“Governments don’t rule the world: Goldman Sachs rules the world,” financial trader Alessio Rastani candidly told BBC News amid the spiraling panic centered around Greece's debt in September of 2011.

Following his comments, mainstream media focused mainly on whether Rastani was a hoax trader. He was not. And the distraction meant that for the most part, no one bothered to investigate the claim – not least the pivotal role Goldman played in Greece’s worsening humanitarian disaster

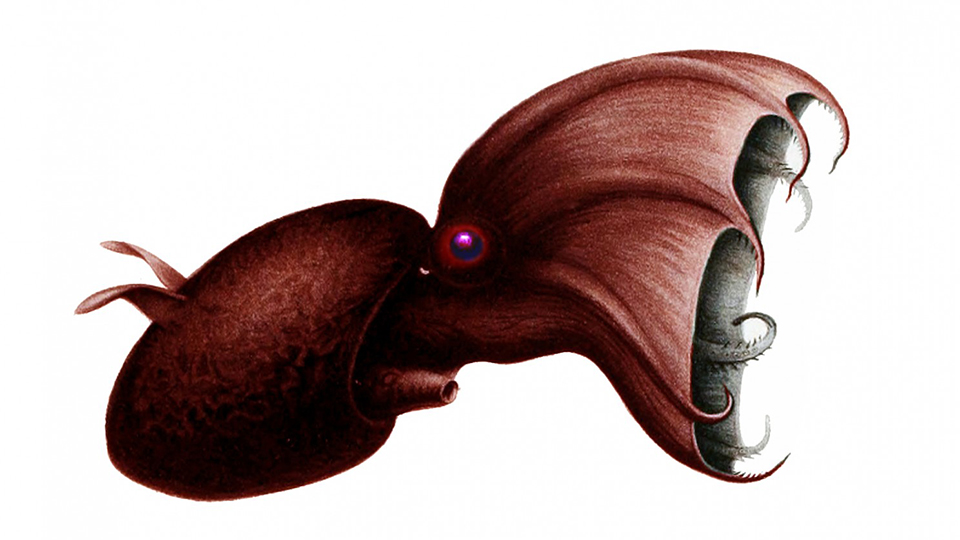

Former Rolling Stone writer Matt Taibbi stands out as an exception among journalists who revealed, and emphasized, the bank’s blatant capitalization from the crises. Two years before Rastani’s statements, Taibbi famously called the bank “a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.”.

He substantiated his metaphor using ample evidence of the bank's malpractices in America. Taibbi tracked Goldman's record of inflating bubbles, then betting against them, back to the 1929 market crash – a process that retells itself in the subprime mortgage bust.

Men on the political inside, lots of them, ensured Goldman would gain handsomely from the 2008 implosion. Amid the long list of establishment names discussed by Taibbi, former Goldman Sachs Chairman and CEO Henry Paulson stands out – the man who became George W. Bush’s last Treasury Secretary and the principal author of the bailout.

As Taibbi asserts, Paulson carried out “a suspiciously self-serving plan to funnel trillions of Your Dollars to a handful of his old friends.”

The bank's record of tax evasion and speculation on essential commodities were other core criticisms he leveled against them. Last year, it was reported that Goldman makes a tidy $400 million (£251 million) annually from food speculation alone.

And in terms of tax evasion, this mapping tool created by OpenCorporates shows the global pathways by which Goldman Sachs channels its enormous profits into tax havens – one of the key engines helping fuel global inequality and poverty.

Goldman Sachs and the Greek Crisis

After raking in wealth from the subprime mortgage spree, Goldman became a pivotal player engineering – and profiteering from – the Greek debt bailout. I spoke to Christina Laskaridis, a founding member of the Greek Debt Audit and researcher for [Corporate Watch(http://www.corporatewatch.org/?lid=5268), whose investigation "False Dilemmas: A Critical Guide to the Euro-Zone Crisis" will soon be published.

“When Greece was seeking Euro membership, Goldman Sachs sold them a complicated swap contract worth $1 billion using a rigged market set at a historical exchange rate. In effect, this currency swap was really a loan in disguise,” Laskaridis explained.

The deal was reported by Business Insider and in a handful of business sections of mainstream newspapers, though few questioned its long-term implications.

“Greece ended up getting $2.8 billion though this, which hid and masked its true debts – making it look better on paper [and] helping it into the euro,” she continued.

In the end the deal cost Greece greatly, said Laskaridis. The swap contract was restructured in 2005 and sold to a private Greek bank. When the 2008 financial crisis spread, that bank was downgraded as was the securitized swap deal, then re-sold to the Greek government.

And, the process “was included in the repeated 2009-10 budget deficit revisions, adding over €5 billion [in] deficit revisions that propelled Greece to the Troika (IMF, European Commission and European Central Bank).”

Criticizing the three investigations made into the mega-scam carried out by Goldman, Laskaridis said: “None have led to anything, except highlighting the deliberate role of the regulators and official sector, plus blaming Greece for fiddling statistics."

"This has shielded Goldman, and the official sector, for allowing the practice and being complicit in the aftermath, including creating the Troika bailout,” she added.

Bloomberg News actually sued the European Central Bank to uncover what it knew about the swap deal before the 2010 bailout, but the ECB refused to tell.

Not incidentally, ECB President Mario Draghi is a former managing director of Goldman Sachs.

And that's not all: in November of 2011, Lucas Papademos was installed as the unelected Greek President to oversee the Troika austerity measures. An ex-Goldman Sachs man as well, Papademos also headed Greece’s central bank when it made the initial swap deal.

A Bank that Governs Governments

According to Joel Benjamin, “Goldman is one of the most powerful banks in the world: it has captured global governments.” Benjamin is campaign manager for Move Your Money UK, a group that has helped over 2 million people to switch their funds from "too-big-to-jail" banks to smaller, more rule-abiding ones.

In the latest example, “as the new Governor of the Bank of England, the former Goldman [executive] Mark Carney wants to increase the UK financial sector from four times GDP in 2013 to nine times GDP by 2050,” Benjamin said.

Yet despite the scale of Goldman's invasion – and occupation – of global governments, it has yet to come under direct fire from global activists who demand its ouster, like the worldwide March against Monsanto campaign that is challenging the GMO giant.

The largest anti-Goldman protests have been national, rather than global. They include mass Danish protests against the bank's purchase of Denmark's national energy company; Occupy Goldman Sachs protests outside the New York City condo of CEO Lloyd Blankfein; andtargeted actions like this London event that highlighted the bank's profiteering through food speculation.

With far more UK protests centering around banks other than Goldman Saches, I asked Benjamin why he thinks the "vampire squid" has managed to avoid greater scrutiny.

“In my opinion it [comes] down to its lack of public profile," he said. "Unlike Britain’s Barclays, RBS or HSBC, Goldman are not a High Street retail bank, so their activities are largely invisible to the majority.”

He suggested I should put this theory to the test with a vox-pop about what the bank does. Taking up the prompt, I surveyed 25 people in Central London to explain their knowledge about Goldman.

The result: 10 responders had never heard the name, while another two were not sure if the bank still existed. Of the other 13, seven were uncertain what Goldman did. Just six out of 25 knew about the bank's criminal activity.

Keeping with the theme, I asked Laskaridis about Goldman’s reputation in her native Greece.

“There are no specific protests or campaigns against Goldman. But many see both domestic and international banks as 'thieves,' even if not specifically targeted,” she said.

“The extent of damage the swap caused, $5 billion, was rarely allowed into public light. Instead the media and government focused on blaming bloated public sector utility companies, and other debts hastily included in the deficit," Laskaridis added. "But the Goldman debts were not really discussed.”

The bank's subversion of democracy around the world also helps explains why it has avoided greater public outcry until now, said Benjamin.

“Goldman are one of the largest political donors worldwide, so like JP Morgan or HSBC, no matter how much nefarious illegal activity they engage in, [they] will never be subject to the kind of regulatory and media pressure we have seen brought to bear, say, on the Coop Bank over the past 12 months,” he said.

Benjamin drew a comparison to the LIBOR rigging traders ICAP, who did not face significant government censure and whose CEO Michael Spencer was a major Conservative Party donor.

“Goldman, like ICAP, is part of the political elite that are protected by the political system and media. They are a symptom of democratic deficit whereby financial elites have captured our political and regulatory systems.”

Yet for all their subversion of global democracy, Benjamin suggested Goldman’s power will not be perpetual: with more truth and information about its activities, the public's patience may soon be running out.

“To sort out Goldman and their ilk we need financial education, to demystify and de-mask what these guys do,” he said. Alternative economic solutions could also help pave the way.

“We can get rid of the banksters with things like peer to peer lending and crowd-funding, which build community cohesion and wealth. An increase in mainstream democratized financial alternatives could make them irrelevant.”

For now, in Goldman versus The World, the squid is still sucking to anything that smells like money.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments

Comments

WatsonZion replied on

They are the power in the

They are the power in the Oval Office, where what Goldman says decides arrangement. The money related counselors behind the Vatican. The funders of quick track to get the Trans Pacific Partnership Agreement through Congress. http://www.researchpaperpal.com/biology-research-paper-help/