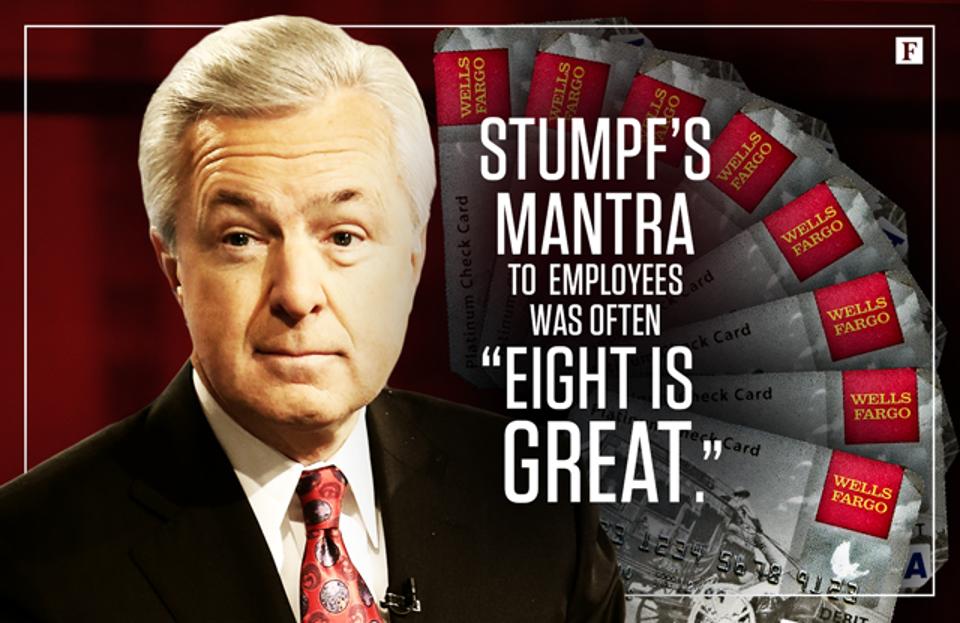

Apparently the Wells Fargo stagecoach is on its way to hell and Kingpin John Stumpf is now flying coach to impart a humbler impression on Congress.

John Stumpf, the bank's CEO and Chairman – and just this year, as of January 2016, Morningstar’s "CEO of the Year" – is not having a good month, and the party is just getting started. I’ll bet Morningstar wishes they could claw that back.

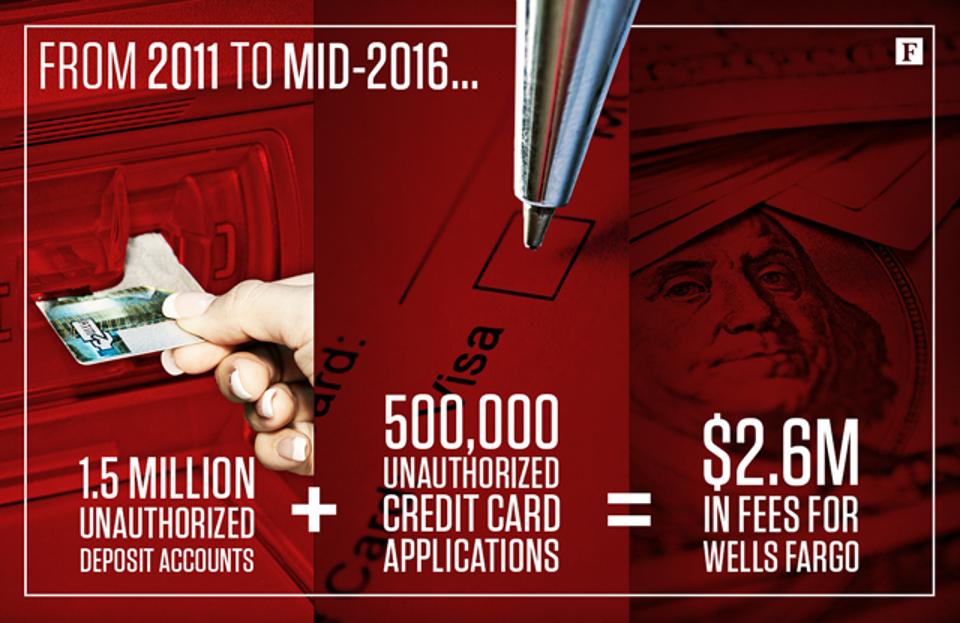

It has literally been a media feeding frenzy the past two weeks as Wells Fargo's scandals have unfolded and exposed the criminogenic environment the bank allegedly fosters at every level, top to bottom. Each day sees the heat turned up with class action lawsuits, whistleblowers emerging from the shadows, customer testimonies of the fraudulent accounts – and even military service members having their cars repossessed as they deploy to Afghanistan.

Okay, so Wells Fargo will now pay $24.1 million for the wrongful repossession of service members vehicles. What's next? Abuse to puppies? Repossessing candy from toddlers?

With all the unraveling and exposure it’s a wonder Mr. Stumpf can withstand the pressure. In the old Japanese tradition he would have committed Hara-Kari by now (also called seppuku, it's a ceremonial suicide that involves ripping open the abdomen with a dagger or knife). But that tradition was based on honor and shame. By all appearances, Mr. Stumpf has neither.

Perhaps there is comfort (or not) in the fact that America's other largest financial institutions are sweating, profusely perhaps, as Stumpf takes the fall for a type of corporate criminality in which they all routinely participate, though their settlements in the billions paid to government enables them to admit no wrongdoing.

The difference with Wells Fargo is that it always appeared to be untouchable, squeaky clean, run like a robotic gestapo from behind bullet proof glass. "We appreciate your business. Here's a lollipop."

I wonder if JPMorgan Chase CEO Jamie Dimon is already polishing his cufflinks in preparation for his turn appearing at the feet of Elizabeth Warren and the Congressional Financial Committee’s long-awaited banker pinata bashing.

I remember that early episode of “The Sopranos” when Tony answers his daughter’s question, “Are you in the mafia?” He smirks and says, “There’s no such thing.”

This is, of course, the bankster mantra as well. “There’s no such thing. I don’t recall. I will rely on the board to decide. It was a few bad apples.”

"But Mr. Stumpf, are you not the Chairman of the Board and the CEO?"

Blink blink. Waste management.

The egregious harm that Wells has inflicted on consumers continues to pummel the middle class, the poor, seniors and military active duty service members to a staggering new low, keeping them there since 2007 as the same financial institutions again, and again, and again, and again continue their abuse. Trillions of dollars have been paid in settlement money for criminal behavior, wrongful termination of employees, retaliation to whistleblowers, wrongful foreclosures, rigging of the LIBOR rates, blackballing appraisers who didn't come in high to bloat the housing bubble, violations in fair debt collections practices, illegal foreclosures, ludicrous sales quotas, fraudulent accounts, forgery, identity theft and more. Plus bonuses and stock options. Here's how the banks do it: Pay the DOJ and get back to work.

What do you care if you make ten thousand dollars an hour and hang out the twelve dollar an hour peasants to dry? All in a day's work for bankster CEOs like John Stumpf, hiding behind the veil of too big to fail, too big to know, too big to feel or smell the stench of the aftermath of so much suffering and harm from the tallest of towers.

The housing bubble Wall Street banks created brought us the “Great Recession” that no one rightfully refers to as the “Millennial Depression.” But there is a shift in consciousness going on now, it seems, and “regular folks” are finally wandering into the streets and picking up signs. Social media connects us and allows us to stay moment to moment with each outrageous criminal act that we see financial elites perpetrate and continue to walk away from. The trillions paid in settlements cost them nothing personally. They will be compensated by insurance and tax write-offs for the loss.

What so many are waiting for is plain old fashioned justice for all. Perp walks for Fashion Week. Orange jumpsuits all around. The time to turn the tables has come. Mr. Stumpf is only the beginning of what hungry Americans now see on the menu for the very first time: egg whites scrambled well with a side of Nationstar, BofA blackened to a crisp, and a shot of Chase bank for dessert. Bring it... with extra cheese please.

Lainey Hashorva is a journalist, activist and advocate for homeowners fighting foreclosure.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments

Comments

Ronda Scott replied on

Epic failure

Thank you for raising hell and fighting for all of is on what is the crime of the century and what I call Epic failure. I'm really sick of settlements that pay off millions to the consumer protection bureau and all the government regulators and law enforcement that is supposed to prosecute crime. Yes that includes the DOJ and the Los Angeles Attorney who agreed to settle with a payof. It's a slap on the wrist to stumpy who made $200 million in just one year