The fifth anniversary of Lehman Brothers’ bankruptcy has occasioned one legacy-spinning defense after another. We’ve heard from Ben S. Bernanke, chairman of the Federal Reserve; Henry M. Paulson Jr., the Treasury secretary at the time; and Timothy F. Geithner, then the New York Fed president and later Mr. Paulson’s successor at Treasury, about their historic decisions to use trillions of dollars of taxpayers’ money to bail out the banking system.

But will we ever know what really happened behind all those closed doors? The seemingly appalling treatment afforded Richard M. Bowen III, a former Citigroup executive who blew the whistle on years of malfeasance there, shows that we may not. Thanks to political pressure and the revolving door between Washington and Wall Street, the events leading up to the financial crisis remain obscured and may never be fully revealed.

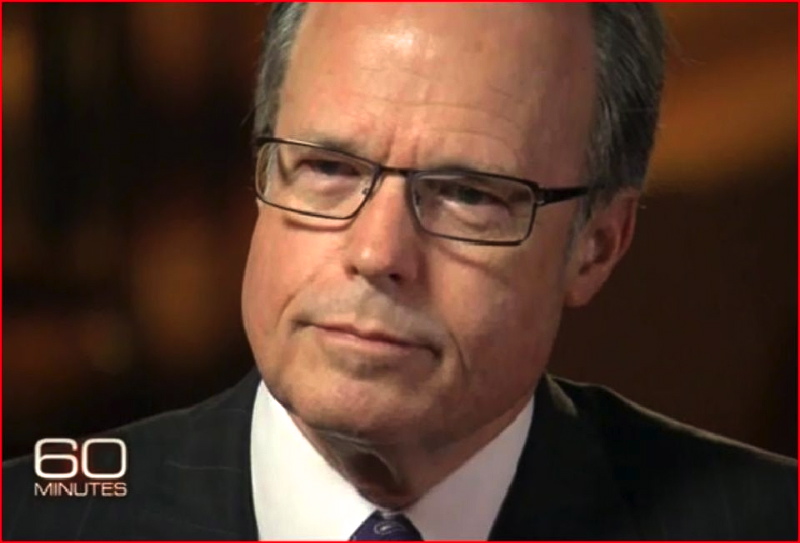

Mr. Bowen, who was featured in a piercing “60 Minutes” segment in December 2011, had discovered that for years before the crisis, Citigroup, like many other Wall Street firms, had been purchasing tens of billions of dollars’ worth of risky home mortgages and then packaging and selling them as investments. “When I started screaming,” he told me, “I was just trying to do my job. Silly me.”

At wits’ end, on Nov. 3, 2007, Mr. Bowen sent an e-mail to a small group of Citigroup executives, including Robert E. Rubin, a former Goldman Sachs executive and former Treasury secretary who was then chairman of the bank’s executive committee (and who received $126 million during his decade at Citigroup). “The reason for this urgent e-mail concerns breakdowns of internal controls and resulting significant but possibly unrecognized financial losses existing within our organization,” Mr. Bowen wrote.

Mr. Bowen told me that the following Tuesday, a Citigroup lawyer told him of his e-mail: We’re taking it seriously. Don’t call us. We’ll call you. He sent more e-mails to the lawyer, but heard nothing. “I mean, silence,” he said. (Months later, the two men did talk about Mr. Bowen’s e-mail to Mr. Rubin.)

Mr. Bowen, who is now 66 and teaches accounting at the University of Texas, Dallas, was fired in January 2009. (After signing a separation and confidentiality agreement, he received a severance package of less than $1 million.) And Citigroup went on to receive a $45 billion bailout from the taxpayers, plus guarantees on nearly $300 billion of securities, some of which were most likely crammed with the very low-quality mortgages Mr. Bowen had warned about.

America became inured to the sight of one extremely wealthy former Goldman Sachs senior partner turned Treasury secretary (Mr. Rubin) asking another (Mr. Paulson) for a favor. But what Mr. Bowen believes happened to him after Citigroup fired him still has the power to shock anyone who cares about accountability and justice. He feels he was muzzled; others involved are adamant that he was not.

In 2008, after his note to Mr. Rubin and after his responsibilities were vastly reduced at Citigroup, but before he was fired, Mr. Bowen decided to become a whistle-blower. That April, he filed a complaint, under the Sarbanes-Oxley Act of 2002, with the Occupational Safety and Health Administration claiming he had been retaliated against after writing his e-mail to Mr. Rubin. (The complaint was settled as part of his separation agreement with Citigroup.) Then, in July, Mr. Bowen went to the Securities and Exchange Commission.

“I testified before the S.E.C.,” he told an audience in Texas earlier this year. “I told them what had happened.” He gave the S.E.C. more than 1,000 pages of documents. “Mr. Bowen, we are going to pursue this,” the agency told him. He never heard back. “Not only did they bury my testimony, they locked it up,” he said in his speech. (The S.E.C. has denied my numerous requests under the Freedom of Information Act for access to Mr. Bowen’s file, even though he has given his permission, claiming that the material was “confidential” and included Citigroup “trade secrets.” On Sept. 11, the S.E.C. denied my administrative appeal of its decision.)

In May 2009, Congress created the 10-member Financial Crisis Inquiry Commission, or F.C.I.C., to examine the causes of the financial crisis. Led by Phil Angelides, a former state treasurer of California, it was empowered to get to the bottom of what had happened and why. The F.C.I.C. invited Mr. Bowen to an interview after an investigator read his Sarbanes-Oxley complaint.

Mr. Bowen was excited to finally be able to share his story. What’s more, he told me, he could tell all, freed from various provisions of his confidentiality agreement with Citigroup.

On Feb. 27, 2010, Mr. Bowen met with Victor J. Cunicelli and Tom Borgers, two F.C.I.C. investigators, and, briefly, with Bradley J. Bondi, the commission’s deputy general counsel. For four hours, with his own two lawyers present, Mr. Bowen told them his story. “This was placing the company in extreme risk with regard to losses, and I made that known,” he told the commission staff.

The investigators told him they found his account “very compelling,” and Mr. Bowen was subsequently invited to testify publicly before the commission, on April 7, 2010. Mr. Bowen’s conversation, like hundreds of others, was recorded (including mine when, as the author of two books on the financial crisis, I was interviewed).

Unlike those other conversations, though, Mr. Bowen’s Feb. 27 interview, a transcript of which I have read, is not publicly available. Instead, the document, along with the commission’s other records, was sealed and sent off to the National Archives, where it may be reviewed beginning in 2016. “Why five years?” Mr. Bowen wondered. “I don’t know. I’m sure it’s just a coincidence that five years is the statute of limitation for fraud.”

On March 22, J. Thomas Greene, the commission’s executive director, gave Mr. Bowen a week to write a statement to accompany his April 7 oral testimony. Mr. Bowen says he was told he could have 30 pages. “Tell us what you told us behind closed doors,” he says the F.C.I.C. staff told him. He took that to mean he should feel free to name names, as he had on Feb. 27, and to explain what happened to him after he wrote to Mr. Rubin.

A week later, he finished his 28-page testimony. Just as he sent it to the commission, the Treasury announced that it intended to sell 7.7 billion shares of Citigroup stock — with an estimated value at the time of $32.2 billion. The projected profit at the time, $7.2 billion, would be among the largest from the government bailouts. (The government ultimately made about $12 billion.) Mr. Bowen suggested, in his Dallas speech, that it was probably just a coincidence, but that he had some lingering doubts.

On March 30, one of Mr. Bowen’s attorneys, Steve Kardell, a partner at the Dallas law firm Clouse Dunn, told Mr. Bowen, in an e-mail, that the F.C.I.C.’s Mr. Bondi suggested “some substantial changes” to his testimony and “thinks that the way it’s written now, Citi will declare war on both you and the F.C.I.C., and it will primarily consist of an effort to discredit you.” While Mr. Kardell noted that the F.C.I.C. investigators said they didn’t want to influence his testimony, he said that Mr. Bondi suggested trimming it by 10 pages. Peeved, Mr. Bowen instructed him to find out what changes the F.C.I.C. staff wanted to make. The next day, Mr. Kardell e-mailed Mr. Bowen, “I get the impression that the revisions are non-negotiable.”

Mr. Bowen says the F.C.I.C. wanted him to delete his concern that Citi may have materially misrepresented its certifications of internal controls, which require corporate officers to certify the accuracy of their financial statements under Sarbanes-Oxley.

Remove the names of people at Citi, he says he was told. Take out his post-Rubin denouement, his conversations with the bank’s internal lawyers and the fact that Citigroup’s outside attorneys at Paul, Weiss, Rifkind, Wharton & Garrison LLP were conducting an investigation of his charges.

Mr. Kardell also said he thought the F.C.I.C. was “catching some serious, serious heat this morning.”

“Who are they catching heat from?” Mr. Bowen asked, according to a transcript of the call provided by Mr. Bowen.

“Umm, Citi,” Mr. Kardell replied, adding, “It’s just a complete all battle stations with Citi about you testifying.” He then dropped the bombshell that Brad S. Karp, managing partner of the law firm Paul, Weiss, had “gotten involved” and that “our guys” on the F.C.I.C. staff, “who are still extremely pro Dick Bowen — although I think there’s pressure to yank Dick Bowen — our guys want to see something plain vanilla pretty fast.” A stunned Mr. Bowen told Mr. Kardell, “So much for an independent Congressional commission.”

But after a night of prayer, Mr. Bowen acquiesced. He cut the offending passages and his testimony by eight pages. “It’s better to get something on record than nothing,” he decided. He also figured that when he testified on April 7, he’d be able to provide more detail. But that morning, he had breakfast with Mr. Kardell, who told him that Mr. Bondi had said that he was not to respond to the commissioners’ questions about his departure from Citigroup. If the commissioners asked him, for instance, what happened after he e-mailed Mr. Rubin, he was to be silent, and claim “employment issues” as justification. When one commissioner, Peter J. Wallison, asked what had happened, Mr. Angelides cut him off.

Mr. Karp, while conceding that he regularly spoke with Mr. Bondi about Citigroup matters before the F.C.I.C., vehemently denies trying to pressure Mr. Bondi about Mr. Bowen’s testimony. “Paul, Weiss, representing Citi, did not ‘pressure’ the F.C.I.C.,” he wrote me. “We represented and defended Citi. And I am certain that the F.C.I.C. would confirm that.”

Mr. Bondi, now a partner at the law firm Cadwalader, Wickersham & Taft, which counts Citigroup among its clients, also rejected the idea that he had been unduly influenced to ask Mr. Bowen to change his testimony. “The F.C.I.C. staff team that investigated issues related to the financial crisis, and Citi in particular, acted impartially and with the highest integrity at each step of the investigation,” he wrote in an e-mail. “Any allegation that information relevant to the Citi investigation was suppressed is untrue.”

Mr. Angelides told me that he had no knowledge of Mr. Bowen’s being censored, but that he was aware that the commission’s staff would generally work with witnesses to focus their testimony “on the most salient facts.” The final report, he said, gave prominence to Mr. Bowen’s most substantial charges, including the e-mail to Mr. Rubin. But, he conceded, the Wall Street banks “and their phalanx of attorneys were putting enormous pressure” on the commission “every day of every week with every witness” in an effort “to discredit people who were testifying against their interests.”

Of course, it’s the old story on Wall Street: One man’s aggressive lobbying is another man’s undue influence. Mr. Kardell believes that “there’s no question that Richard was censored.”

Mr. Bowen told me that, despite the denials from Mr. Karp and Mr. Bondi, he continues to believe he was censored and bullied into changing his testimony. The experience has shaken his faith in the country’s institutions.

“It was devastating,” he said. “It truly was. From my standpoint, the corruption extends to the highest levels of government. I feel absolutely, completely violated. Every principle that I grew up with, and even when I did a brief stint in the R.O.T.C. and the Air Force, it’s just completely violated.”

He plans to keep talking about what happened to him. “By God, I’ve got to leave this country better off than the way I found it.”

William D. Cohan is a former Wall Street investment banker, a contributor to Bloomberg View and Vanity Fair and the author, most recently, of “Money and Power: How Goldman Sachs Came to Rule the World.”

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments