With the mortgage crisis behind us, and the stock market hitting new highs, it's easy to get complacent about the banking sector. The new Dodd-Frank banking regulations were passed and are being implemented. Through the "Basel III" agreements, capital standards are being raised.

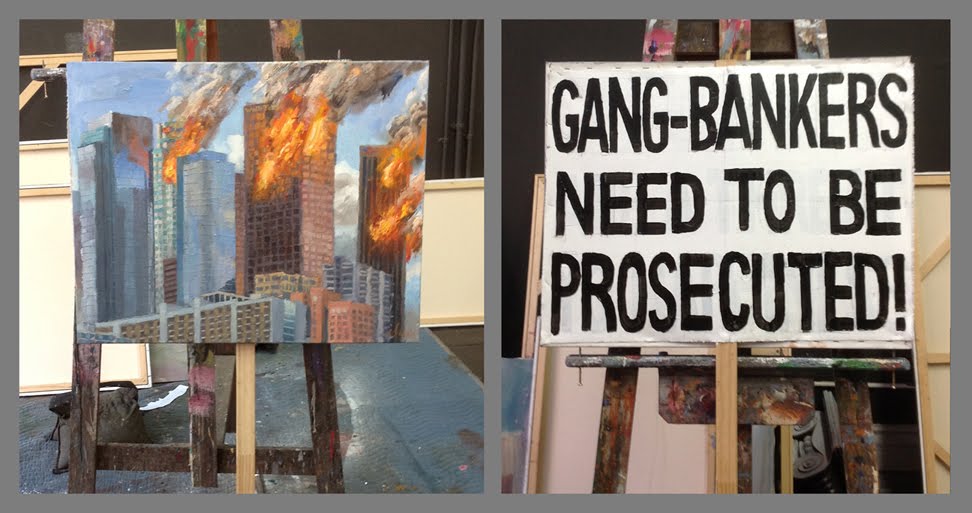

Yet a growing chorus from across the political spectrum is questioning whether the so-called improvements are enough – or whether Dodd-Frank and related regulations actually encourage risk and increase the threat to ordinary depositors.

One of the sharpest critics is Ellen Brown of the Public Banking Institute, who says that the changes imposed by Dodd-Frank may protect taxpayers from funding the next bailout.

But if the taxpayer doesn't foot the bill, and if Washington feels it's too dangerous to let a major bank fail, who pays? Shareholders and bondholders will take the first hit, as they should: Dodd-Frank allows the government to forcibly convert bonds to common stock, wiping out the bank's obligation to pay back the bondholders.

Unfortunately, the combined wealth of shareholders and bondholders probably won't be enough to cover a major meltdown. The next crisis, when it occurs, is likely to be due to the derivatives trade, and the amounts of derivatives in play are staggering: the exposure in derivatives at the "too big to fail" banks exceeds the total world's gross domestic product. A derivatives-led meltdown could quickly overwhelm the funds available from banks' stock and bond holders.

So Who's Next in Line to Pay?

According to Brown, the depositors are next in line to get wiped out, and they'll get tapped before another government-funded bailout is approved by Congress. Brown argues that depositing your money in a bank is essentially the same as lending money to the bank (as if, say, you bought one of the bank's bonds instead of opening a checking account).

Intuitively you may think that when you deposit your money in a bank, it's yours, and the bank has to give it back on demand – but that's not completely true. It's legally the bank's money now, says Brown. The bank only has to give it back to the extent that it has money left to give after settling up with parties who have a higher priority than the depositors.

Perhaps you are wondering who those parties might be. Who has a higher priority claim than the depositors in the event a bank fails?

It turns out that the counterparties in a bank's derivatives trades actually have higher priority in getting paid back than ordinary depositors. That's right: The very same folks who are engaging in the speculative trades that are likely to bring down the bank are also the ones who will step to the front of the line to get paid off if the bank does fail. (Technically, the reason they have this priority is that under the Bankruptcy Reform Act of 2005, derivatives counterparties are given preference over all other creditors and customers.)

Even Federal Deposit Insurance Corp.-insured deposits are not safe, once we enter a world where derivatives counterparties take priority over individual depositors. The scale of losses that are likely in a derivatives-led meltdown would quickly exhaust available FDIC reserves, and these reserves could only be replenished with an act of Congress. Yet, provisions in Dodd-Frank that are still hotly contested would prohibit this replenishment.

Brown's concerns are shared, to varying degrees, by many experienced observers of the financial industry. For example, Yves Smith, at the Naked Capitalism blog, underscores Brown's point about the risk to ordinary depositors due to their position subordinate to derivatives traders.

"When [Lehman] failed, unsecured creditors (and remember, depositors are unsecured creditors) got eight cents on the dollar. One big reason was that derivatives counterparties require collateral for any exposures, meaning they are secured creditors. The 2005 bankruptcy reforms made derivatives counterparties senior to unsecured lenders," she writes.

According to a recent article in the Financial Times, a groundswell of support has arisen for taking further steps to prevent instability in big banks from threatening depositors and burdening taxpayers. The call for bolder action comes from many places. It comes from former executives in the banking industry: Sandy Weil and John Reed, the architects of CitiGroup, have openly criticized the risks involved in the current regulatory structure. It comes from progressive groups like Americans for Financial Reform. It comes from the Obama administration: Attorney General Eric Holder publicly admitted that the Department of Justice could not realistically prosecute illegal behavior at the biggest banks for fear of causing financial instability.

And it comes from both sides of the aisle in Congress: Liberal Democratic Senator Sherrod Brown and conservative Republican Senator David Vitter have joined forces to call for much higher capital requirements to be imposed on the largest banks. If passed, the proposal from Brown and Vitter would both reduce the chance that a "too big to fail" bank would need a bailout, and at the same time it would create a strong financial incentive for the biggest banks to split themselves into multiple entities, each below the threshold where extra capital requirements kick in.

What Should a Depositor Do?

Even though it may seem farfetched that individual deposits might be at risk, investors and savers should not be complacent. Individuals can seek out smaller banks with good credit ratings that do not participate in derivatives trading. (Recommended banks, credit unions and other options are listed at the Move Your Money project.) Municipalities and other institutional investors can seek out only collateralized investing situations, which put them in a much better position in the event of a banking crisis. And all involved should pay close attention to the legislation, rule-making and enforcement (or lack thereof) in Washington. Your financial security depends on it.

David Brodwin is a cofounder and board member of American Sustainable Business Council. Follow him on Twitter at @davidbrodwin.

Originally published by U.S. World & News Report.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments