Apple's tax bill is likely to increase in the coming years as politicians look to ensure multinationals are paying what they owe, according to a CNBC report.

Edward Kleinbard, a law professor at the University of Southern California, told CNBC on Monday that Apple's "easy days of single-digit tax rates are over."

He added that the big question now is how much of Apple's tax revenue will go to the U.S. in the future and how much will go to Europe.

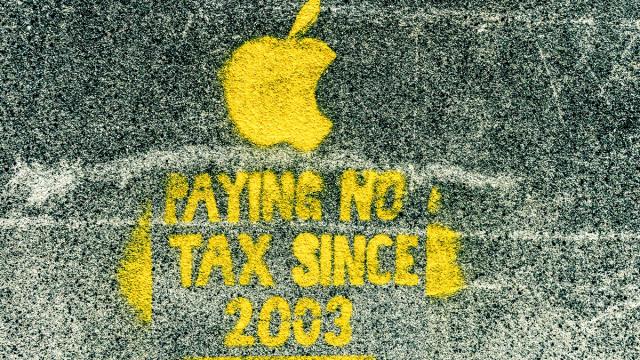

For decades, Apple and other multinationals have set up corporate structures overseas where they can get away with paying less tax than they would if they were in their home country.

Roughly 90% of Apple’s foreign profits are earned by Irish subsidiaries, according to The Financial Times, and the company has paid a corporate tax rate of less than 1% in some years.

The European Commission is expected to pass a ruling on Tuesday on Apple's tax affairs in Ireland and some predict that the company will be levied with a fine that runs into the tens of billions.

Apple and Ireland deny any wrongdoing, and are expected to appeal if hit with a negative ruling.

An Apple spokesperson pointed Business Insider towards a recent interview Apple CEO Tim Cook gave to The Washington Post.

"It’s important for everyone to understand that the allegation made in the E.U. is that Ireland gave us a special deal. Ireland denies that. The structure we have was applicable to everybody — it wasn’t something that was done unique to Apple. It was their law," Cook said.

"And the basic controversy at the root of this is, people really aren’t arguing that Apple should pay more taxes. They’re arguing about who they should be paid to. And so there’s a tug of war going on between the countries of how you allocate profits. The way tax law works is the place you create value is the place where you are taxed. And so because we develop products largely in the United States, the tax accrues to the United States."

Kleinbard told CNBC that he also thinks the U.S. tax system is broken. "Because it's broken, Apple pays extraordinarily low tax rates on its global income," he said. "The end result is going to be more tax for Apple regardless of tomorrow's ruling."

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments