst offender.

After 2007-08, when the economy came tumbling down, taxpayers bailed out Wall Street banks with TARP funds to the tune of trillions of dollars. Unseen levels of gluttony and layers of fraud bloated the housing market to ludicrous heights, blackballing appraisers if they didn’t come in high on the estimates for refi's and purchases, and helping a feeding frenzy of mortgage brokers who got anyone and everyone to sign on to a mortgage – including going to poor neighborhoods and churches to recruit first-time home buyers to sign their lives away for the American Dream of homeownership.

The issues our economy still suffer from, and will in no near future be healed by, are the very same patterns of institutional fraud and egregious crimes against consumers illustrated in last week's revelations brought to you by Wells Fargo Bank. The accounts being opened without customer knowledge, the fabricated email addresses used to open accounts, the excessive fees: these all indicate deep corporate systems of forgery, accounting fraud, theft, identity theft, stealing and an obvious disregard for ethical business practices. They are the very same issues that banks like Wells Fargo have been practicing for years, to a much larger take in areas of real estate, foreclosures, insurance, short sales, “robo signing,” and rigging of the Home Affordable Modification Program, aka HAMP and HARP.

The irony is that in the Wells Fargo web of deceit and the consumer death spiral, no one can hear you scream. The fees and losses of $40 is pretty insignificant to homeowners being scammed out of $400,000, the family home, equity and actual shelter. The $20 loss isn’t comparable to what it would take financially to fight banks like Wells Fargo at nearly $2,000 a month to retain an attorney. It does, however, clearly indicate a criminogenic environment of intent, fraud and disturbing arrogance.

A Former Wells Fargo Employee Speaks Out

I recently spoke to a former Wells Fargo employee turned whistleblower about the ongoing issues of fraud and predatory banking practices implemented by the bank regarding the ongoing housing and mortgage fraud. Beth Jacobson is a former high level employee of the bank, who told me:

“In 1998, I was hired by Wells Fargo Home Mortgage as a 'Home Mortgage Consultant' or loan officer. I worked for Wells Fargo Home Mortgage ('Wells Fargo') until December, 2007. After a period of time, I was promoted to Sales Manager. I told DOJ over six years ago about Wells Fargo's quotas. At that time it was subprime loans. A loan officer had to fund three subprime loans per month. If there was a quarter when that didn't happen, they were fired. So the result is prime borrowers were put in subprime loans so that the loan officer kept their job.

"[John] Stumpf was also part of the management team that stated the company goal was to have Wells Fargo's fixed cost paid by the subprime division. Once Countywide went under, Wells Fargo was the #1 subprime lender in the country, specifically [in the] third quarter of 2007. The media keeps whitewashing Wells Fargo as this great lender that avoided all the pitfalls of the other lenders in the mortgage meltdown. No, Wells Fargo was the worst, they are just pure evil, [but] they hired more lawyers and more PR people to spin it Wells Fargo's way. They are all riding the stagecoach to hell.”

Jacobson went on to illustrate the nature of the quotas imposed on Wells employees and underwriters:

“The commission and referral system at Wells Fargo was set up in a way that made it more profitable for a loan officer to refer a prime customer for a subprime loan than make the prime loan directly to the customer. The commission and fee structure gave the A rep a financial incentive to refer the loan to a subprime loan officer.

"Initially, subprime loan officers had to give 40 percent of the commission to the A rep who made the referral; later on, A reps received 50 basis points of the available commission. Because commissions were higher on the more expensive subprime loans, in most situations the A rep made more money if he or she referred or steered the loan to a successful subprime loan officer like me. A reps knew about my success in qualifying customers for subprime loans. As a result, I received hundreds of referrals. When I got the referrals, it was my job to figure out how to get the customer into a subprime loan. I knew that many of the referrals I received could qualify for a prime loan. If I had access to Wells Fargo's loan files right now and could review these files, I could point out exactly which of these customers who got a subprime loan could have qualified for a prime loan.

"Because I worked on the subprime side of the business, once I got the referral the only loan products that I could offer the customer were subprime loans. My pay was based on the volume of loans that I completed. It was in my financial interest to figure out how to qualify referrals for subprime loans.

"Moreover, in order to keep my job, I had to make a set number of subprime loans per month. I also know that there were some loan officers who did more than just use the discretion that the system allowed to get customers into subprime loans. Some A reps actually falsified the loan applications in order to steer prime borrowers to subprime loan officers. These were loan applicants who either should not have been given loans or who qualified for a prime loan.

"One means of falsifying loan applications that I learned of involved cutting and pasting credit reports from one applicant to another. I was aware of A reps who would 'cut and paste' the credit report of a borrower who had already qualified for a loan into the file of an applicant who would not have qualified for a Wells Fargo subprime loan because of his or her credit history. I was also aware of subprime loan officers who would cut and paste W-2 forms. IDs deception by the subprime loan officer would artificially increase the creditworthiness of the applicant so that Wells Fargo's underwriters would approve the loan. I reported this conduct to management and was not aware of any action that was taken to correct the problem.

"High-ranking Wells Fargo managers knew that this practice was going on, because after about a year of these standby explanations being given, underwriters in the underwriting department were told to call the customers directly rather than contact the loan officer who was working with the customer. The loan officers quickly figured out how to work around this by warning customers that underwriters might call them and then coaching the customers about what to say. For example, customers were told that they should just tell the underwriter that they did not have much in the way of assets or documentation for their income, because otherwise the underwriter would deny their loan or force them to fill out additional paperwork to document their financials. The point was to get the customer to say whatever would allow them to qualify for a subprime loan, even if it was not true. The customers went along with this because they thought it would expedite the process of getting them the loan that they had been told was the right one for them.”

As we know, former Attorney General Eric Holder did nothing to reign in the institutional fraud that brought down the global economy and caused the bail-out by Main Street to further enable Wall Street practices like these to continue. Holder then went back to work for the very same law firm that represents JP Morgan Chase, which has also paid billions in fines to the government for egregious criminal behavior. It's nice work if you can get it.

Last week, 5,300 low-level employees' heads rolled, while one high-level executive, Carrie Tolstedt, who oversaw the implementation of over 2 million bogus customer accounts, retired and floated away with a $125 million golden parachute just as the stench hit the fan.

The only difference in bringing Wells Fargo’s John Stumpf to justice regarding the mortgage fraud is that it’s a very complex web, and justice must start somewhere. The patterns of institutional fraud and consumer abuse; securitization and bifurcation of the mortgage notes; violations of the SIGTARP agreement; billions in payoffs to the government; bogus fees; forced sales; unclean hands; courtrooms clogged across the country with homeowners struggling to be heard; and the ongoing systemic criminogenic environment of the banks make for much murkier waters that few even talk about anymore. And murky waters make it harder to catch the bigger fish.

The system in place is all about pay to play, back door deals and tiny fish being swallowed whole. But wait – what’s that smell? Methinks it is the head of John Stumpf.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments

Comments

bigaltheterp replied on

May I please use your picture on a boycott Wells Fargo fb page?

Great article, may I please use your picture on a boycott Wells Fargo Facebook page?

https://www.facebook.com/Stop-Wells-Fargo-Golf-Championship-2017-in-WIlmington-NC-340678392963542/