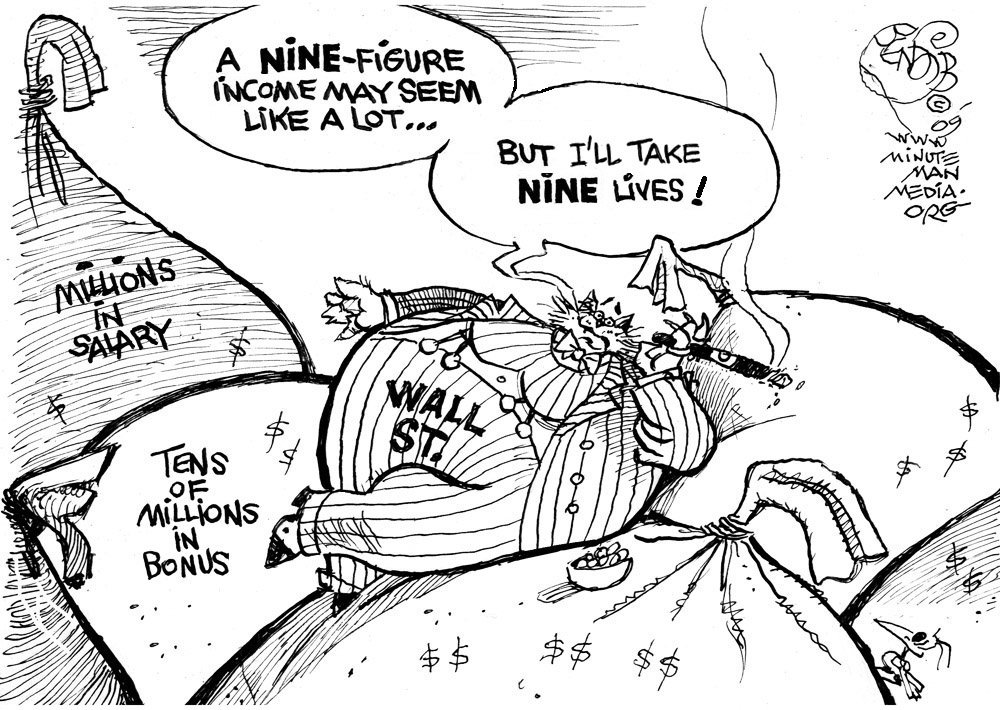

Seven of the 30 largest American corporations paid more money to their chief executive officers last year than they paid in U.S. federal income taxes, according to a study released Tuesday that was disputed by at least one of the companies.

The study, put out by the Institute for Policy Studies and the Center for Effective Government, two think tanks in Washington, D.C., said the seven companies, which in 2013 reported more than $74 billion in combined U.S. pre-tax profits, came out ahead on their taxes, gaining $1.9 billion more than they owed.

At the same time, the CEOs at each of the seven companies last year was paid an average of $17.3 million, said the study.

The seven companies cited were Boeing, Chevron, Citigroup, Ford Motor Company, Verizon Communications, JPMorgan Chase and General Motors.

The report’s co-authors said its findings reflected "deep flaws in our corporate tax system."

In reply, Verizon said it paid $422 million in income taxes in 2013. "We do not provide a breakdown between federal vs. state in that total; however, I am confirming for you that the federal portion of that number is well more than Verizon's CEO's compensation," a spokesman said in an email.

Boeing said its 2013 global tax bill was $1.6 billion, though all but $5 million was deferred due to development and production investments. A spokesman said current tax expense and cash taxes were likely to rise as 787-jet deliveries ramp up.

Like the other companies, Citigroup said it abides by all tax laws. "In 2013, Citi paid more than $3 billion in payroll taxes and more than $95 million in use tax, personal property and real property taxes in the U.S.,” a spokesman said.

Both automakers Ford and General Motors said their current U.S. tax bills are reduced by tax loss carry forwards stemming from severe losses suffered a few years ago.

Energy giant Chevron said its 2013 current U.S. federal income tax expense of $15 million "was much lower than normal" due to several factors. Echoing other companies, Chevron stressed it pays taxes worldwide.

JPMorgan Chase declined to comment.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments